How Is Trakm8 Holdings' (LON:TRAK) CEO Compensated?

John Watkins is the CEO of Trakm8 Holdings PLC (LON:TRAK), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Trakm8 Holdings.

See our latest analysis for Trakm8 Holdings

How Does Total Compensation For John Watkins Compare With Other Companies In The Industry?

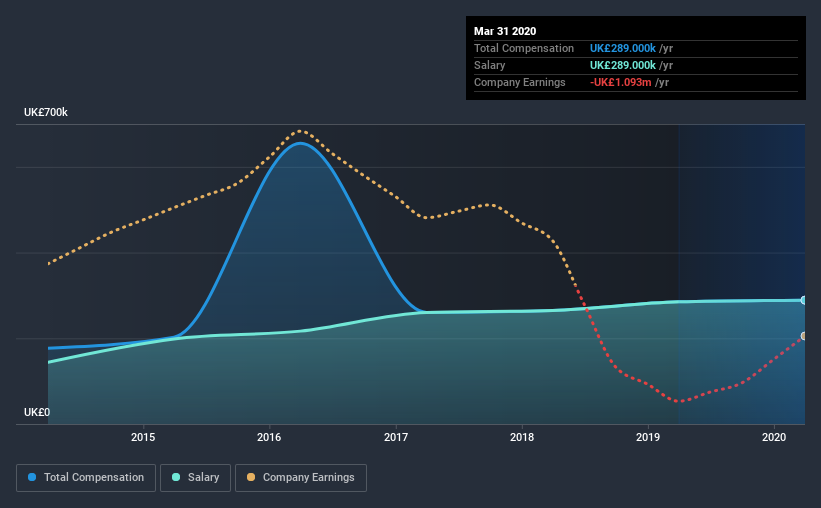

At the time of writing, our data shows that Trakm8 Holdings PLC has a market capitalization of UK£9.1m, and reported total annual CEO compensation of UK£289k for the year to March 2020. That is, the compensation was roughly the same as last year. Notably, the salary of UK£289k is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations under UK£152m, the reported median total CEO compensation was UK£268k. So it looks like Trakm8 Holdings compensates John Watkins in line with the median for the industry. Furthermore, John Watkins directly owns UK£1.4m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£289k | UK£285k | 100% |

Other | - | - | - |

Total Compensation | UK£289k | UK£285k | 100% |

Talking in terms of the industry, salary represented approximately 74% of total compensation out of all the companies we analyzed, while other remuneration made up 26% of the pie. Speaking on a company level, Trakm8 Holdings prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Trakm8 Holdings PLC's Growth

Over the last three years, Trakm8 Holdings PLC has shrunk its earnings per share by 89% per year. It achieved revenue growth of 2.1% over the last year.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Trakm8 Holdings PLC Been A Good Investment?

Given the total shareholder loss of 79% over three years, many shareholders in Trakm8 Holdings PLC are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Trakm8 Holdings pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As previously discussed, John is compensated close to the median for companies of its size, and which belong to the same industry. On the other hand, EPS growth and total shareholder return have been negative for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Trakm8 Holdings you should be aware of, and 1 of them is potentially serious.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance