Trade between the US and China is drying up. That could be bad news for American consumers.

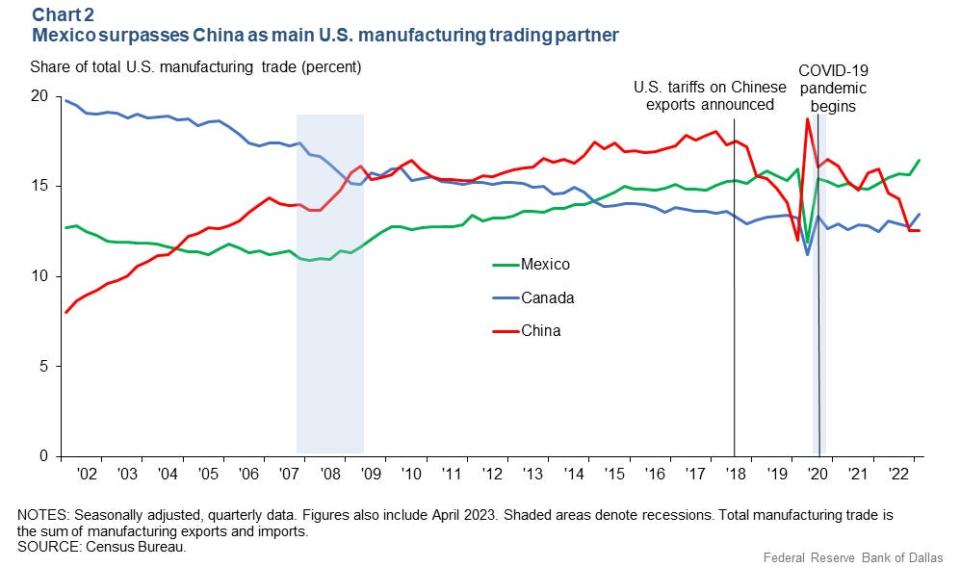

Trade between the US and China has declined dramatically. Mexico is now the US's top trade partner.

However, fewer cheap Chinese imports could mean more expensive domestic prices for American buyers.

Concerns such as national security and supply-chain resiliency have weighed on US-China trade relations.

With ties this year between Washington and Beijing have becoming more and more strained, Chinese imports to the US have tumbled to their lowest level in two decades.

That might be bad news for American consumers.

Deteriorating political ties have weighed on trade between the two world powers. Both China and the US are vying for supremacy in the semiconductor and technology sectors, and there's an ongoing currency war between the yuan and dollar. These concerns, according to a Tuesday report from the Dallas Fed, highlight that today's global trade dynamics no longer look at low prices in a vacuum. National security, policy, and supply-chain resiliency now factor into the equation, too.

This year, Mexico supplanted China as the US's top trading partner, with bilateral trade hitting $263 billion in the first four months of the year. Census Bureau data shows that in the four months up to May, imports from China dropped 25% from a year ago, falling from $175 billion to $130 billion.

In that same stretch, however, US exports to China climbed from $48.8 billion to $49.3 billion.

To be clear, if companies pivot away from China's cheap production and supply chains, that likely increases costs for those firms, costs which then trickle down to everyday consumers. All things point to the US and China becoming less reliant on one another as time goes on, which suggests prices for goods that were once sourced from China could get more expensive as the US brings more production stateside or closer to home, "nearshoring" operations in neighboring countries like Mexico.

In 2001, China joined the World Trade Organization, a group that grants members preferential tariffs when trading with one another. That access opened the door to China to become a leading trade and manufacturing hub, as the Dallas Fed pointed out.

"Within a decade of its admission, critics increasingly accused China of flooding the world with cheap exports while limiting foreign access to its market," Dallas Fed senior economist Luis Torres said. "China's trade growth coincided with sharp declines in U.S. manufacturing employment. Sectors and regions especially exposed to China's trade tended to experience higher unemployment, lower labor force participation and reduced wage growth."

Mexico, for its part, benefits from increased trade with the US — beating out China in US trade volume means it's climbing on the world stage. But ultimately, because so few countries can compete with China as far as cost efficiency, Americans could be left holding a bigger bill because of Mexico's rise.

"While Mexico benefits from increased trade with the U.S., the impact on U.S. producers and consumers has been mixed," the Dallas Fed's report reads. "To the extent that frictions with China account for Mexico's ascension in the trade rankings, the higher profile comes at a cost to U.S. firms and consumers through higher input and purchase prices."

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance