Top Ranked Value Stocks to Buy for June 26th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, June 26th:

Encore Capital Group, Inc. (ECPG): This specialty finance company provides debt recovery solutions and other related services has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 34.4% over the last 60 days.

Encore Capital Group Inc Price and Consensus

Encore Capital Group Inc price-consensus-chart | Encore Capital Group Inc Quote

Encore Capital has a price-to-earnings ratio (P/E) of 4.85, compared with 77.00 for the industry. The company possesses a Value Score of A.

Encore Capital Group Inc PE Ratio (TTM)

Encore Capital Group Inc pe-ratio-ttm | Encore Capital Group Inc Quote

Laredo Petroleum, Inc. (LPI): This independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 6.7% over the last 60 days.

Laredo Petroleum, Inc. Price and Consensus

Laredo Petroleum, Inc. price-consensus-chart | Laredo Petroleum, Inc. Quote

Laredo Petroleum has a price-to-earnings ratio (P/E) of 1.77, compared with 7.40 for the industry. The company possesses a Value Score of A.

Laredo Petroleum, Inc. PE Ratio (TTM)

Laredo Petroleum, Inc. pe-ratio-ttm | Laredo Petroleum, Inc. Quote

AerCap Holdings N.V. (AER): This aircraft leasing company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 16.6% over the last 60 days.

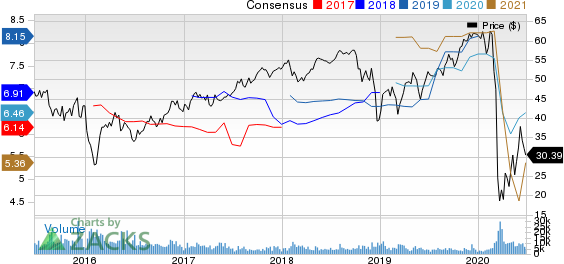

Aercap Holdings N.V. Price and Consensus

Aercap Holdings N.V. price-consensus-chart | Aercap Holdings N.V. Quote

AerCap has a price-to-earnings ratio (P/E) of 4.74, compared with 7.50 for the industry. The company possesses a Value Score of A.

Aercap Holdings N.V. PE Ratio (TTM)

Aercap Holdings N.V. pe-ratio-ttm | Aercap Holdings N.V. Quote

Grupo Supervielle S.A. (SUPV): This financial services holding company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 6.7% over the last 60 days.

Grupo Supervielle S.A. Price and Consensus

Grupo Supervielle S.A. price-consensus-chart | Grupo Supervielle S.A. Quote

Grupo Supervielle has a price-to-earnings ratio (P/E) of 3.40, compared with 8.10 for the industry. The company possesses a Value Score of A.

Grupo Supervielle S.A. PE Ratio (TTM)

Grupo Supervielle S.A. pe-ratio-ttm | Grupo Supervielle S.A. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Grupo Supervielle S.A. (SUPV) : Free Stock Analysis Report

Laredo Petroleum, Inc. (LPI) : Free Stock Analysis Report

Encore Capital Group Inc (ECPG) : Free Stock Analysis Report

Aercap Holdings N.V. (AER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance