TriplePoint Venture (TPVG) Q4 Earnings Beat, Revenues Rise

TriplePoint Venture Growth BDC Corp.’s TPVG fourth-quarter 2020 net investment income of 39 cents per share outpaced the Zacks Consensus Estimate of 36 cents. However, the bottom line declined 13.3% from the year-ago quarter.

In the reported quarter, the company recorded a rise in total investment income. Also, the balance sheet position remained strong. Further, decent portfolio activity was a tailwind. However, higher expenses hurt results to some extent.

Net investment income was $11.9 million, up 7% year over year.

For 2020, net investment income was $47.9 million or $1.57 per share compared with $38.3 million or $1.54 per share recorded in 2019. The Zacks Consensus Estimate was $1.56 per share.

Total Investment Income Improves, Expenses Rise

Total quarterly investment and other income amounted to $23.4 million, up 10.1% year over year, reflecting higher interest income from investments. Moreover, the figure beat the Zacks Consensus Estimate of $21.4 million.

For the year, total investment and other income was $91.2 million, up 24.3% from 2019. The figure surpassed the Zacks Consensus Estimate of $89.2 million.

Total quarterly operating expenses jumped 13.6% year over year to $11.5 million. The increase reflected a rise in base management fee and income incentive fee.

Balance Sheet Strong

As of Dec 31, 2020, TriplePoint Venture’s net asset value was $12.97 per share compared with $13.34 on Dec 31, 2019.

The company had $251.7 million in liquidity, consisting of $44.7 million in cash and restricted cash, and $207 million available capacity under the revolving credit facilities as of Dec 31, 2020. The revolving credit facility figure excluded an additional $75 million available under the facility’s accordion feature.

As of Dec 31, 2020, total assets amounted to $683.5 million, down from $684.1 million on Dec 31, 2019.

Total Portfolio Value & New Commitments Decent

The fair value of TriplePoint Venture’s total investment portfolio was $633.8 million as of Dec 31, 2020, down from $653.1 million on Dec 31, 2019.

As of Dec 31, 2020, TriplePoint Venture held debt investments with 33 portfolio companies, warrants in 64 portfolio companies and equity investments in 24 portfolio companies.

In the reported quarter, the company entered $73.4 million of new debt commitments with six portfolio companies and funded $67.4 million in debt investments to nine portfolio companies. Further, it had $63 million of principal prepayments and $10.8 million of scheduled principal amortization.

Our View

TriplePoint Venture’s investment income is expected to continue improving, driven by the rise in demand for customized financing. However, mounting operating expenses are likely to hurt the bottom line to some extent.

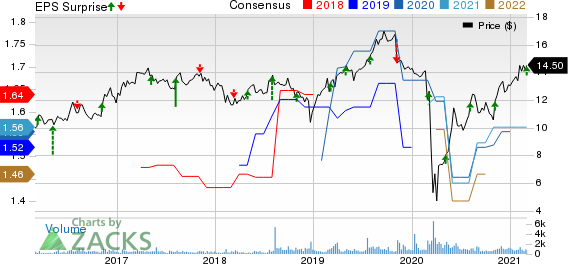

TriplePoint Venture Growth BDC Corp. Price, Consensus and EPS Surprise

TriplePoint Venture Growth BDC Corp. price-consensus-eps-surprise-chart | TriplePoint Venture Growth BDC Corp. Quote

Currently, TriplePoint Venture carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Schedule of Other Finance Stocks

Hercules Capital Inc.’s HTGC fourth-quarter 2020 net investment income of 37 cents per share surpassed the Zacks Consensus Estimate of 33 cents. However, the bottom line declined 2.6% from the year-ago reported figure.

Ares Capital Corporation’s ARCC fourth-quarter 2020 core earnings of 54 cents per share surpassed the Zacks Consensus Estimate of 40 cents. Moreover, the bottom line reflects a year-over-year rise of 20%.

Barings BDC, Inc. BBDC is slated to announce quarterly results on Mar 24.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

TriplePoint Venture Growth BDC Corp. (TPVG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance