Top Swiss Dividend Stocks To Consider In July 2024

As the Swiss market demonstrated resilience, closing on a strong note bolstered by easing consumer price inflation, investors are presented with a favorable backdrop for considering stable income-generating assets. In this context, dividend stocks emerge as particularly appealing options, offering potential for both income and growth amidst the current economic environment.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.50% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.15% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.39% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.32% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.94% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★☆ |

CPH Group (SWX:CPHN) | 5.90% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.13% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.73% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

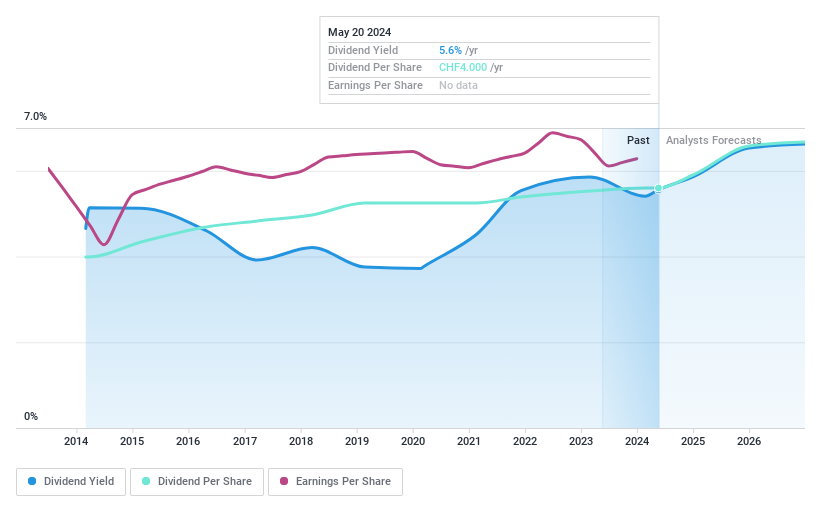

Cembra Money Bank

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG operates in Switzerland, offering a range of consumer finance products and services, with a market capitalization of approximately CHF 2.28 billion.

Operations: Cembra Money Bank AG generates revenue primarily through its banking segment, which reported earnings of CHF 458.78 million.

Dividend Yield: 5.2%

Cembra Money Bank offers a solid dividend yield of 5.19%, ranking in the top 25% of Swiss dividend payers. The dividends are currently well-covered by earnings with a payout ratio of 74.3%, and this trend is expected to continue with a forecasted coverage of 69.5% in three years. Dividend reliability is supported by ten years of stable payments and growth, alongside an anticipated annual earnings increase of 8.72%. Despite these strengths, the stock trades at a significant discount, valued at 25.5% below its estimated fair value.

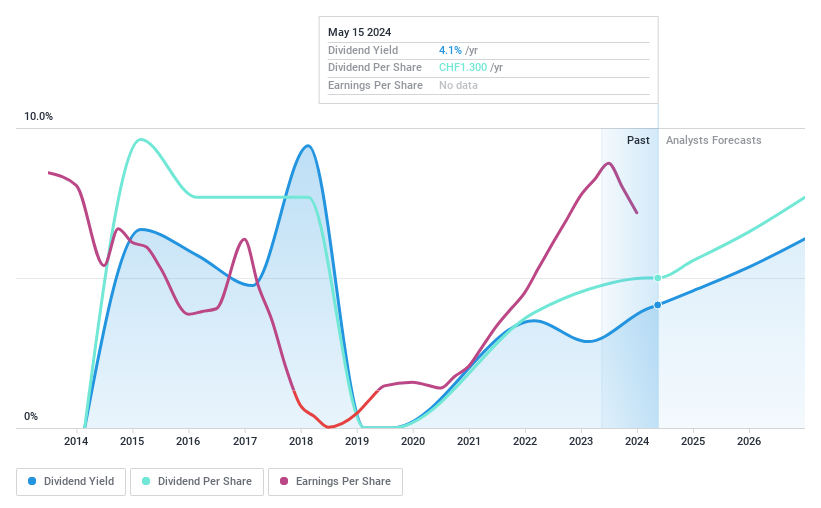

Liechtensteinische Landesbank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft operates as a bank offering products and services in Liechtenstein, Switzerland, Germany, Austria, and other international markets, with a market capitalization of CHF 2.19 billion.

Operations: Liechtensteinische Landesbank's revenue is primarily derived from three segments: Retail & Corporate Banking, which generated CHF 273.32 million; International Wealth Management, with CHF 241.19 million; and the Corporate Center, contributing CHF 27.26 million.

Dividend Yield: 3.8%

Liechtensteinische Landesbank exhibits a mixed dividend profile, with a low allowance for bad loans at 44%, suggesting potential risk management strengths. However, its dividend history has been marked by volatility and unreliability over the past decade. Currently, the dividend yield stands at 3.77%, which is below the top quartile of Swiss dividend stocks at 4.21%. Positively, its dividends are well-covered by earnings with a payout ratio of 50.3%, and this is expected to remain stable in the next three years. Additionally, LLBN trades at a 25.5% discount to its estimated fair value, potentially offering value to investors despite its lower yield and past payment inconsistencies.

Meier Tobler Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG specializes in trading and servicing heat generation and air conditioning systems, with a market capitalization of CHF 369.69 million.

Operations: Meier Tobler Group AG generates CHF 104.67 million from its services segment and CHF 441.25 million from distribution activities.

Dividend Yield: 4%

Meier Tobler Group has demonstrated inconsistent dividend reliability over the past decade, with significant annual fluctuations exceeding 20%. Despite this, its dividends are sustainably covered by both earnings and cash flows, with payout ratios of 54.8% and 50.7% respectively. The stock is currently trading at a substantial discount, marked at 65% below its estimated fair value. Additionally, while MTG's dividend yield of 4.07% is slightly below the top Swiss dividend payers' average of 4.22%, forecasts suggest an earnings growth of approximately 7.84% per year.

Where To Now?

Investigate our full lineup of 26 Top Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:CMBN SWX:LLBN and SWX:MTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance