TransferWise launches US debit card that cuts costs when spending abroad

U.K.-based fintech company TransferWise launched a Mastercard (MA) debit card in the U.S. Wednesday, that allows travelers to spend in 40 different currencies with one card.

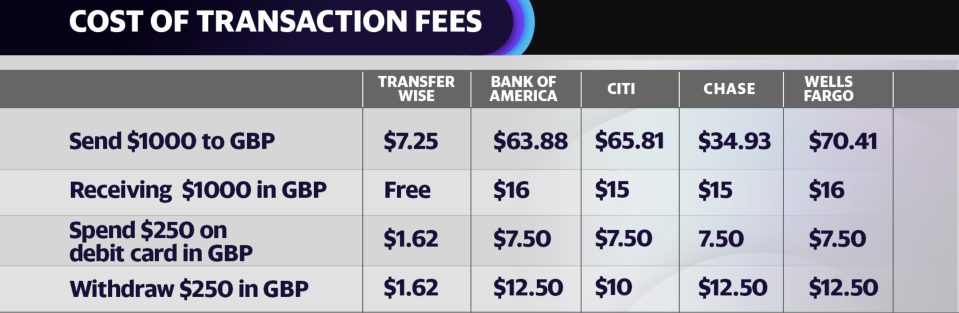

“If you are traveling with a card from your bank you would typically be subject to foreign fees and additional exchange rates...so we developed the TransferWise card which would keep the exchange rate at a very low markup,” TransferWise Co-Founder Taavet Hinrikus told Yahoo Finance’s The Final Round.

The card mirrors the debit card the company originally launched in the U.K. and E.U. in 2018. There have been over 15 million transactions on U.K. and E.U. TransferWise cards to date.

In order to keep costs low, unlike traditional banks, TransferWise focuses on just one service and one branch.

“We only work with one branch, which is your smartphone, that’s the only bank branch that matters nowadays,” Hinrikus said. “We offer a very limited set of services...and by doing it this way we’re able to run a company worth hundreds of millions of dollars and that is profitable.”

TransferWise says it is now valued at $3.5 billion but following the path of other fintech giants like Robinhood and Coinbase, don’t expect it to go public any time soon.

“We’ve thought about it long and hard and we have one goal today which is to continue to grow TransferWise, continue to grow it globally as fast as we can and we kind of felt that being public would be a distraction for us,” Hinrikus said. “It wouldn’t help us do it any faster.”

Over 5 million people use TransferWise and the company processes over $5 billion in payments every month, saving customers over $1 billion a year.

Sara Dramer is a producer for Yahoo Finance. Follow her on twitter @saradramer.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance