True value always prevails against technological advancement

Note: A version of this article was published on TKer.co.

With the emergence of generative artificial intelligence (GenAI) technologies like AI chatbots, there are concerns about how writing could become an obsolete career path as jobs are destroyed. (I think these fears are overblown and misplaced. Read more here and here.)

While I expect work related to the more tedious and mundane forms of writing could become automated, I think there are many forms that’ll continue regardless of how good the technology gets.

One powerful form of writing is the handwritten note.

In his "20 Life Lessons," Wall Street legend Byron Wien said: "When someone extends a kindness to you, write them a handwritten note, not an e-mail. Handwritten notes make an impact and are not quickly forgotten."

About 15 years ago, when I worked at Forbes, my team hosted a nice dinner and reception. Byron was one of the 20 or so guests. At one point, he invited me to sit with him and chat, which surprised me because I was without a doubt the least influential person at that event. (The encounter makes more sense once you read Life Lessons 3 and 8.)

A few days later, I noticed a handwritten note on Pequot Capital stationery on my boss’s desk. For some reason, it jumped out to me amid the printouts, magazines, and whatever else might’ve been on that desk. I asked my boss about it, and he said it was from Byron. The note thanked him for hosting the event, and it expressed gratitude for his friendship.

Byron was right. Handwritten notes are not quickly forgotten. And this particular note wasn’t even addressed to me!

As technological advancements become increasing parts of our lives, the remaining human interactions become that much more powerful. I think Byron understood this.

Byron died at 90 on Wednesday.

Without a doubt, his legacy lives on! Take some time to read his 20 Life Lessons.

On markets and spaghetti marinara

Stocks tumbled last week, with the S&P 500 falling 2.5% to close at 4,117.37, the lowest level since May 24. The index is now up 7.2% year to date, up 15.1% from its October 12, 2022 closing low of 3,577.03, and down 14.1% from its January 3, 2022 record closing high of 4,796.56.

Notably, the S&P is now down 10% from its July 31 intra-year high (a move that’s actually pretty typical in an average year).

When markets tumble, it’s time for comfort food. And my favorite comfort food is spaghetti marinara.

Earlier this month, I did a taste test pitting Rao’s "Homemade" marinara against Good & Gather, Target’s private label brand. The former goes for about $8 a jar, and the latter goes for about $2.

I shared my observations on social media. And of course, many purists missed the point of the exercise and sent me messages arguing that I should take the time to make my own sauce from scratch.

Anyone who knows me or who has been following me on Instagram knows that I like to cook. But sometimes I want spaghetti without having to get all the groceries, prepare the ingredients, and do all the extra dishes. Sometimes I just don’t have the time or energy.

The availability of jarred sauce means people can enjoy spaghetti marinara for less money and less time. That means more money and time to spend on other things.

To be sure, the proliferation of ready-to-eat, shelf-stable sauce was not the end of homemade sauce. For many, it’s a valued family tradition. When homemade sauce is done well, jarred sauce can’t compete. When it’s good enough, people will pay up for a good marinara at an Italian red sauce joint. Who doesn’t have a favorite Italian restaurant they go to?

Whether it’s the steam engine, the tractor, the spreadsheet, the internet, AI, or something else, technological advancements will continue to disrupt the way we do things. Jobs will be destroyed. Jobs will be created. Meanwhile, the old way of doing things will never completely go away.

But most importantly, these advances free up time and money, which can now be used to pursue other productive things. This accelerates new innovations. From there, standards of living improve, the economy grows, earnings rise, and stocks go up.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

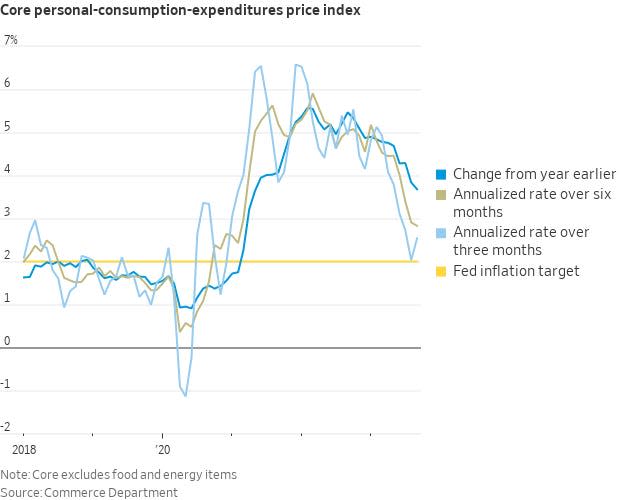

Inflation remains cool, but ticks up. The personal consumption expenditures (PCE) price index in September was up 3.4% from a year ago, unchanged from August’s level. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 3.7% during the month after coming in at 3.8% higher in the prior month.

On a month over month basis, the core PCE price index was up 0.3%, up from the prior month’s print of 0.1%. If you annualized the rolling three-month and six-month figures, the core PCE price index was up 2.5% and 2.8%, respectively.

The bottom line is that while inflation rates have been trending lower, many measures continue to be above the Federal Reserve’s target rate of 2%.

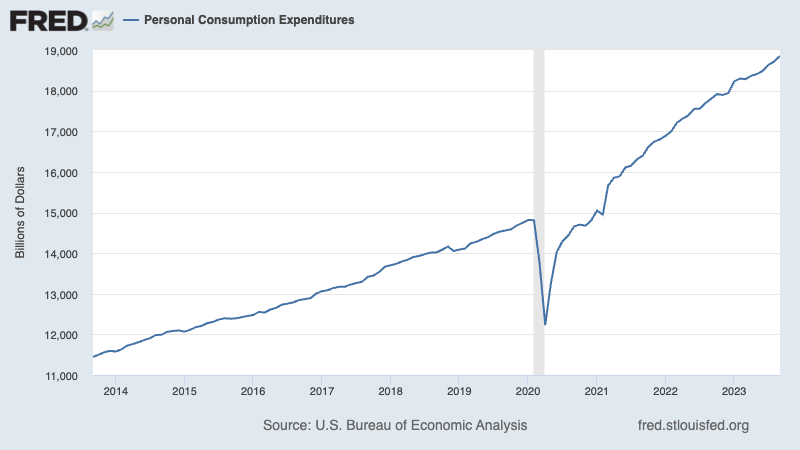

Consumer spending ticked higher last month. According to BEA data, personal consumption expenditures increased 0.7% month over month in September to a record annual rate of $18.85 trillion.

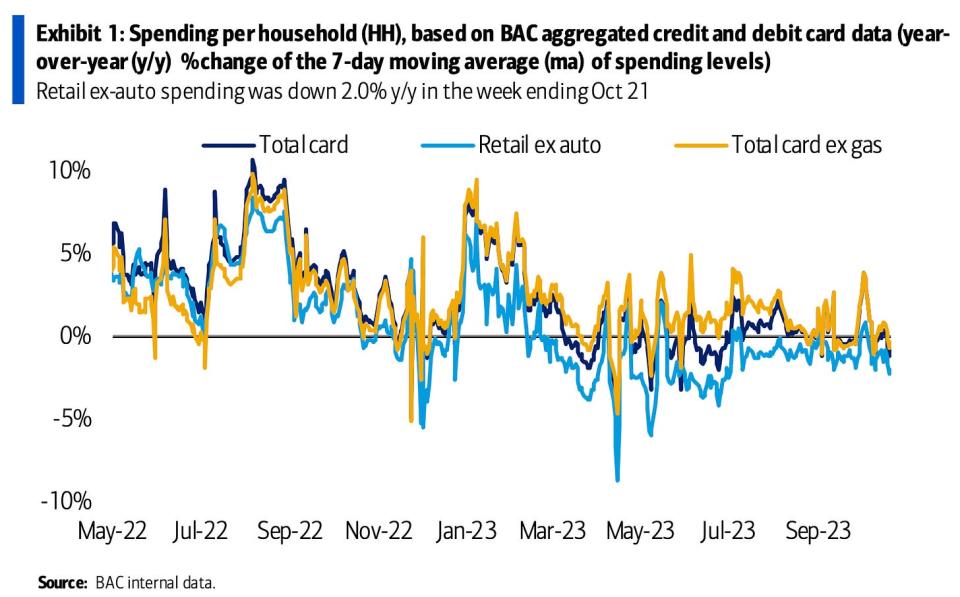

Spending is cooling, according to credit card data. From BofA: "Total card spending per HH was down 0.8%y/y in the week ending Oct 21 according to BAC aggregated credit and debit card data. Total spending per HH ex gas was down 0.4% y/y, while retail ex autos was down 2.0% y/y in the week ending Oct 21."

Business investment is strong. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — rose 0.6% to a record $74.46 billion in September.

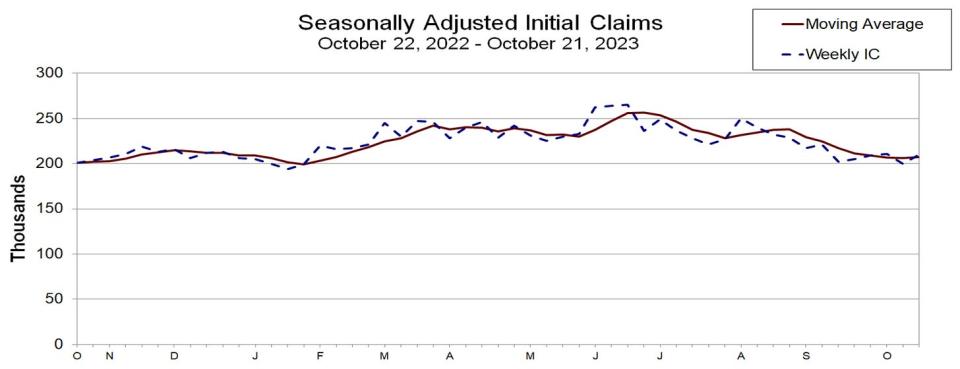

Unemployment claims tick up. Initial claims for unemployment benefits rose to 210,000 during the week ending October 21, up from 200,000 the week prior. While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

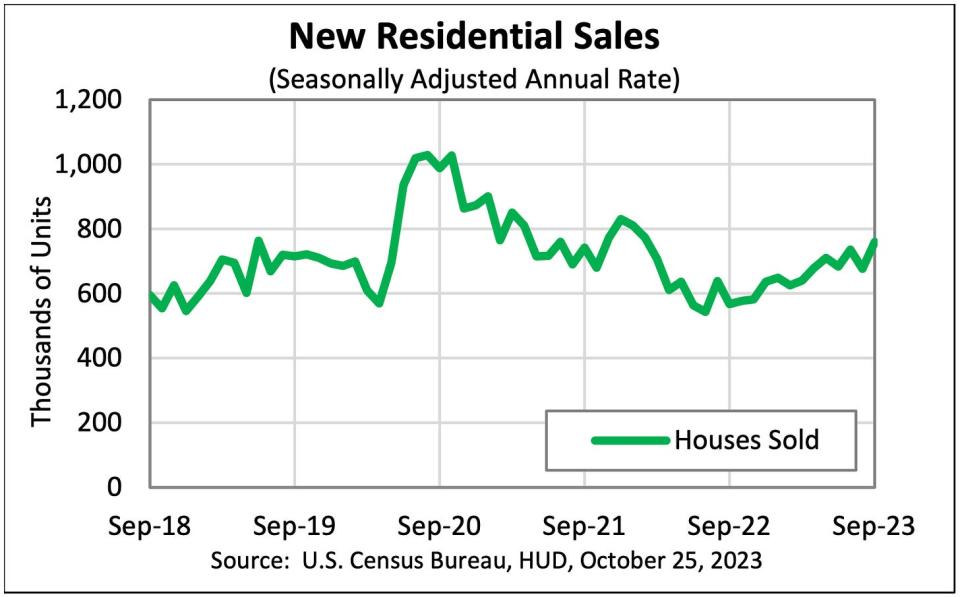

New home sales jump. Sales of newly built homes increased by 12.3% in September to an annualized rate of 759,000 units.

Mortgage rates continue to rise. According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 7.79%, the highest level since November 2000. From Freddie Mac: "For the seventh week in a row, mortgage rates continued to climb toward eight percent, resulting in the longest consecutive rise since the Spring of 2022. Rates have risen two full percentage points in 2023 alone and, as we head into Halloween, the impacts may scare potential homebuyers. Purchase activity has slowed to a virtual standstill, affordability remains a significant hurdle for many and the only way to address it is lower rates and greater inventory."

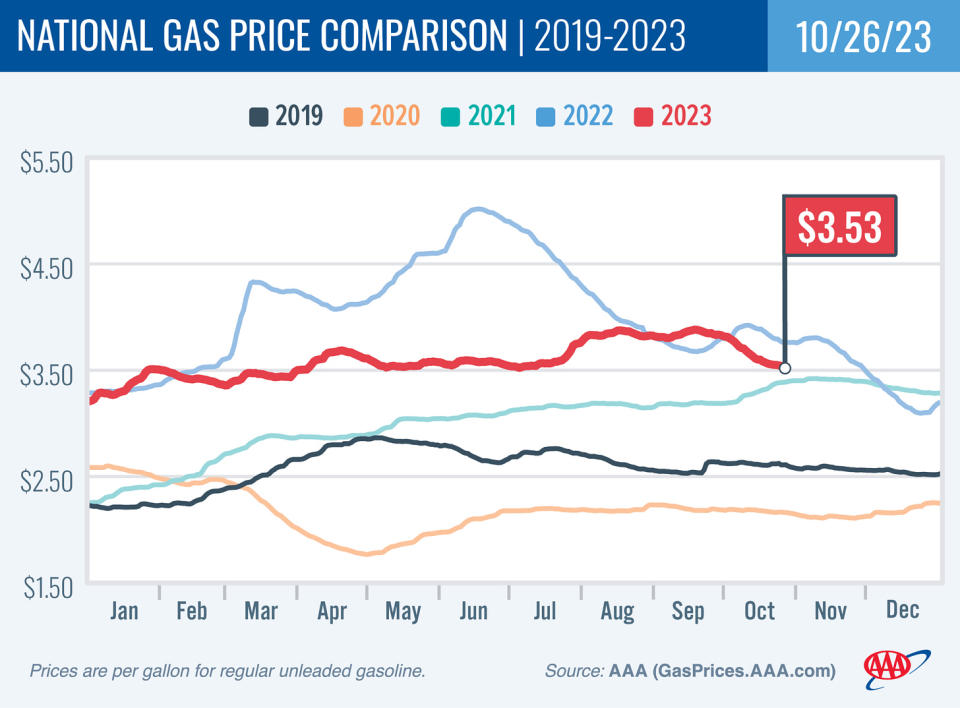

Gas prices fall. From AAA: "The national average for a gallon of gas dipped by only three cents since last week to $3.53. Despite slackening demand, the pace of falling gas prices is being held up by the cost of oil, which is hovering in the mid-$80s per barrel."

U.S. economic growth accelerated. U.S. GDP grew at a robust 4.9% rate in Q3, driven by a 4.0% jump in personal consumption.

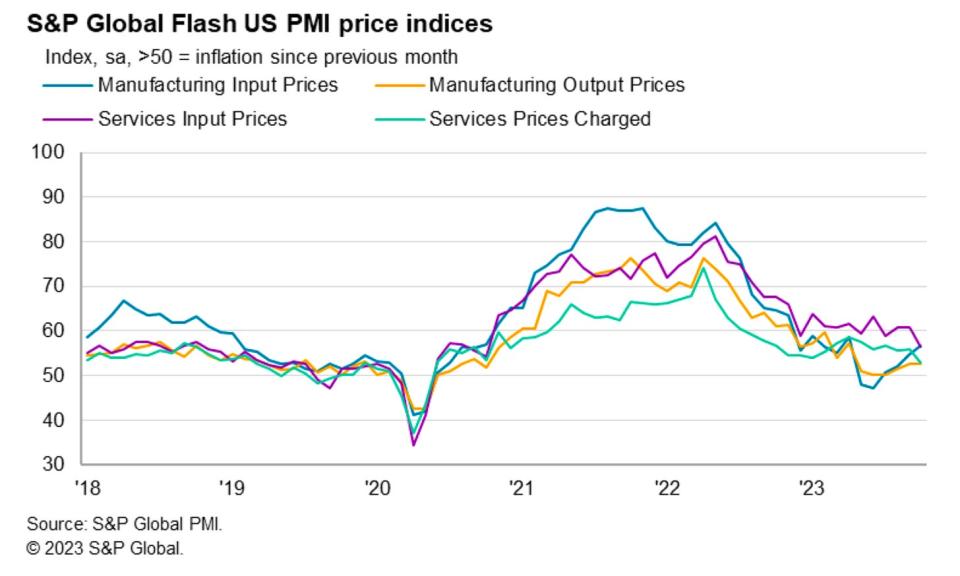

Private sector surveys improve. S&P Global’s Flash U.S. Composite PMI survey showed services activity and manufacturing output in October were growing at an improving pace. From S&P Global’s Chris Williamson: "Hopes of a soft landing for the US economy will be encouraged by the improved situation seen in October. The S&P Global PMI survey has been among the most downbeat economic indicators in recent months, so the upturn in US output growth signaled at the start of the fourth quarter is good news. Future output expectations have also turned up despite rising geopolitical concerns and domestic political tensions, climbing to the joint-highest for nearly one-and-a-half years."

The survey also suggested prices were cooling. From Williamson: "Sentiment has improved in part due to hopes of interest rates having peaked, something which looks increasingly likely given the further cooling of inflationary pressures witnessed in October. In spite of higher oil prices, firms’ input cost inflation fell sharply to the lowest since October 2020, and average selling prices for goods and services posted the smallest monthly rise since June 2020."

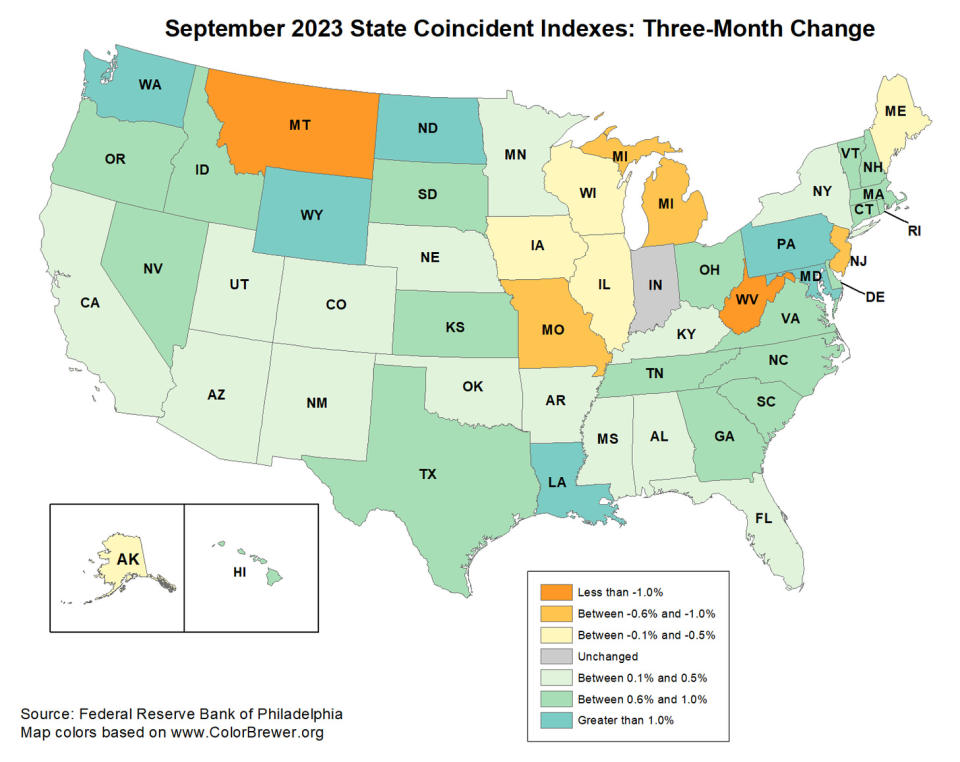

Most U.S. states are still growing. From the Philly Fed’s State Coincident Indexes report: "Over the past three months, the indexes increased in 39 states, decreased in 10 states, and remained stable in one, for a three-month diffusion index of 58. Additionally, in the past month, the indexes increased in 30 states, decreased in 17 states, and remained stable in three, for a one-month diffusion index of 26."

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.3% rate in Q4.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this article was published on TKer.co.

Yahoo Finance

Yahoo Finance