Tribe Property Technologies Inc. (CVE:TRBE) Screens Well But There Might Be A Catch

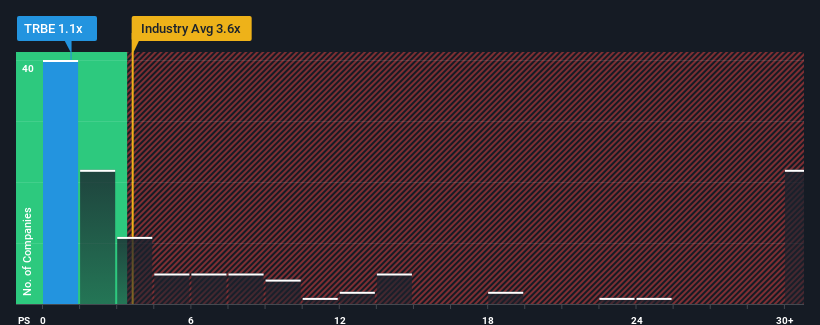

With a price-to-sales (or "P/S") ratio of 1.1x Tribe Property Technologies Inc. (CVE:TRBE) may be sending very bullish signals at the moment, given that almost half of all the Software companies in Canada have P/S ratios greater than 3.6x and even P/S higher than 13x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Tribe Property Technologies

How Has Tribe Property Technologies Performed Recently?

Recent times haven't been great for Tribe Property Technologies as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tribe Property Technologies.

Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Tribe Property Technologies' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 18% over the next year. With the industry predicted to deliver 18% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Tribe Property Technologies' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Tribe Property Technologies' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You need to take note of risks, for example - Tribe Property Technologies has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

If these risks are making you reconsider your opinion on Tribe Property Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance