Top Ranked Value Stocks to Buy for October 30th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, October 30th:

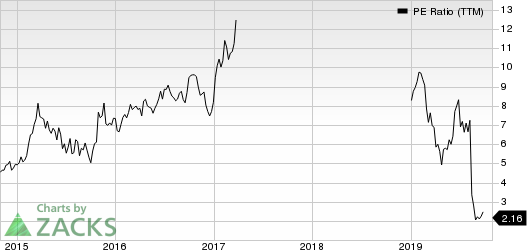

Grupo Financiero Galicia S.A. (GGAL):This financial service holding company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.9% over the last 60 days.

Grupo Financiero Galicia S.A. Price and Consensus

Grupo Financiero Galicia S.A. price-consensus-chart | Grupo Financiero Galicia S.A. Quote

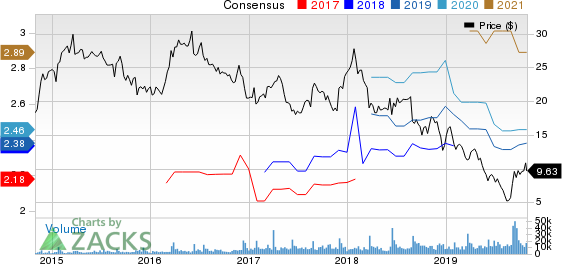

Grupo Financiero Galicia has a price-to-earnings ratio (P/E) of 2.71, compared with 3.10 for the industry. The company possesses a Value Scoreof B.

Grupo Financiero Galicia S.A. PE Ratio (TTM)

Grupo Financiero Galicia S.A. pe-ratio-ttm | Grupo Financiero Galicia S.A. Quote

The Michaels Companies, Inc. (MIK): This arts and crafts specialty retail stores company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1.7% over the last 60 days.

The Michaels Companies, Inc. Price and Consensus

The Michaels Companies, Inc. price-consensus-chart | The Michaels Companies, Inc. Quote

The Michaels Companies has a price-to-earnings ratio (P/E) of 4.05, compared with 10.30 for the industry. The company possesses a Value Score of A.

The Michaels Companies, Inc. PE Ratio (TTM)

The Michaels Companies, Inc. pe-ratio-ttm | The Michaels Companies, Inc. Quote

JinkoSolar Holding Co., Ltd. (JKS): This higher education providing company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 7.5% over the last 60 days.

JinkoSolar Holding Company Limited Price and Consensus

JinkoSolar Holding Company Limited price-consensus-chart | JinkoSolar Holding Company Limited Quote

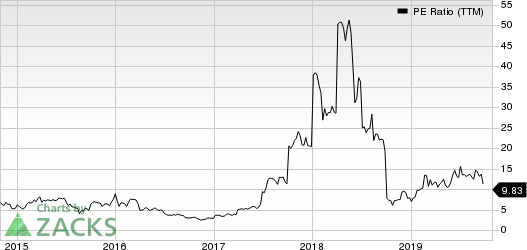

JinkoSolar Holding has a price-to-earnings ratio (P/E) of 4.88, compared with 16 for the industry. The company possesses a Value Score of A.

JinkoSolar Holding Company Limited PE Ratio (TTM)

JinkoSolar Holding Company Limited pe-ratio-ttm | JinkoSolar Holding Company Limited Quote

Mr. Cooper Group Inc. (COOP): This company offers servicing, origination, and transaction-based services related principally to single-family residences has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 25% over the last 60 days.

MR. COOPER GROUP INC Price and Consensus

MR. COOPER GROUP INC price-consensus-chart | MR. COOPER GROUP INC Quote

Mr. Cooper Group has a price-to-earnings ratio (P/E) of 4.46, compared with 8.10 for the industry. The company possesses a Value Score of A.

MR. COOPER GROUP INC PE Ratio (TTM)

MR. COOPER GROUP INC pe-ratio-ttm | MR. COOPER GROUP INC Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Michaels Companies, Inc. (MIK) : Free Stock Analysis Report

JinkoSolar Holding Company Limited (JKS) : Free Stock Analysis Report

Grupo Financiero Galicia S.A. (GGAL) : Free Stock Analysis Report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance