Top Three Dividend Stocks For July 2024

As the U.S. stock market shows resilience, with indices like the Nasdaq Composite and S&P 500 hitting record highs amidst mixed economic signals, investors may find it prudent to consider stable income-generating assets. In this context, dividend stocks emerge as appealing options for those seeking to balance potential growth with ongoing income in a fluctuating economic environment.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.36% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.31% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.15% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.97% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.87% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.21% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.46% | ★★★★★☆ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.75% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.78% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Middlefield Banc

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Middlefield Banc Corp., with a market cap of approximately $187.96 million, serves as the holding company for The Middlefield Banking Company, offering commercial banking services to small and medium-sized businesses, professionals, and retail customers in northeastern and central Ohio.

Operations: Middlefield Banc Corp. generates its revenue primarily through banking services, totaling $68.11 million.

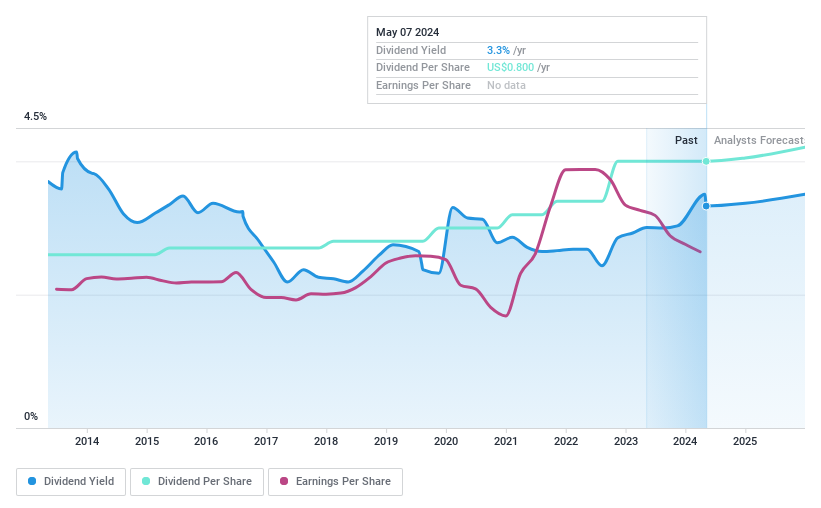

Dividend Yield: 3.4%

Middlefield Banc Corp. has maintained a stable dividend with a 3.4% yield, supported by a low payout ratio of 38.9%, indicating reliability and coverage by earnings. Despite this, the dividend's attractiveness is limited in the broader U.S market context, where it falls below the top quartile average of 4.71%. Additionally, while dividends have consistently grown over the past decade, earnings are expected to decline annually by 12.1% over the next three years, raising concerns about future sustainability amidst recent financial underperformance noted in Q1 2024 results with net income and interest income both declining from the previous year.

National Bankshares

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bankshares, Inc., operating through its subsidiary National Bank of Blacksburg, offers retail and commercial banking services to various sectors including individuals and local governments, with a market capitalization of approximately $179.70 million.

Operations: National Bankshares, Inc. provides a range of banking services tailored to meet the needs of individuals, businesses, and local government entities.

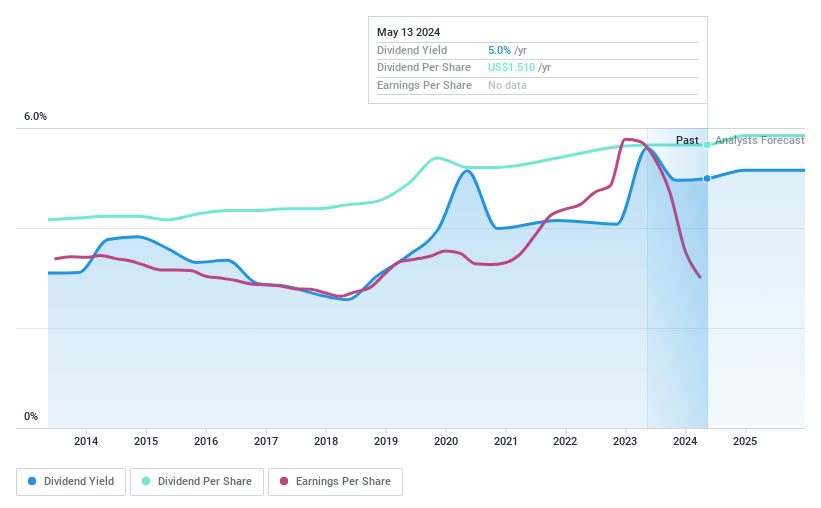

Dividend Yield: 5%

National Bankshares offers a compelling 4.99% dividend yield, ranking it in the top 25% of U.S. dividend payers. The company has shown consistent dividend growth and stability over the past decade, underpinned by a reasonable payout ratio of 66.7%. However, recent financial results indicate a dip in profit margins from 43.1% to 29.5%, and there's insufficient data to confirm future coverage by earnings or cash flows, raising some concerns about long-term sustainability despite current strengths.

ESSA Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ESSA Bancorp, Inc., functioning as a bank holding company for ESSA Bank & Trust, offers various financial services to individuals, families, and businesses in Pennsylvania, with a market capitalization of approximately $167.18 million.

Operations: ESSA Bancorp, Inc. generates its revenue primarily through its thrift and savings and loan operations, totaling approximately $68.88 million.

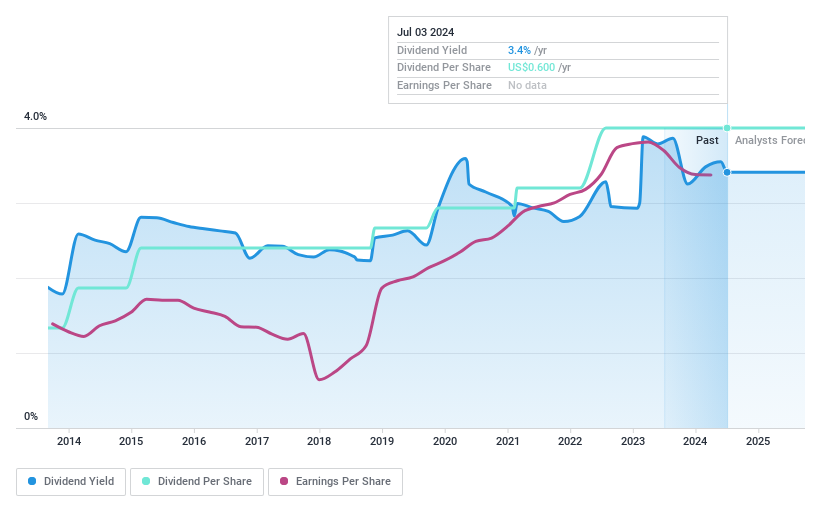

Dividend Yield: 3.4%

ESSA Bancorp has demonstrated a consistent dividend history with a stable 3.42% yield and reliable payments over the past decade. The dividend is well-supported by a modest payout ratio of 32.3%, suggesting sustainability from earnings. Trading at 10.4% below estimated fair value, ESSA appears attractively priced relative to peers. Recent activities include affirming quarterly dividends and completing significant share buybacks, reinforcing its commitment to shareholder returns despite slightly lower recent earnings figures reported in June 2024.

Next Steps

Delve into our full catalog of 202 Top Dividend Stocks here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:MBCN NasdaqCM:NKSH and NasdaqGS:ESSA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance