Do Trican Well Service's (TSE:TCW) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Trican Well Service (TSE:TCW). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Trican Well Service

Trican Well Service's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Trican Well Service's EPS went from CA$0.048 to CA$0.35 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Trican Well Service is growing revenues, and EBIT margins improved by 12.9 percentage points to 13%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

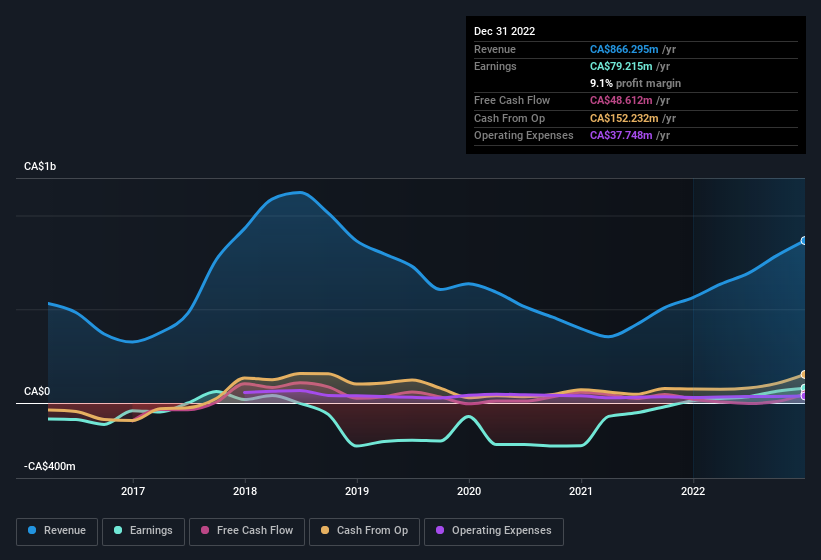

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Trican Well Service's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Trican Well Service Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Trican Well Service, is that company insiders spent CA$24k acquiring shares in the last year. While this isn't much, we also note an absence of sales.

Does Trican Well Service Deserve A Spot On Your Watchlist?

Trican Well Service's earnings per share growth have been climbing higher at an appreciable rate. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Trican Well Service on your watchlist. Of course, just because Trican Well Service is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Trican Well Service is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance