Top Stocks to Consider After Cooler PCE Data

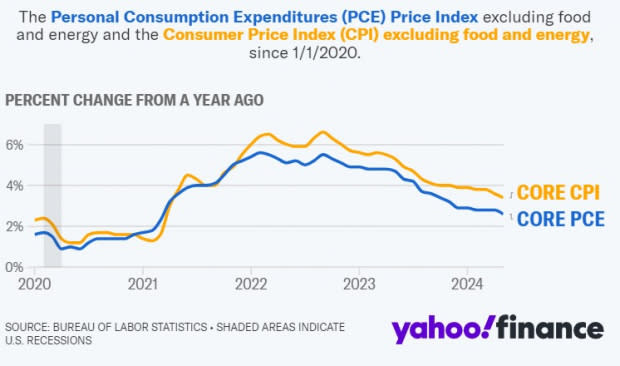

Notably, the Personal Consumption Expenditures (PCE) Price Index tracks changes in the cost of goods and services purchased by consumers in the United States through the lens of businesses.

Additionally, Core PCE is a key economic indicator the Federal Reserve uses to gauge inflation by measuring the average change in these consumer goods prices when excluding volatile items like food and energy.

With Core PCE being the Fed's preferred inflationary measure, this reading optimistically cooled to a 0.1% uptick in May compared to a 0.3% increase in April. Year over year, Core PCE rose by 2.6% which Yahoo Finance points out was the slowest annual gain in three years.

Although this is still above the Fed’s preferred target of a 2% annual inflation rate, May’s Core PCE data is a positive sign for the economy and stocks.

Considering last month’s Consumer Price Index (CPI) data showed a cooler print as well, here are three stocks investors may want to consider on the prospects of a more favorable operating environment.

Image Source: Yahoo Finance

Nvidia NVDA

Easing inflation is crucial to the tech sector regarding internal operating costs and the willingness of not only consumers but also businesses to spend on technology which in many instances can be deemed non-essential despite its clear importance.

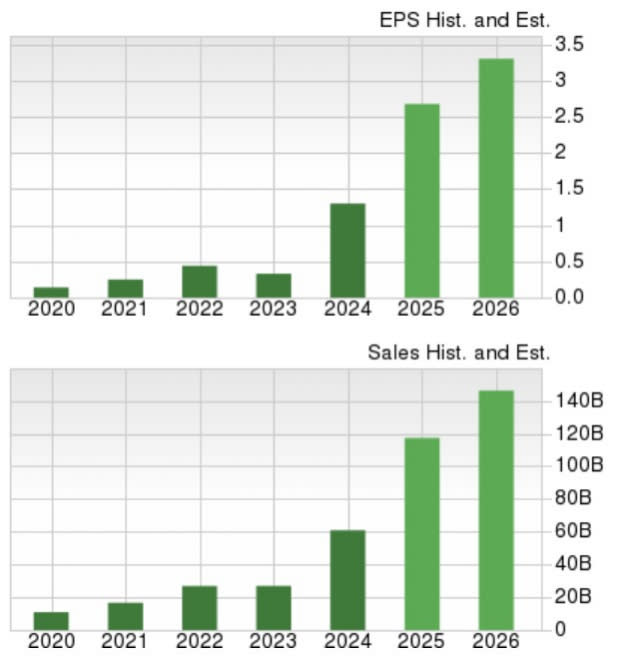

Perhaps broader spending on artificial intelligence continues to increase and keeps Nvidia’s stock attractive as the leader in producing AI chips. Tracking Nvidia’s performance since its 10-1 stock split on June 10, NVDA is only up +2% but had already more than doubled this year beforehand with a very positive trend of earnings estimate revisions suggesting more upside. Correlating with such, the chip giant sports a Zacks Rank #1 (Strong Buy) amid what continues to be captivating growth on its top and bottom lines.

Image Source: Zacks Investment Research

Amazon AMZN

Outside of the tech sector, the obvious beneficiaries of a more stable inflationary environment are consumer retail-driven companies and no one stands out more in this regard than e-commerce giant Amazon.

The market is suggesting this as well as Amazon’s stock spiked +10% this month and currently lands a Zacks Rank #3 (Hold) with gains already at +27% for the year.

Image Source: Zacks Investment Research

Bank of America BAC

Although banks can benefit from a high inflationary environment higher loan volumes and net inflows from depsits look plausible in both commercial and consumer segments if reseeding PCE and better-than-expected CPI data were to continue.

Furthermore, one bank that excels in its use of technology and can benefit from the perceived notion of lower technology costs is Bank of America which sports a Zacks Rank #2 (Buy). Bank of America’s attractive price tag may also interest investors as its stock costs less than many of the other big banks at just under $40 while its forward P/E of 12.1X is on par with most of its peers.

While Bank of America has traded at sharper P/E discounts in the past it's noteworthy that earnings estimates for FY24 and FY25 are slightly up over the last 60 days.

Image Source: Zacks Investment Research

BAC also has a 2.45% annual dividend yield that only trails Citigroup’s C 3.44% out of the big four domestic banks as this edges Wells Fargo’s WFC 2.44% and JPMorgan’s JPM 2.31%.

Image Source: Zacks Investment Research

Final Thought

Rounding out Q2, reseeding core PCE is a good sign for businesses and the broader economy with Nvidia, Amazon, and Bank of America being three stocks to keep an eye on next quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance