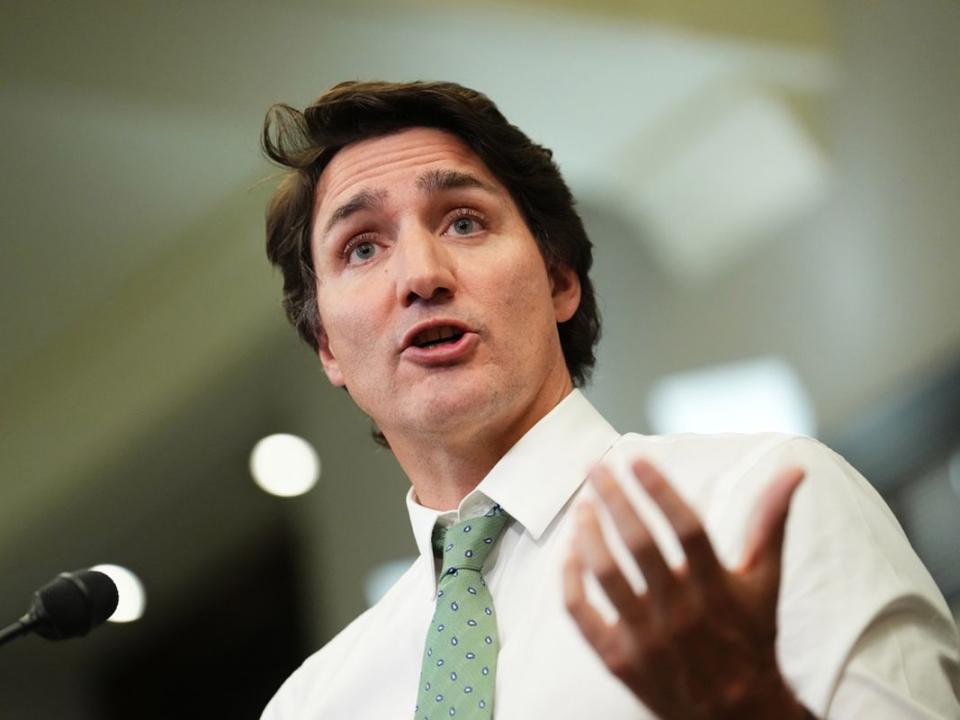

Trudeau's bashing of real estate investors shows lack of understanding about housing

Housing construction in Canada has not kept pace with population growth since the early 1970s. But despite the evidence and the realization that insufficient housing supply has contributed the most to worsening housing affordability, Prime Minister Justin Trudeau is now blaming investors and corporations for contributing to the crisis.

Trudeau believes housing has been commodified by investors and corporations that use “homes as an investment vehicle — rather than families using them as a place to live, grow their lives and build equity for their future.”

The prime minister’s comments, which reflect his understanding of the housing crisis, or lack thereof, should alarm Canadians, especially those facing acute affordability challenges. Canada Mortgage and Housing Corp. (CMHC), the federal government’s housing agency, believes 5.8 million homes must be constructed by 2030 to restore housing affordability. CMHC further estimates, rather conservatively, that this construction will require more than $1 trillion.

If it doesn’t come from investors, where will $1-trillion-plus come from in the next eight years?

Trudeau was in Brampton, Ont., announcing $114 million in funding for housing initiatives from his government’s $4-billion Housing Accelerator Fund when he made his comments this week. Now, $4 billion may sound like a lot, but the cost to build enough housing to restore affordability is more than $1 trillion, leaving someone, somewhere, to come up with the other $996 billion.

If the prime minister truly believes housing investors are part of the problem, Canada’s housing woes are likely to worsen, and the targets to restore affordability will certainly remain elusive. Vilifying investors is why investment in housing in this country has been lacking for decades. His comments do not help at a time when the nation desperately seeks housing investment on an unprecedented scale.

Trudeau could have been justified in his critique of investors if he had identified alternative funding sources. But he didn’t.

Let’s face it, housing is a commodity. Homes are bought, leased and sold. Every housing transaction involves an exchange of money. To suggest anything but is a disservice to the nation’s unmet housing needs.

Housing in great cities has historically been financed by investors. Even Paris is no exception. In 2018, we wrote about how the much-admired built form of Paris was a result of investments by, you guessed it, investors and speculators.

In Selling Paris, University of Manchester professor Alexia Yates chronicled “the people, practices, and politics that spurred the largest building boom of the nineteenth century, turning city-making into big business in the French capital.” She described “the ways housing and property became commodities during a crucial period of (French) urbanization.”

How is it that the urban planning literature in North America is saturated with praise for French cities — their high density, their bike, pedestrian and transit-friendly transport systems, and their Haussmannized boulevards — but completely disregard the enabling contributions by investors and speculators?

Almost every single renter in Canada lives in a dwelling unit owned by an investor. From British Columbia to Newfoundland, five million households are sheltered in dwellings provided by investors, many of whom are corporations that own purpose-built rental housing. Yet Trudeau believes investors and corporations are part of the problem.

Since 2015, when the Liberals took charge in Ottawa, investment in housing has been mostly flat, except for an unexpected COVID-19 boom-and-bust cycle. Since March 2021, the value of single-family dwelling permits has been declining. During the same time, housing prices and rents have increased beyond the reach of low-income households.

Consider that the average house price in Canada, according to the Canadian Real Estate Association, jumped to $703,574 in 2022 from $441,766 in 2015, an increase of 60 per cent.

The federal government has been active in housing with a 10-year, $75-billion National Housing Strategy, unveiled in 2018. But the federal government’s investments have been unable to move the needle on affordability, suggesting the feds can’t do the job alone.

Canada needs massive investment and tons of investors to make progress on housing affordability. It doesn’t help if the highest office in the country accuses investors of contributing to worsening affordability.

The Prime Minister’s Office needs to pivot and adopt a different narrative that acknowledges the federal and other governments’ inability to provide sufficient funds to build the housing Canada needs. The PMO should be the lead cheerleader in attracting investments to the housing sector, not the enemy.

Murtaza Haider is a professor of real estate management and director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.

Yahoo Finance

Yahoo Finance