Top Swedish Dividend Stocks For July 2024

As global markets navigate through varying economic signals, Sweden's market remains a focal point for investors looking for stability and yield, particularly through dividend stocks. Given the current economic climate and investor sentiment, dividend-paying stocks could be appealing for those seeking regular income streams alongside potential capital appreciation.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.33% | ★★★★★★ |

Betsson (OM:BETS B) | 5.61% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.57% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.38% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.02% | ★★★★★☆ |

Duni (OM:DUNI) | 4.99% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.10% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.39% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.33% | ★★★★★☆ |

AB Traction (OM:TRAC B) | 4.02% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

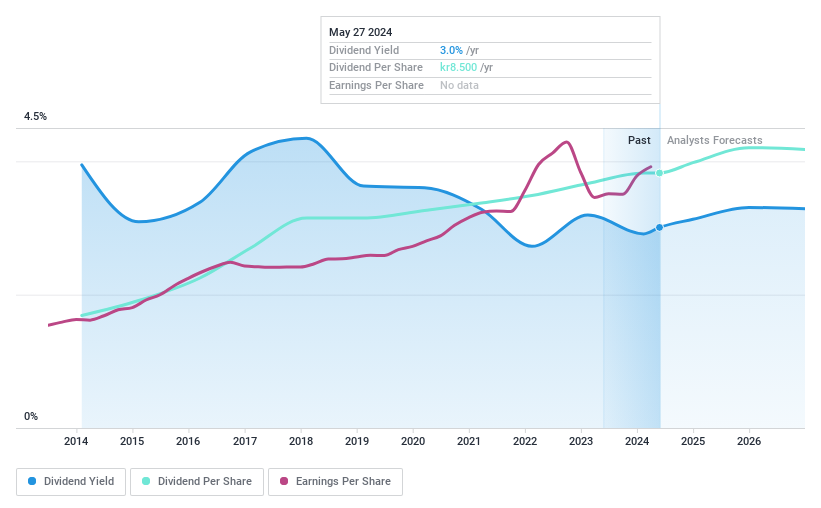

Axfood

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB operates primarily in Sweden, focusing on food retail and wholesale, with a market capitalization of approximately SEK 60.66 billion.

Operations: Axfood AB's revenue is generated through several segments: Dagab contributes SEK 74.94 billion, Willys SEK 44.54 billion, Home Purchase SEK 7.57 billion, and Snabbgross SEK 5.35 billion.

Dividend Yield: 3%

Axfood, a prominent player in the Swedish retail sector, reported a significant year-over-year increase in sales and net income for Q1 2024, with earnings per share also rising. The company's dividends are well-supported by both earnings and cash flows, with a payout ratio of 75.1% and a cash payout ratio of 34.8%, respectively. Despite its reliable dividend history over the past decade, Axfood's dividend yield of 3.02% remains below the market's top quartile average of 4.31%. Recent leadership changes include Simone Margulies taking over as CEO in August 2024, potentially steering future strategic directions including the recent decision to acquire City Gross Sverige AB.

Click here to discover the nuances of Axfood with our detailed analytical dividend report.

The valuation report we've compiled suggests that Axfood's current price could be inflated.

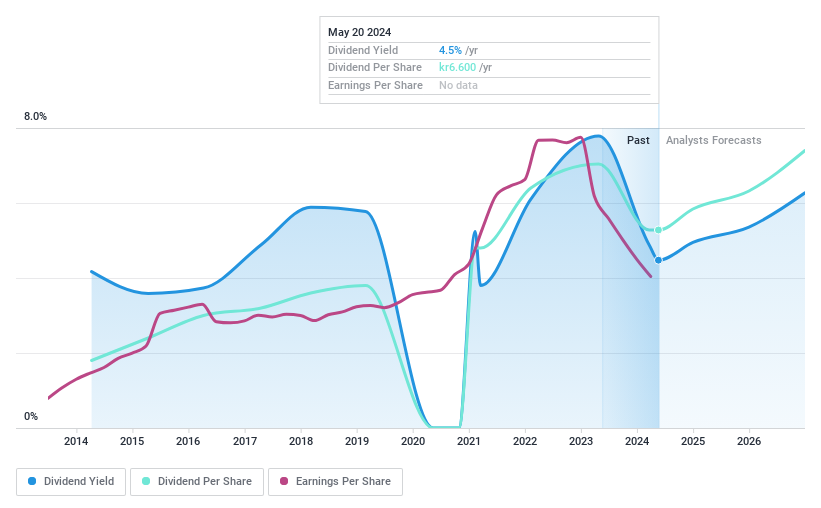

Bilia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership operating in Sweden, Norway, Luxembourg, and Belgium, with a market capitalization of SEK 13.48 billion.

Operations: Bilia AB generates revenue through various segments, with SEK 19.28 billion from car sales in Sweden, SEK 7.16 billion in Norway, and SEK 3.61 billion in Western Europe; additionally, service revenues amount to SEK 6.16 billion in Sweden, SEK 2.16 billion in Norway, and SEK 654 million in Western Europe.

Dividend Yield: 4.5%

Bilia's recent partnership with Volvo Car Sweden, effective from September 2024, aims to enhance customer experiences across all channels, potentially boosting company stability. However, Bilia's dividend yield of 4.66% is above the market average but faces coverage issues with a high cash payout ratio of 518.9%, indicating potential sustainability concerns despite a reasonable earnings payout ratio of 72.6%. Additionally, Bilia's financial position is burdened by significant debt levels and a recent dividend cut to SEK 6.60 per share reflects possible caution regarding its future payouts amidst declining quarterly net income and sales figures from SEK 9.87 billion to SEK 9.37 billion year-over-year in Q1 2024.

Delve into the full analysis dividend report here for a deeper understanding of Bilia.

Our valuation report here indicates Bilia may be undervalued.

Softronic

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) specializes in providing IT and management services mainly in Sweden, with a market capitalization of approximately SEK 1.26 billion.

Operations: Softronic AB generates its revenue primarily through computer services, totaling SEK 834.42 million.

Dividend Yield: 5.7%

Softronic's recent earnings show a slight decline with Q1 2024 sales at SEK 230.1 million and net income at SEK 18 million, down from last year. Despite a high dividend yield of 5.81%, its sustainability is questionable as the payout ratio stands at 86.6% and the cash payout ratio even higher at 138%. Dividend reliability has been compromised by volatility over the past decade, although there has been growth in payments within this period. The company's P/E ratio is favorable at 14.9x compared to the Swedish market average of 22.5x, suggesting some value potential despite financial pressures on dividend sustainability.

Dive into the specifics of Softronic here with our thorough dividend report.

Our valuation report unveils the possibility Softronic's shares may be trading at a premium.

Next Steps

Explore the 25 names from our Top Dividend Stocks screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AXFO OM:BILI A and OM:SOF B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance