Top Ranked Value Stocks to Buy for December 1st

Here are four stocks with buy rank and strong value characteristics for investors to consider today, December 1st:

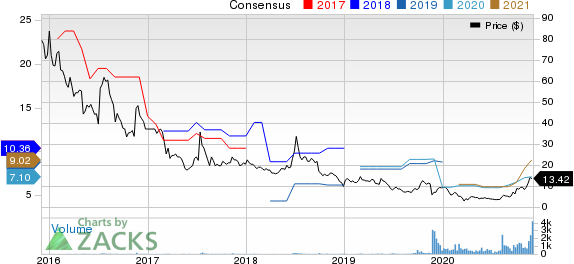

Danaos Corporation (DAC): This owner and operator of containerships has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 15.5% over the last 60 days.

Danaos Corporation Price and Consensus

Danaos Corporation price-consensus-chart | Danaos Corporation Quote

Danaos Corp has a price-to-earnings ratio (P/E) of 1.89, compared with 5.20 for the industry. The company possesses a Value Score of A.

Danaos Corporation PE Ratio (TTM)

Danaos Corporation pe-ratio-ttm | Danaos Corporation Quote

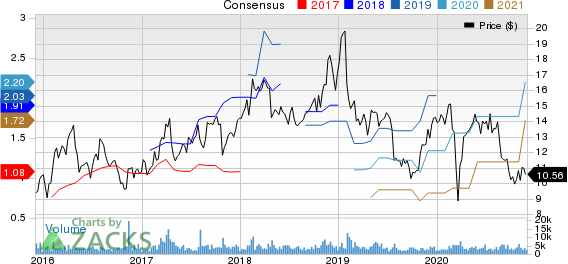

Innoviva, Inc. (INVA): This pharmaceuticals company has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 24.3% over the last 60 days.

Innoviva, Inc. Price and Consensus

Innoviva, Inc. price-consensus-chart | Innoviva, Inc. Quote

Innoviva has a price-to-earnings ratio (P/E) of 4.93, compared with 14.50 for the industry. The company possesses a Value Score of A.

Innoviva, Inc. PE Ratio (TTM)

Innoviva, Inc. pe-ratio-ttm | Innoviva, Inc. Quote

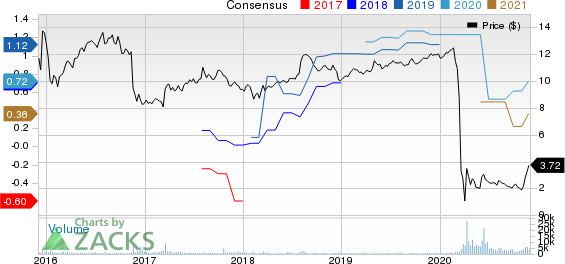

360 DigiTech, Inc. (QFIN): This provider of data driven, technology empowered digital platform has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 19% over the last 60 days.

360 DigiTech, Inc. Price and Consensus

360 DigiTech, Inc. price-consensus-chart | 360 DigiTech, Inc. Quote

360 DigiTech has a price-to-earnings ratio (P/E) of 3.73, compared with 31.90 for the industry. The company possesses a Value Score of A.

360 DigiTech, Inc. PE Ratio (TTM)

360 DigiTech, Inc. pe-ratio-ttm | 360 DigiTech, Inc. Quote

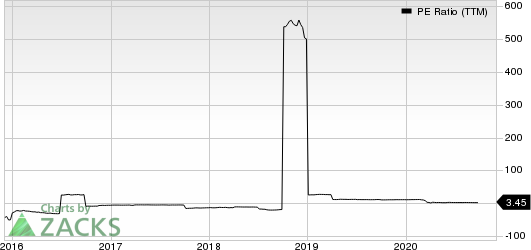

Exantas Capital Corp. (XAN): This real estate investment trust has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 18% over the last 60 days.

Exantas Capital Corp. Price and Consensus

Exantas Capital Corp. price-consensus-chart | Exantas Capital Corp. Quote

Exantas Capital has a price-to-earnings ratio (P/E) of 4.83, compared with 7.10 for the industry. The company possesses a Value Score of A.

Exantas Capital Corp. PE Ratio (TTM)

Exantas Capital Corp. pe-ratio-ttm | Exantas Capital Corp. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exantas Capital Corp. (XAN) : Free Stock Analysis Report

360 DigiTech, Inc. Sponsored ADR (QFIN) : Free Stock Analysis Report

Innoviva, Inc. (INVA) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance