Top Ranked Value Stocks to Buy for March 3rd

Here are four stocks with buy rank and strong value characteristics for investors to consider today, March 3rd:

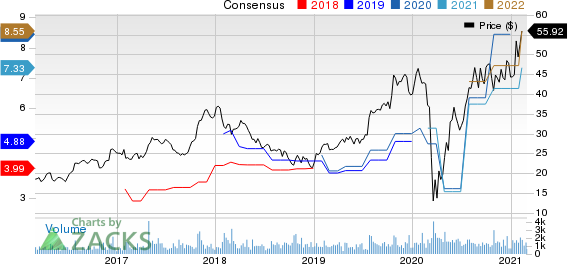

Danaos Corporation (DAC): This seaborne transportation services provider has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 80.2% over the last 60 days.

Danaos Corporation Price and Consensus

Danaos Corporation price-consensus-chart | Danaos Corporation Quote

Danaos has a price-to-earnings ratio (P/E) of 3.01, compared with 4.20 for the industry. The company possesses a Value Score of A.

Danaos Corporation PE Ratio (TTM)

Danaos Corporation pe-ratio-ttm | Danaos Corporation Quote

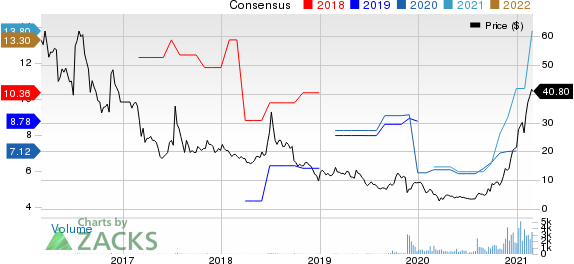

Ternium S.A. (TX): This manufacturer and processer of various steel products has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 29.8% over the last 60 days.

Ternium S.A. Price and Consensus

Ternium S.A. price-consensus-chart | Ternium S.A. Quote

Ternium has a price-to-earnings ratio (P/E) of 4.58, compared with 7.90 for the industry. The company possesses a Value Score of A.

Ternium S.A. PE Ratio (TTM)

Ternium S.A. pe-ratio-ttm | Ternium S.A. Quote

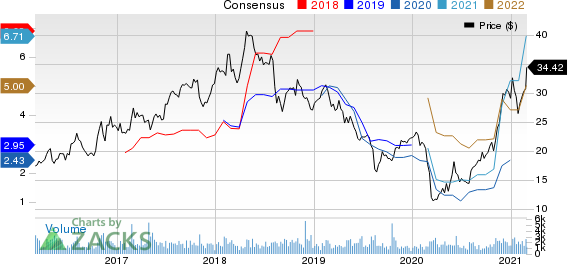

M/I Homes, Inc. (MHO): This single-family home builder has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 10.4% over the last 60 days.

MI Homes, Inc. Price and Consensus

MI Homes, Inc. price-consensus-chart | MI Homes, Inc. Quote

M/I Homes has a price-to-earnings ratio (P/E) of 6.81, compared with 11.60 for the industry. The company possesses a Value Score of A.

MI Homes, Inc. PE Ratio (TTM)

MI Homes, Inc. pe-ratio-ttm | MI Homes, Inc. Quote

OneMain Holdings, Inc. (OMF): This financial service holding company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 12.8% over the last 60 days.

OneMain Holdings, Inc. Price and Consensus

OneMain Holdings, Inc. price-consensus-chart | OneMain Holdings, Inc. Quote

OneMain has a price-to-earnings ratio (P/E) of 6.73, compared with 16.40 for the industry. The company possesses a Value Score of A.

OneMain Holdings, Inc. PE Ratio (TTM)

OneMain Holdings, Inc. pe-ratio-ttm | OneMain Holdings, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ternium S.A. (TX) : Free Stock Analysis Report

OneMain Holdings, Inc. (OMF) : Free Stock Analysis Report

MI Homes, Inc. (MHO) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance