The TopBuild (NYSE:BLD) Share Price Is Up 175% And Shareholders Are Boasting About It

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the TopBuild Corp. (NYSE:BLD) share price has flown 175% in the last three years. How nice for those who held the stock! On top of that, the share price is up 11% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 12% in 90 days).

Check out our latest analysis for TopBuild

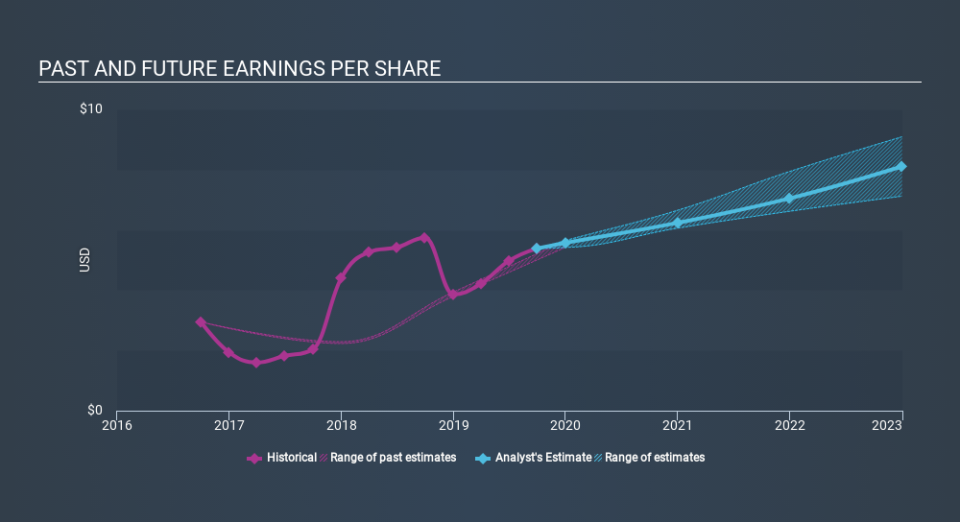

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

TopBuild was able to grow its EPS at 22% per year over three years, sending the share price higher. In comparison, the 40% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. That's not necessarily surprising considering the three-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on TopBuild's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that TopBuild rewarded shareholders with a total shareholder return of 127% over the last year. That's better than the annualized TSR of 40% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. Before spending more time on TopBuild it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance