Top Ranked Value Stocks to Buy for December 27th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, December 27th:

Signet Jewelers Ltd. (SIG): This retailer of diamond jewelry, watches, and other products has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 4.2% over the last 60 days.

Signet Jewelers Limited Price and Consensus

Signet Jewelers Limited price-consensus-chart | Signet Jewelers Limited Quote

Signet has a price-to-earnings ratio (P/E) of 6.46 compared with 16.10 for the industry. The company possesses a Value Score of A.

Signet Jewelers Limited PE Ratio (TTM)

Signet Jewelers Limited pe-ratio-ttm | Signet Jewelers Limited Quote

Verso Corporation (VRS): This producer of specialty and graphic papers, packaging and pulp has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 86.2% over the last 60 days.

Verso Corporation Price and Consensus

Verso Corporation price-consensus-chart | Verso Corporation Quote

Verso has a price-to-earnings ratio (P/E) of 5.75 compared with 10.10 for the industry. The company possesses a Value Score of A.

Verso Corporation PE Ratio (TTM)

Verso Corporation pe-ratio-ttm | Verso Corporation Quote

Essent Group Ltd. (ESNT): This provider of private mortgage insurance and reinsurance for mortgages secured by residential properties has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.4% over the last 60 days.

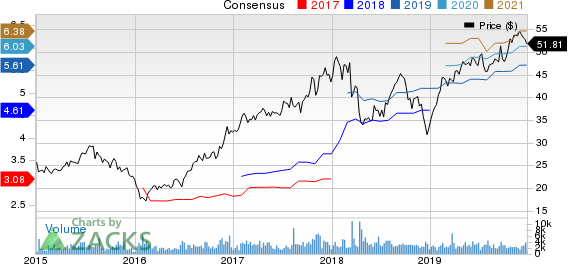

Essent Group Ltd. Price and Consensus

Essent Group Ltd. price-consensus-chart | Essent Group Ltd. Quote

Essent has a price-to-earnings ratio (P/E) of 9.23 compared with 18.90 for the industry. The company possesses a Value Score of B.

Essent Group Ltd. PE Ratio (TTM)

Essent Group Ltd. pe-ratio-ttm | Essent Group Ltd. Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Find more top income stocks with some of our great premium screens.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verso Corporation (VRS) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

Essent Group Ltd. (ESNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance