TransCanada Corporation Just Gave Investors a Big Raise: There’s More Where That Came From

Pipeline giant TransCanada Corporation (TSX:TRP)(NYSE:TRP) just completed its best year ever. The company finished a slew of strategic growth initiatives, which fueled a 12% increase in earnings compared to 2015. Meanwhile, cash flow from operations exceeded $5 billion for the first time in the company?s history, which put it in the position to provide investors with their biggest raise in years. However, as good as last year was, even better days lie ahead.

The acceleration has begun

TransCanada has a long history of providing its investors with a raise each year. In fact, the company has increased the dividend for 17 consecutive years. However, what?s different about its most recent increase is the size. The company boosted the dividend by 10.6%, which is well above its long-term average of providing investors with annual growth of 7%. Further, the payout increase was above the high end of the company?s guidance range of 8-10% in annual increases through 2020.

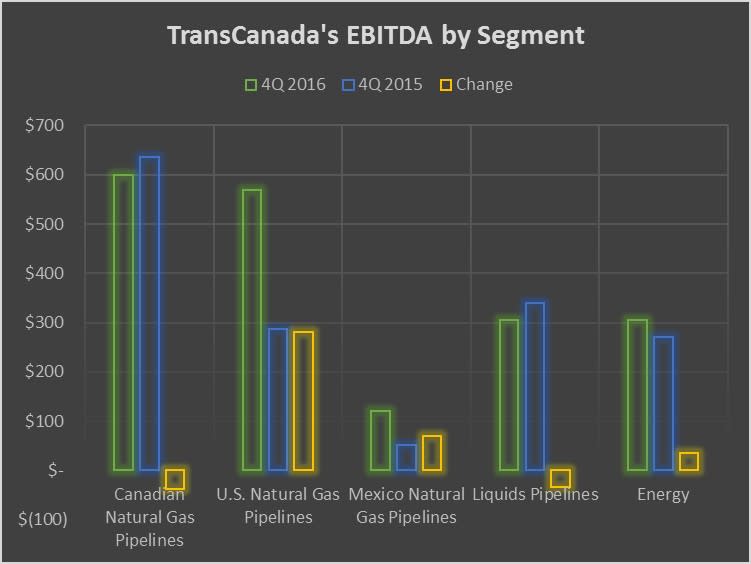

Fueling the company?s ability to deliver high-end dividend growth were the strong results of its natural gas pipeline segments in the U.S. and Mexico. As the following chart shows, both produced robust results in the recently completed fourth quarter:

Data source: TransCanada Corporation. Chart by author.

Fueling growth in the U.S. was the acquisition of Columbia Pipeline Group, which significantly expanded that segment. In addition, the company completed two pipeline projects in Mexico last year, which significantly boosted earnings from that country. The incremental income from those strategic growth initiatives enabled TransCanada to more than offset weakness in its Canadian natural gas and liquids pipelines segments.

Plenty in the pipeline to continue the momentum

That said, as great as last year was, it was only the beginning. CEO Russ Girling called 2016 a ?transformational year for TransCanada? because it acquired a new growth platform in Colombia. That acquisition alone provided the company with US$7.1 billion of growth projects that are currently underway, including US$2.3 billion of projects that are expected to enter service this year.

On top of the growing stream of cash flow as those projects come online, the company expects to realize US$250 million in cost savings by the end of next year as it integrates Columbia into its network.

Overall, TransCanada has $23 billion of projects underway. These investments will not only continue to expand its U.S. natural gas pipeline earnings, but the company will double the profits within its Mexico pipeline business by the end of next year and restart growth in its Canadian natural gas pipeline segment thanks to a $5.4 billion expansion to its NGTL System.

These and other clearly visible growth projects give the company complete confidence that it can deliver an annual dividend-growth rate at the upper end of its 8-10% range through 2020.

TransCanada?s growth will not grind to a halt.

The company has another $45 billion of large-scale projects waiting in the wings, including the recently restarted Keystone XL pipeline, which now has a real shot of getting built. That project, however, is just one of four transformational projects the company is working on that could fuel dividend growth beyond 2020. Further, that $45 billion figure doesn?t include any more expansion projects in its U.S. or Mexico gas pipeline segments, which isn?t a reasonable assumption given how rapidly those markets are growing these days.

Suffice it to say, TransCanada shouldn?t have any problem continuing to grow its dividend at a robust clip for the foreseeable future.

Investor takeaway

TransCanada has been a very reliable dividend-growth stock over the past 17 years. However, the company expects to take its growth rate up a notch over the next few years thanks to a robust pipeline of investment opportunities. That pipeline should fuel healthy dividend growth at least through 2020 with the growing likelihood that the company can maintain its momentum as it moves forward on some of its mega-projects.

How to Find Great Dividend Stocks

Over a nearly 30-year period, dividend-paying stocks earned about 18X more than their non-dividend counterparts!

Yet incredibly, it's only one part of the story.

To find out how these same stocks had 45% less volatility (and how you can try to take advantage!), click here to read this exhaustive report.

More reading

Fool contributor Matt DiLallo has no position in any stocks mentioned.

How to Find Great Dividend Stocks

Over a nearly 30-year period, dividend-paying stocks earned about 18X more than their non-dividend counterparts!

Yet incredibly, it's only one part of the story.

To find out how these same stocks had 45% less volatility (and how you can try to take advantage!), click here to read this exhaustive report.

Fool contributor Matt DiLallo has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance