Tractor Supply (TSCO) Q1 Earnings & Sales Miss Estimates

Tractor Supply Company TSCO has posted first-quarter 2023 results, wherein the top and bottom lines missed the Zacks Consensus Estimate but improved year over year. The year over year growth in top and bottom lines reflected gains from continued market share growth and progress on its strategic initiatives. Moreover, TSCO benefited from its Life Out Here Strategy, Neighbor’s Club membership program and healthy demand for its products. Management retained its view for 2023.

Tractor Supply’s earnings of $1.65 per share were flat year over year but missed the Zacks Consensus Estimate of $1.69 and our estimate of $1.67.

Net sales advanced 9.1% year over year to $3,299.2 million and missed the Zacks Consensus Estimate of $3,302 million. However, sales beat our estimate of $3,294.4 million. . Sales in the first quarter benefited from contributions from the Orscheln Farm and Home acquisition concluded in October 2022, store openings and increased comparable store sales (comps).

Comps improved 2.1%, led by growth in comparable average tickets, offset by a decline in comparable average transactions. The company’s comparable average ticket improved 2.8%, while the comparable average transaction count was down 0.7%. Sturdy demand for everyday merchandise, including consumable, usable and edible products, as well as year-round products, contributed to comp growth. This was partly offset by a decline in seasonal goods.

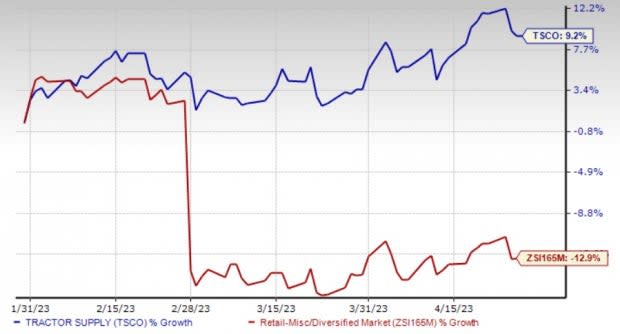

Shares of the Zacks Rank #3 (Hold) company have gained 9.2% in the past three months against the industry’s 12.9% decline.

Image Source: Zacks Investment Research

Costs and Margins

The gross profit rose 10.7% year over year to $1,169.9 million, while the gross margin expanded 52 basis points (bps) to 35.5%. The execution of everyday low-price strategy, reduced transportation costs and other margin-driving initiatives aided margins, partly offset by cost inflation and the unfavorable product mix.

Selling, general and administrative (SG&A) expenses, including depreciation and amortization, as a percentage of sales, expanded 119 bps year over year to 28.1%. In dollar terms, SG&A expenses, including depreciation and amortization, rose 13.9% year over year to $925.5 million. Higher SG&A expenses resulted from the deleverage due to moderate comps and higher depreciation and amortization, the opening of the new distribution center, and the impacts of the Orscheln Farm and Home acquisition.

The operating income was nearly flat year over year at $244.4 million in the first quarter. Meanwhile, the operating margin contracted 67 bps to 7.41%.

Tractor Supply Company Price, Consensus and EPS Surprise

Tractor Supply Company price-consensus-eps-surprise-chart | Tractor Supply Company Quote

Financial Position

Tractor Supply ended first-quarter 2023 with cash and cash equivalents of $190.1 million, long-term debt of $1,601.6 million, and total stockholders’ equity of $1,914.5 million.

In first-quarter 2023, the company incurred a capital expenditure of $157.9 million and generated a cash flow from operating activities of $19.6 million. Capital expenditure is expected to be $700-$775 million for 2023.

In the first quarter, Tractor Supply returned $310.6 million to its shareholders, including $197.2 million to repurchase 0.9 million shares, and $113.4 million as quarterly cash dividends.

Store Update

In the quarter under review, the company opened 17 Tractor Supply stores and three Petsense by Tractor Supply stores. As of Apr 1, 2023, it operated 2,164 Tractor Supply stores across 49 states, including 81 Orscheln Farm and Home acquired in 2022. The company expects to complete the planned conversion of 81 Orscheln Farm and Home to Tractor Supply stores by the end of 2023. It also operated 189 Petsense stores in 23 states as of Apr 1, 2023.

Management expects to continue its store-opening initiatives in 2023. It plans to open 70 Tractor Supply stores and 10-15 Petsense stores in 2023. Additionally, it expects to complete the aforementioned Orscheln Farm and Home conversions, as well as the Project Fusion remodels and garden center transformations.

2023 Outlook

Tractor Supply has reiterated its guidance for 2023. The company expects net sales of $15-$15.3 billion, with comp growth of 3.5-5.5%. The operating margin is anticipated to be 10.1-10.3%. Net income is expected to be $1.13-$1.17 billion. Earnings per share are likely to be $10.30-$10.60.

Stocks to Consider

Here are three better-ranked stocks to consider — Build-A-Bear Workshop BBW, DICK’S Sporting Goods DKS and Ulta Beauty ULTA.

Build-A-Bear Workshop, the leading and only national company, providing a make-your-own stuffed animal interactive retail-entertainment experience, currently sports a Zacks Rank #1 (Strong Buy). BBW has a trailing four-quarter earnings surprise of 17.4%, on average.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Build-A-Bear’s current financial-year sales and earnings suggests growth of 6.2% and 12.3%, respectively, from the year-ago reported number.

DICK’S Sporting, a major omni-channel sporting goods retailer, currently carries a Zacks Rank #2 (Buy). DKS has an expected EPS growth rate of 5.4% for three to five years.

The Zacks Consensus Estimate for DICK’S Sporting’s current financial-year revenues and earnings suggests growth of 3% and 12.1%, respectively, from the year-ago reported figures. DKS has a trailing four-quarter earnings surprise of 10%, on average.

Ulta Beauty, a leading beauty retailer in the United States, carries a Zacks Rank #2 at present. The company has a trailing four-quarter earnings surprise of 26.2%, on average.

The Zacks Consensus Estimate for Ulta Beauty’s current financial year’s revenues and earnings suggests growth of 8.4% and 5.1%, respectively, from the year-ago reported figure. ULTA has an expected EPS growth rate of 26.2% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance