Top UK Dividend Stocks To Watch In July 2024

As the FTSE 100 shows signs of rebounding from a recent downturn, investors may find it opportune to consider the stability offered by dividend-paying stocks. In light of current market fluctuations and upcoming economic updates, stocks that consistently pay dividends can be particularly appealing for those seeking potential income alongside capital growth opportunities.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.62% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.44% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.98% | ★★★★★☆ |

DCC (LSE:DCC) | 3.48% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.82% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.32% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.52% | ★★★★★☆ |

Epwin Group (AIM:EPWN) | 5.45% | ★★★★☆☆ |

Click here to see the full list of 55 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

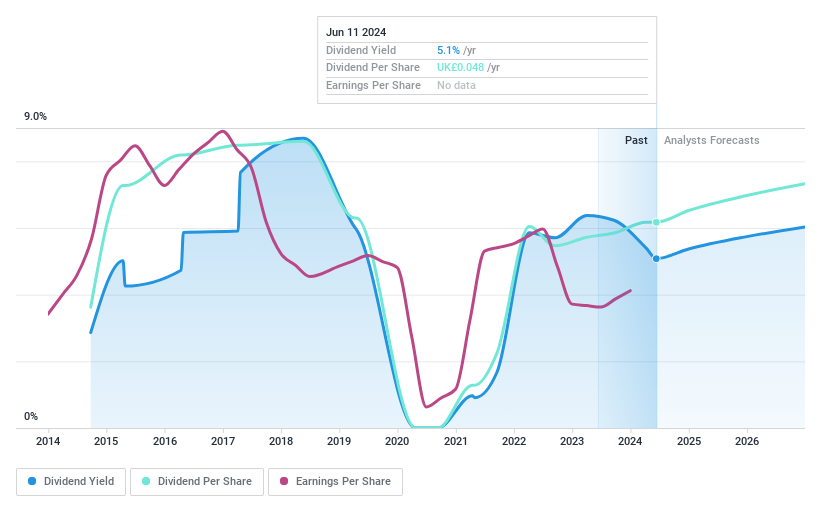

Epwin Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc is a manufacturer and distributor of building products primarily in the United Kingdom and other parts of Europe, with a market capitalization of approximately £124.16 million.

Operations: Epwin Group Plc generates revenue through two main segments: Extrusion and Moulding, which brings in £250.50 million, and Fabrication and Distribution, contributing £135.20 million.

Dividend Yield: 5.5%

Epwin Group's dividend sustainability is underpinned by a reasonable payout ratio of 74.9% and a low cash payout ratio of 23.4%, indicating dividends are well covered by both earnings and cash flows. Despite this, the dividend track record has been unstable, with payments showing volatility over the past decade. The recent increase in dividends suggests a positive trend, yet its yield remains slightly below the top UK payers. Recent share buybacks and executive changes might influence future financial strategies but have not directly impacted dividend policies as of now.

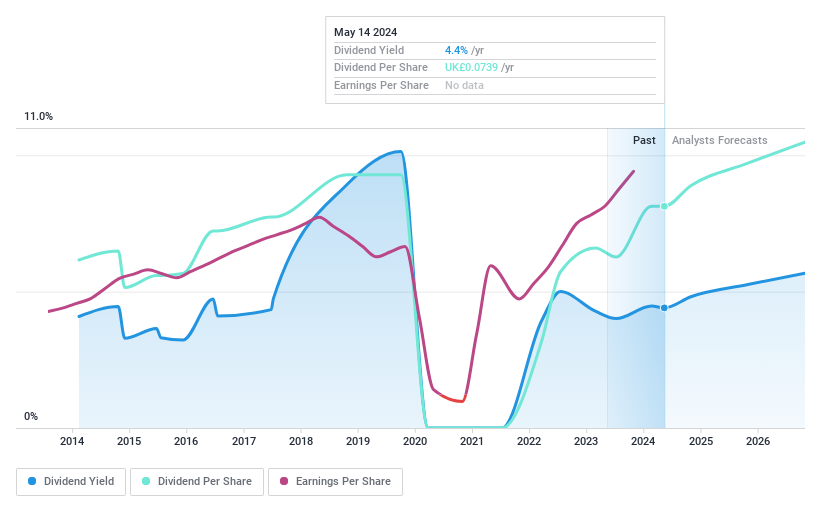

ME Group International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc is a company based in the United Kingdom that operates, sells, and services a range of instant-service equipment, with a market capitalization of approximately £0.66 billion.

Operations: ME Group International plc generates £297.66 million from its Personal Services - Others segment.

Dividend Yield: 4.2%

ME Group International plc's recent dividend increase to 4.42 pence per share highlights a positive step, despite a history of volatile dividends over the past decade. With an earnings growth of 30.6% last year and forecasts predicting further annual growth of 7.42%, its financial health appears robust. However, its dividend yield at 4.19% trails behind the top UK dividend payers' average of 5.55%. The dividends are reasonably covered by both earnings and cash flows, with payout ratios at 55.2% and 82.6% respectively, suggesting sustainability but cautioning on its fluctuating nature in payouts.

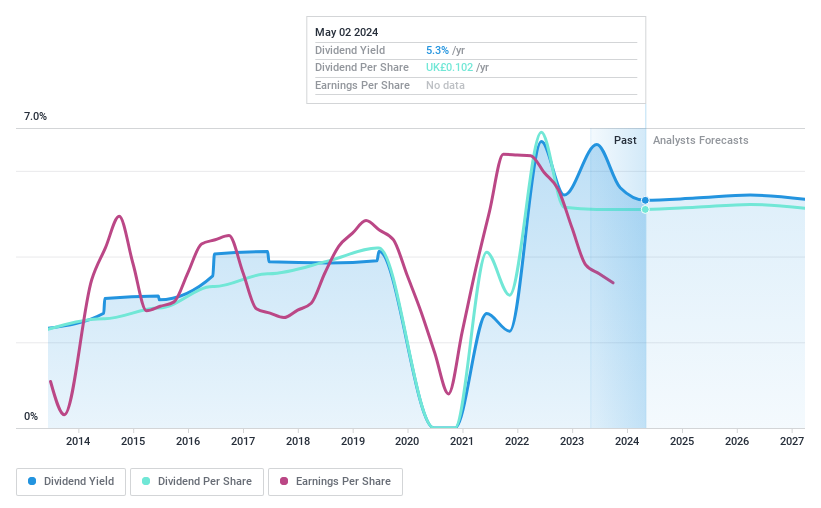

Norcros

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc operates in the development, manufacturing, and marketing of bathroom and kitchen products across the United Kingdom, Ireland, and South Africa with a market capitalization of approximately £207.04 million.

Operations: Norcros plc generates £392.10 million in revenue from its building products segment.

Dividend Yield: 4.4%

Norcros plc maintained its total annual dividend at 10.2 pence per share, with a final dividend proposal of 6.8 pence, payable on August 2, 2024. Despite a decrease in sales to £392.1 million and a slight reduction in dividend cover to 3.1 times from the previous year's 3.7 times, net income improved significantly to £26.8 million from £16.8 million last year, supporting the sustainability of dividends with earnings coverage at 33.9% and cash flow coverage at 31.2%. However, earnings are expected to decline by an average of 1.2% annually over the next three years, indicating potential challenges ahead for growth.

Seize The Opportunity

Navigate through the entire inventory of 55 Top UK Dividend Stocks here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:EPWN LSE:MEGP and LSE:NXR

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance