Top US Dividend Stocks To Consider In July 2024

As the U.S. market shows mixed signals with sectors like electric vehicles and AI experiencing growth while others face challenges, investors may find stability in dividend stocks. These stocks can offer consistent returns in a fluctuating economic landscape, making them an attractive consideration for those looking to balance their portfolios amidst current market conditions.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.14% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.73% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.16% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.94% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.06% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.53% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.78% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.77% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.41% | ★★★★★☆ |

Click here to see the full list of 210 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

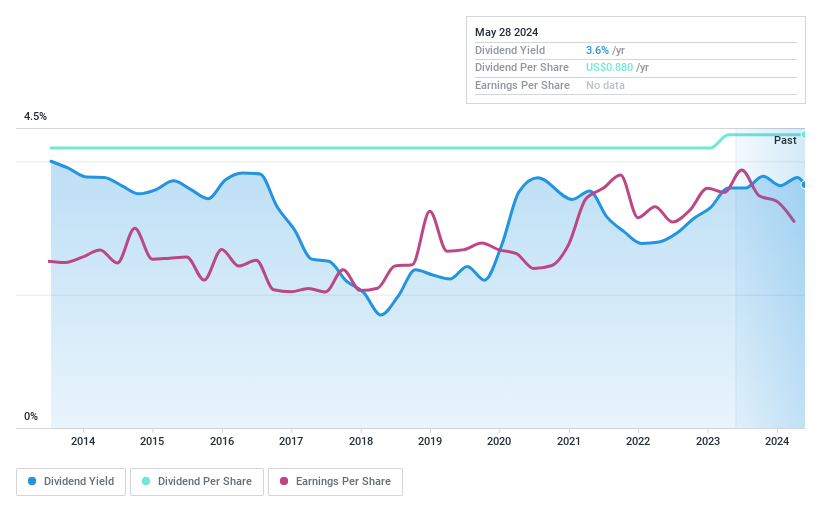

Ohio Valley Banc

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ohio Valley Banc Corp., with a market cap of approximately $101.24 million, serves as the holding company for The Ohio Valley Bank Company, offering a range of commercial and consumer banking products and services.

Operations: Ohio Valley Banc Corp. generates revenue primarily through its banking segment, which amassed $52.42 million, and its consumer finance operations, which contributed $3.28 million.

Dividend Yield: 4.2%

Ohio Valley Banc Corp. offers a steady dividend yield of 4.17%, under the top tier in the U.S. market but supported by a low payout ratio of 36.5%, indicating sustainability from earnings. Despite trading at 59.9% below estimated fair value, recent financial performance shows a decline with Q1 net income dropping to US$2.79 million from US$3.91 million year-over-year, and dividends per share have been consistent over the past decade, though recent index drops could impact visibility and investor sentiment.

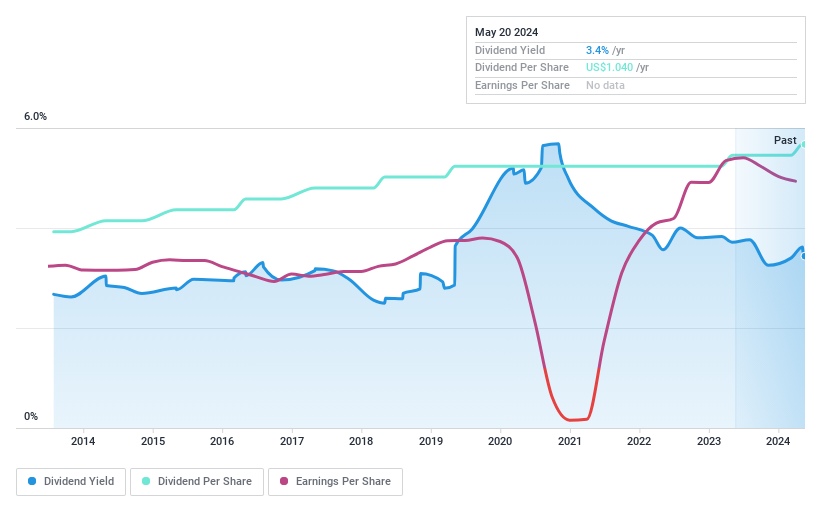

Weyco Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Weyco Group, Inc., a company that designs and distributes footwear for men, women, and children, has a market capitalization of approximately $276.08 million.

Operations: Weyco Group, Inc. generates its revenue primarily through two segments: retail, which brought in $38.90 million, and wholesale, contributing $236.75 million.

Dividend Yield: 3.5%

Weyco Group maintains a stable dividend track record, with recent increases to US$0.26 per share, reflecting a consistent commitment over the past decade. Despite soft sales projections for Q2 2024 and a slight decline in Q1 earnings to US$6.65 million from US$7.45 million year-over-year, the dividends are well-supported by a low cash payout ratio of 11.3% and an earnings payout ratio of 32.4%. However, its dividend yield of 3.5% is below the top quartile of U.S market payers at 4.76%.

Unlock comprehensive insights into our analysis of Weyco Group stock in this dividend report.

Our expertly prepared valuation report Weyco Group implies its share price may be too high.

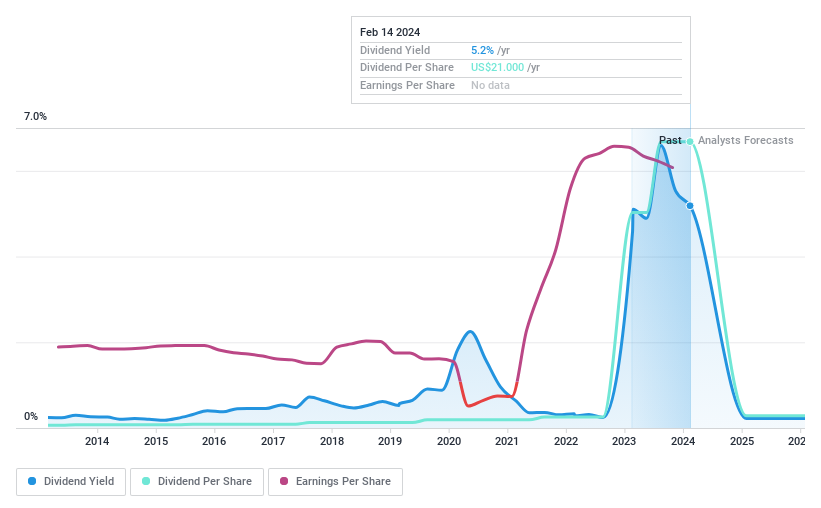

Dillard's

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. is a retailer that operates department stores primarily in the southeastern, southwestern, and midwestern United States, with a market capitalization of approximately $7.02 billion.

Operations: Dillard's, Inc. generates revenue primarily through its retail operations, which amounted to $6.57 billion.

Dividend Yield: 4.8%

Dillard's has demonstrated a consistent commitment to dividends, recently declaring a quarterly payout of US$0.25 per share. Despite a slight decline in Q1 2024 net income to US$180 million from US$201.5 million year-over-year, the dividend is well-supported by robust coverage metrics: a low payout ratio of 2.2% and cash flow coverage at 47.9%. The stock's dividend yield stands at an attractive 4.83%, placing it in the top quartile of U.S market payers. Recent index changes reflect its shifting market position, with multiple additions and removals across various Russell indexes as of July 1, 2024, indicating evolving investor perception and classification within the market landscape.

Make It Happen

Reveal the 210 hidden gems among our Top US Dividend Stocks screener with a single click here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:OVBC NasdaqGS:WEYS and NYSE:DDS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance