Tractor Supply (NASDAQ:TSCO) Reports Q1 In Line With Expectations

Rural goods retailer Tractor Supply (NASDAQ:TSCO) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 2.9% year on year to $3.39 billion. On the other hand, the company's full-year revenue guidance of $14.9 billion at the midpoint came in slightly below analysts' estimates. It made a GAAP profit of $1.83 per share, improving from its profit of $1.65 per share in the same quarter last year.

Is now the time to buy Tractor Supply? Find out in our full research report.

Tractor Supply (TSCO) Q1 CY2024 Highlights:

Revenue: $3.39 billion vs analyst estimates of $3.40 billion (small miss)

EPS: $1.83 vs analyst estimates of $1.72 (6.4% beat)

The company reconfirmed its revenue guidance for the full year of $14.9 billion at the midpoint (below expectations of $15.0 billion)

The company reconfirmed its EPS guidance for the full year of $10.18 billion at the midpoint (below expectations of $10.24)

Gross Margin (GAAP): 36%, up from 35.5% in the same quarter last year

Free Cash Flow of $100.2 million is up from -$138.4 million in the same quarter last year

Same-Store Sales were up 1.1% year on year (beat vs. expectations of up 1.1% year on year)

Store Locations: 2,435 at quarter end, increasing by 82 over the last 12 months

Market Capitalization: $27.86 billion

“For the first quarter, Tractor Supply’s results were in line with our expectations with positive comparable store sales and robust earnings growth. I want to thank our more than 50,000 Team Members for their enduring commitment to living our Mission and Values and providing exceptional customer service, which allowed us to deliver solid financial performance in the first quarter. We saw several positive signs in our business during the quarter, including ongoing market share gains, transaction growth and strength in big ticket sales. Most importantly, we believe that our customer base remains healthy and engaged. We remain confident in our outlook for 2024 given our share gains and the continued scaling of our Life Out Here strategy. We remain committed to disciplined investments to capture the significant long-term growth opportunities in our market,” said Hal Lawton, President and Chief Executive Officer of Tractor Supply.

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

Tractor Supply is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

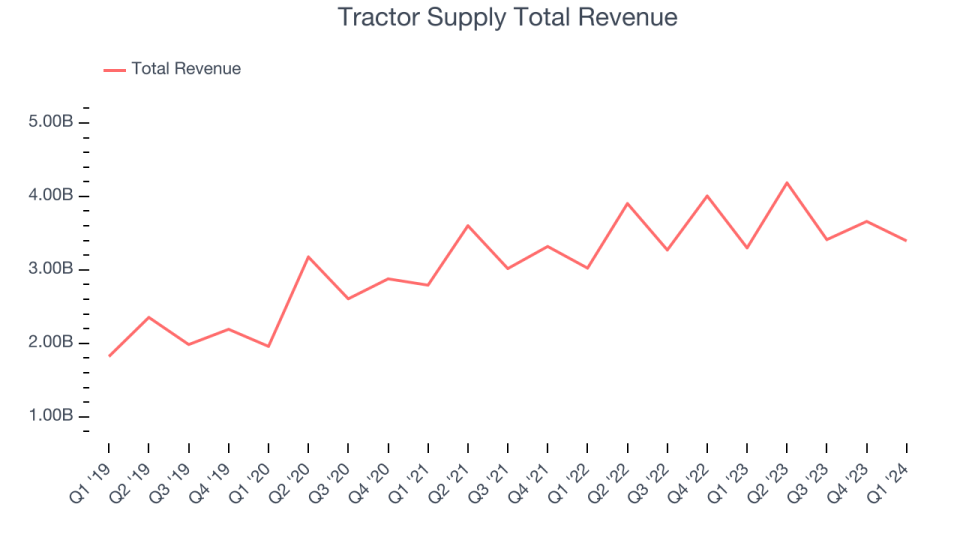

As you can see below, the company's annualized revenue growth rate of 12.7% over the last five years was solid as it opened new stores and grew sales at existing, established stores.

This quarter, Tractor Supply's revenue grew 2.9% year on year to $3.39 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.9% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

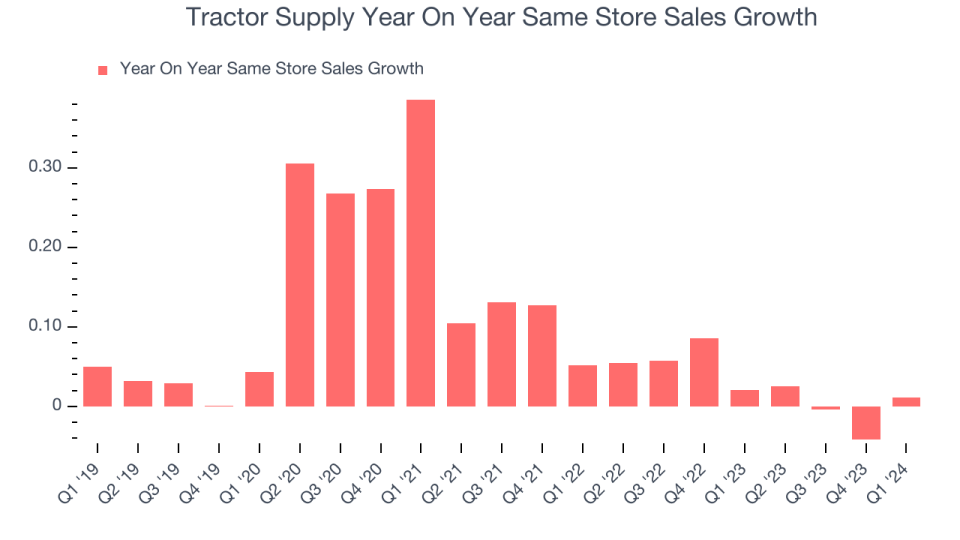

Tractor Supply's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.6% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Tractor Supply is reaching more customers and growing sales.

In the latest quarter, Tractor Supply's same-store sales rose 1.1% year on year. This growth was a deceleration from the 2.1% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Key Takeaways from Tractor Supply's Q1 Results

It was good to see Tractor Supply beat analysts' same store sales and EPS expectations this quarter. On the other hand, its revenue and gross margin missed analysts' expectations and its full-year revenue and earnings guidance, while maintained from the previous outlook, missed Wall Street's estimates. Overall, this was a mixed quarter for Tractor Supply. The stock is flat after reporting and currently trades at $256.97 per share.

So should you invest in Tractor Supply right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance