Trump's wide-reaching tariff plan will hurt average Americans and only help the top 1%, Nobel-winning economist says

Trump's proposed tariffs would benefit only the wealthiest Americans, Paul Krugman wrote in a new op-ed.

80% of US consumers would lose after-tax income, he said.

Goldman Sachs also sees higher tariffs triggering sizable Fed interest-rate hikes, Goldman Sachs says.

Donald Trump has pitched sweeping tariffs as a win for the US consumer, but only the wealthiest Americans will benefit from rising trade barriers, Paul Krugman wrote in The New York Times.

In Tuesday's opinion piece, the Nobel-winning economist took aim at Trump's recently floated idea to replace the US income tax with higher import duties.

Putting aside the wide gap between the revenue streams both provide, a simpler policy that would maximize tariffs and cut income taxes by the same amount still bodes ill for most Americans, Krugman wrote.

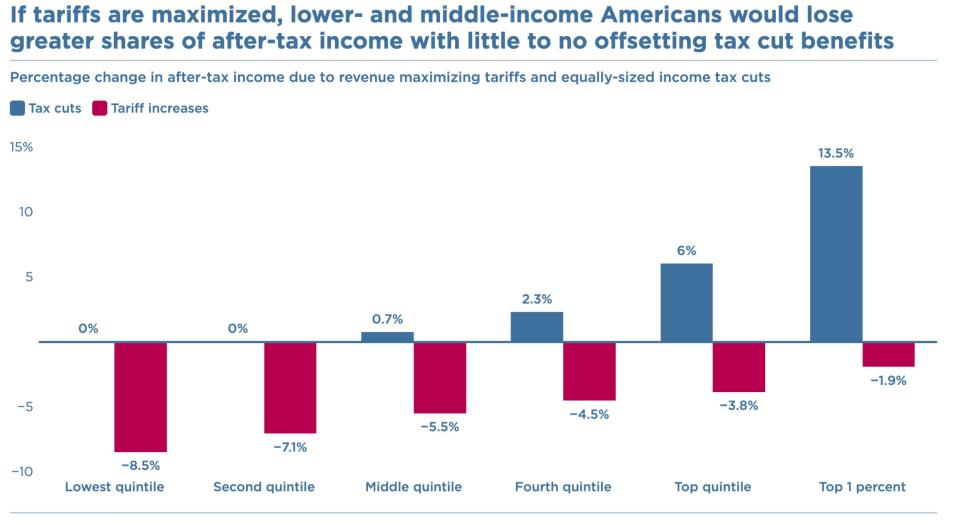

"The net effect would be negative for 80 percent of the population, especially for the bottom 60 percent, while extremely positive for the top 1 percent," he outlined, citing data from the Peterson Institute for International Economics.

In this scenario, lower- and middle-income consumers would see their after-tax income drop, and would enjoy little benefit from the tax cuts. The opposite is true for the wealthiest Americans.

Krugman gave two reasons for this:

First, income taxes are mainly paid by the country's richest, while about half of the population doesn't pay these at all; instead, they're burdened by other taxes.

Secondly, as tariffs apply higher costs on importers, these firms either pull their product away or raise their pricing. Both actions are inflationary, and can even boost the price of US-made products, research from the non-partisan Tax Foundation has shown.

And since lower-income families spend a bigger share of their income than the wealthy do, their pockets will take a greater hit from rising prices.

"So who would pay the tariffs that Trump will almost surely impose if he wins? Not China or foreigners in general," Krugman argued. "Everything says that the burden would fall on Americans, mainly the working class and the poor."

Trump's tariff plans go beyond their potential in replacing the income tax. The Republican candidate has previously preached the need for a universal tariff rate of 10% on all US imports, regardless of who the trade is with.

Some countries may even face higher rates, such as China: if Trump wins, Beijing could expect duties as high as 60%, he says.

If Trump is taken at his word, mounting trade barriers would boost inflation by 1.1 percentage point, Goldman Sachs' Jan Hatzius wrote on Tuesday. Higher prices would also hit at consumption, and US GDP would slump 0.5%.

Another Nobel-winning economist — Joseph Stiglitz — recently told Business Insider that he shares similar concerns of spiking inflation.

It's a recipe that would unwind the Federal Reserve's ability to cut interest rates, a hope that's contributed to this year's stock highs.

Instead, the Fed would likely turn hawkish again, raising rates as much as 130 basis points, Hatzius projected. That's equivalent to around five 25-basis-point hikes.

"A trade war between the US and China would significantly amplify our results, with a bigger increase in US inflation, a bigger hit to European growth, and a stronger case for monetary policy divergence between Europe and the US," he concluded.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance