Treasuries Advance Ahead of US Jobs Data Key to Fed Outlook

(Bloomberg) -- Treasuries inched higher across the curve as traders looked ahead to a monthly US employment report that’s widely expected to show a gradual cooling in the labor market, potentially bolstering the case for monetary policy easing.

Most Read from Bloomberg

Biden’s Defiant Interview Unlikely to Calm Democratic Nerves

A $14 Billion Walmart Heir Joins Novogratz Urging Biden Exit

Stocks Up as Path to September Fed Cut Gets Wider: Markets Wrap

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

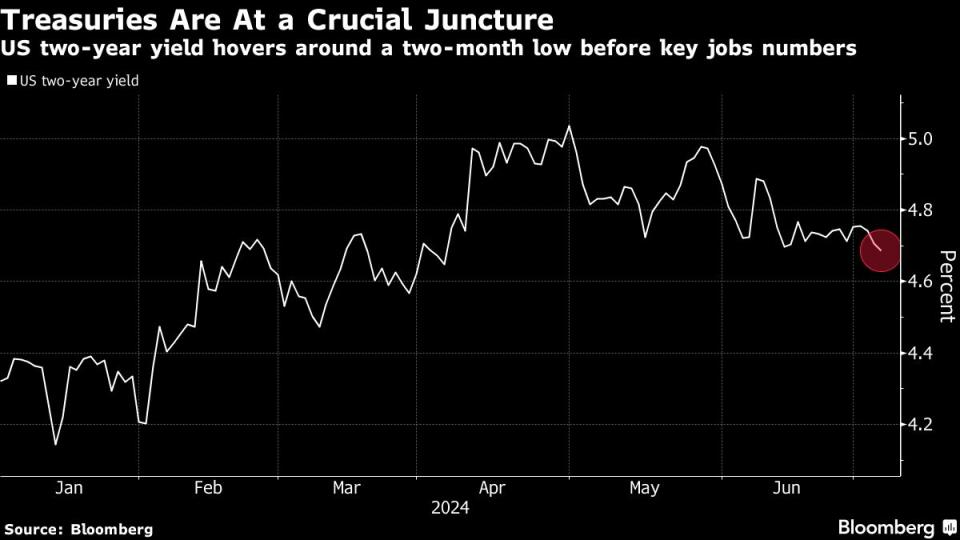

Two-year yields, among the most sensitive to changes in the outlook for interest rates, dropped three basis points to 4.69% as trading resumed following the July 4 holiday. Payrolls probably rose by 190,000 last month, according to the median estimate in a Bloomberg survey, down from 272,000 in May.

Investors are keenly awaiting signs that the Federal Reserve has enough evidence of abating price pressures to begin lowering borrowing costs. The report due at 8:30 a.m. in New York is expected to show average hourly earnings eased to 0.3% on the month in June, down from 0.4% previously.

This comes as the debate over whether President Joe Biden will scrap his run for re-election heats up, and what if anything that would mean for the Fed. Some argue that the return of Donald Trump to the White House would lead to looser fiscal policy and more inflation.

“The jobs data is the only thing markets can really get anything concrete out of,” said Jon Levy, macro strategist at Loomis Sayles & Co in an interview. “If you’re trying to define what the Fed is going to do, the Fed is not political.”

The dollar dropped against all Group-of-10 peers, with the Bloomberg Dollar Spot Index hovering around the lowest level in over three weeks. Money markets are currently pricing around 50 basis points of easing by year-end, with the first reduction expected as early as September.

--With assistance from James Hirai.

(Adds details on the US jobs report in the third paragraph. A previous version of this story corrected the chart subhead to show the yield is near a three-month low.)

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance