Traders Gird for Weaker Canadian Dollar as First Rate Cut Eyed

(Bloomberg) -- Traders are bracing for weakness in the Canadian dollar amid wagers that local policymakers will likely reduce interest rates before their peers at the Federal Reserve.

Most Read from Bloomberg

Modi Vows to Retain Power Even as Party Loses India Majority

Short Sellers in Danger of Extinction After Crushing Stock Gains

Bonds Rally as Traders Reload Fed Bets After Data: Markets Wrap

Stock Pickers Defy Wall Street Norm to Risk It All on a Few Bets

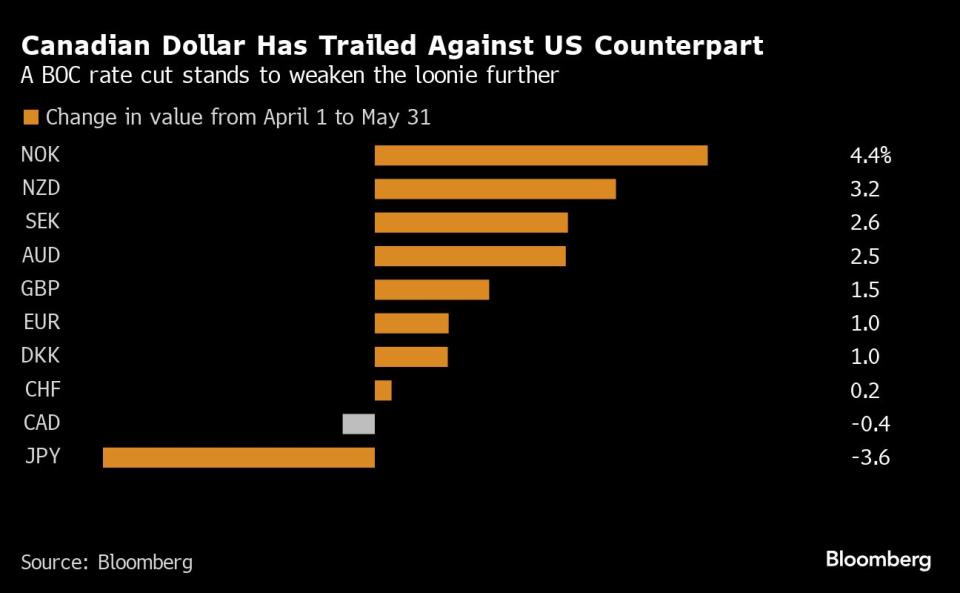

That rate differential — which some on Wall Street expect to widen when the Bank of Canada meets on Wednesday — is already fueling one of the worst performances among Group-of-10 currencies this quarter. The loonie has been the second-weakest performer in the Group of 10 since the end of March, trailing only the Japanese yen.

“The BOC will deliver a cut which will weigh on the Canadian dollar,” said Elias Haddad, a senior strategist at Brown Brothers Harriman. He — like many on Wall Street — expects the Canadian central bank to reduce rates soon, while data in the US may force Fed officials to keep rates higher for longer.

For many currency traders, that means the loonie is likely to keep slipping against the greenback, regardless of whether a Canadian rate cut comes in June or July. The market is pricing in around an 80% probability of a cut on Wednesday, a jump from about 60% odds implied before last week’s weaker-than-expected reading of Canada’s gross domestic product.

Asset managers and hedge funds have kept their wagers against the loonie near a seven-year high, only slightly trimming the positions, according to recent Commodity Futures Trading Commission data.

“Even if a rate cut does not pan out next week, the Canadian dollar is unlikely to see a sustained near-term rally,” said Howard Du, a foreign-exchange strategist at Bank of America Corp. “The BOC communication or guidance next week would likely remain dovish as the BOC looks to lay the groundwork for a July rate cut.”

A slew of technical signals are also raising alarm bells. One-week option volatility, a tenor that also incorporates US and Canadian jobs data this week, touched 6.07% Tuesday, its highest level in more than a month.

Over the past week, turnover on US-Canadian call options have outpaced bearish puts by about three-to-two amid the growing odds of a BOC rate cut, according to Depository Trust & Clearing Corporation data. Of the calls traded, 20% are strikes set at or above 1.40 — a level of weakness the loonie last breached in 2020.

While traders are still aggressively shorting the Canadian dollar, “unless there is new or additional motivation to extend shorts even further,” there’s a limit to how much it falls even in the event of a rate cut, according to Shaun Osborne, chief FX strategist at Scotiabank, one of the few holdouts in favor of a hold.

Citi economist Veronica Clark also expects a hold this week. “The US experience of a pick-up in inflation after six-to-seven favorable months could be a particularly cautionary tale against premature cuts,” she wrote in a note to clients Monday. “We continue to expect the first rate cut in July.”

Some proponents of a June cut see the loonie regaining some of its strength later this year, when a potential Fed cut stands to reduce the differentials with the BOC’s rate.

BofA’s Du sees the loonie strengthening to 1.35 against the greenback by year-end with US inflation and growth data continuing to follow Canada lower. “The Canadian dollar should rally more meaningfully against the US dollar once Fed rate cuts become more imminent.”

Most Read from Bloomberg Businessweek

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

Disney Is Banking On Sequels to Help Get Pixar Back on Track

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance