Top Three Euronext Paris Dividend Stocks For July 2024

As the French market shows resilience with the CAC 40 Index climbing 2.62%, investors are keenly observing shifts in economic indicators and political landscapes that could influence market dynamics. In this context, dividend stocks remain a focal point for those seeking potential stability and steady returns amidst fluctuating markets.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 7.01% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 9.67% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.88% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.72% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.47% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.23% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.96% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.01% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.24% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.70% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

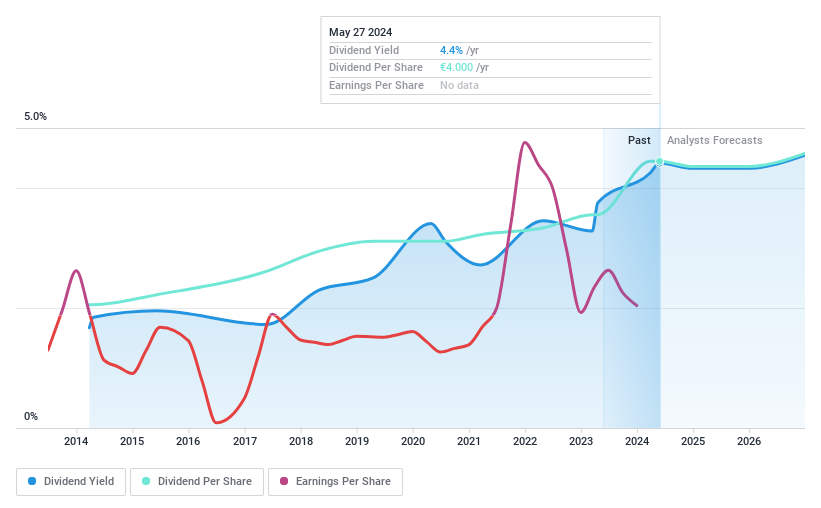

Wendel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm focusing on equity financing in middle-market and later-stage companies, primarily through leveraged buyouts and acquisitions, with a market capitalization of approximately €3.67 billion.

Operations: Wendel's revenue is generated from various segments, including CPI (€128 million), ACAMS (€91.60 million), Stahl (€913.50 million), Scalian (€126.80 million), and Bureau Veritas (€5.87 billion).

Dividend Yield: 4.7%

Wendel, a French investment firm, recently raised its dividend to €4.00 per share, marking a 25% increase from the previous year. Despite this growth, the company's dividends are not well covered by earnings or cash flows, with a high payout ratio of 301.9%. However, Wendel maintains reliable dividend payments supported by strong cash flow coverage at 14.7%. Recent strategic moves include proposing an investment in Globeducate with Providence Equity Partners and appointing Laure Delabeye as Director of Human Resources and Services.

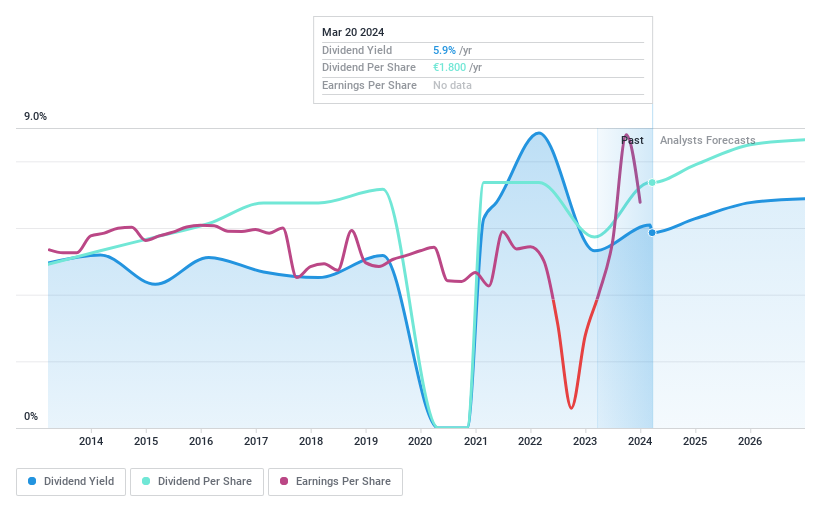

SCOR

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SCOR SE operates globally, offering life and non-life reinsurance products across multiple regions, with a market capitalization of approximately €4.63 billion.

Operations: SCOR SE generates revenue primarily through its life reinsurance segment, SCOR L&H, which contributed €8.45 billion, and its property and casualty reinsurance segment, SCOR P&C, with €7.04 billion in revenue.

Dividend Yield: 6.9%

SCOR SE recently approved a dividend of €1.80 per share for 2023, reflecting its commitment to shareholder returns despite some volatility in its dividend history. The company's dividends are reasonably covered by earnings with a payout ratio of 39.7% and even more securely by cash flows at 24.2%. Although SCOR's dividends have shown instability over the past decade, recent financial performance suggests an improving outlook with earnings growth of 1448.9% last year, indicating potential for more stable future payouts.

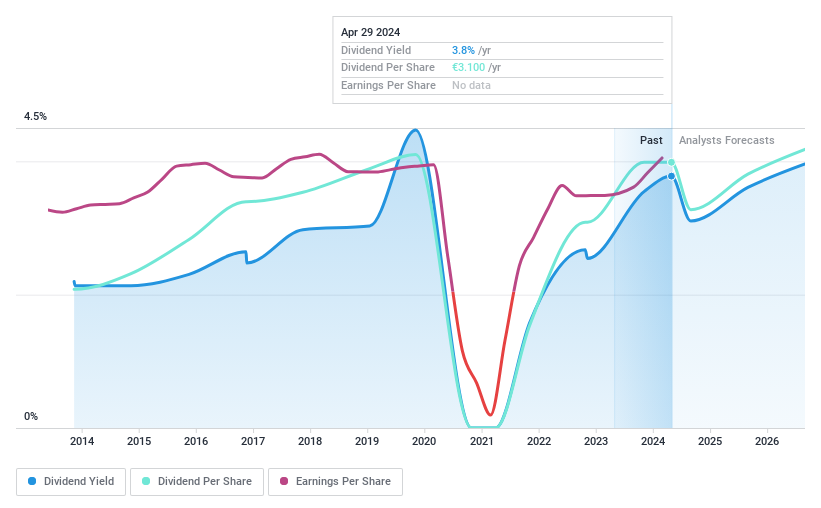

Sodexo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. operates globally, offering food services and facilities management, with a market capitalization of approximately €11.77 billion.

Operations: Sodexo S.A. generates €8.30 billion, €10.74 billion, and €4.12 billion in revenue from its operations in Europe, North America, and the Rest of the World respectively.

Dividend Yield: 3.9%

Sodexo S.A. reported a net loss of EUR 74 million for the first half of fiscal 2024, contrasting sharply with the previous year's net income of EUR 440 million. Despite this setback, third-quarter revenues grew by +5.6% to EUR 6.1 billion, driven by organic growth of +6.8%. The company forecasts continued revenue growth at the upper end of their +6 to +8% target for FY2024. Dividend sustainability is supported by a payout ratio of 63.2% and a cash payout ratio at 44%, although dividend history has been volatile over the past decade, reflecting some inconsistency in payments.

Dive into the specifics of Sodexo here with our thorough dividend report.

The valuation report we've compiled suggests that Sodexo's current price could be inflated.

Turning Ideas Into Actions

Get an in-depth perspective on all 38 Top Euronext Paris Dividend Stocks by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:MF ENXTPA:SCR and ENXTPA:SW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance