The Top Money Advice From Mark Cuban, Dave Ramsey and More of the Most Influential Experts

With so much financial advice out there, it's hard to know what's actually essential and what's just white noise.

Find: 6 Richest People in the World You've Never Heard of

Discover: How To Build Your Savings From Scratch

To get the best of the best advice, GOBankingRates asked some of the most trusted financial experts in America to share the one thing everyone should do to build wealth. Here are the top tips from Mark Cuban, Dave Ramsey and more.

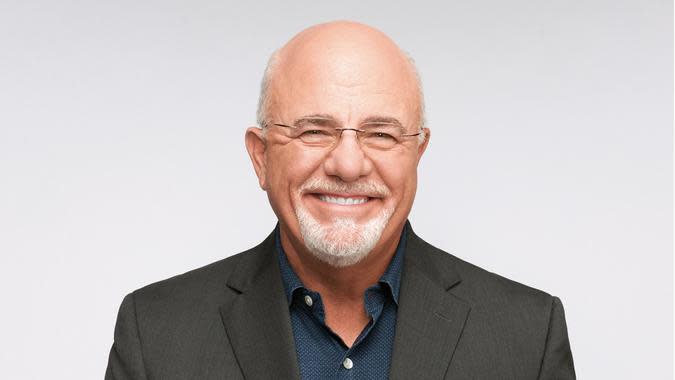

Dave Ramsey, Author of 'The Total Money Makeover' and Host of 'The Ramsey Show'

"Play longball and invest consistently. Mutual funds are the way to go. They cast a wide net across many companies, helping you avoid the risks that come with trendy stuff, like crypto. Just remember, Match beats Roth beats Traditional on figuring out where to invest for retirement first."

Read: Dave Ramsey Says 401(k)s Have a Big Tax Downside - Pick This Retirement Plan Instead

See: 14 Ways to Invest That Don't Involve the Stock Market

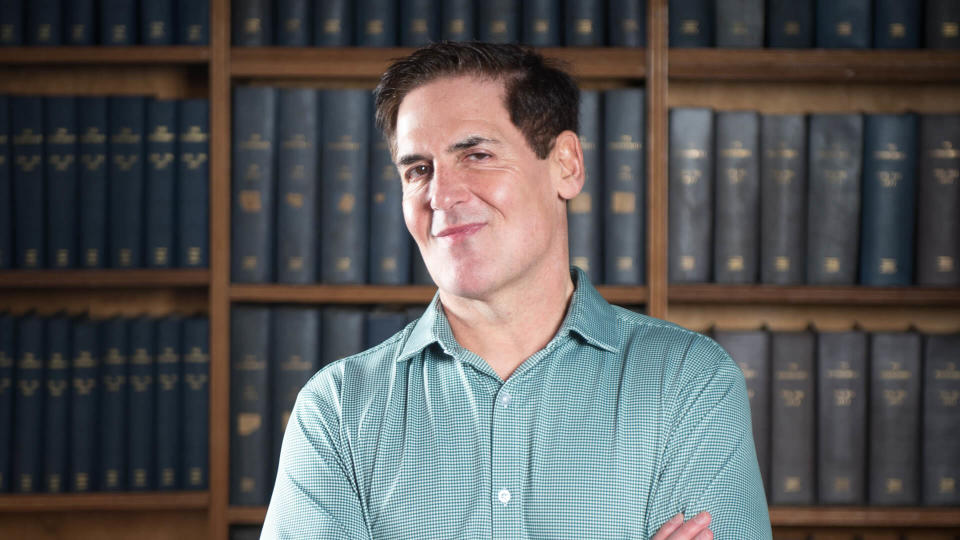

Mark Cuban, Entrepreneur and Shark on 'Shark Tank'

"Have appreciable assets. Whether it's a home, mutual fund -- something that can appreciate in value over the long term."

I'm a Self-Made Millionaire: These Are Investments Everyone Should Avoid During an Economic Downturn

Chris Farrell, Author of 'Your Money' Column

"The bedrock insights of personal finance include: save often, keep fees low, prepare for the unexpected, invest in learning and create a margin of financial safety. These ideas have been honed over centuries of dealing with financial uncertainty and upheaval. The principles seem easy enough, but they're often hard to follow in practice. Life is complicated and messy."

Chris Hill, Host of 'Motley Fool Money'

"Find a way to put money towards your investments every month. If you have a 401(k) plan, max it out. If you don't, set a schedule of putting even just a few dollars into an investment account every month. Your future self will be so grateful."

Jully-Alma Taveras, Creator of The Investing Latina

"Everyone should be thinking and implementing the small financial actions that will be required to build wealth over the long term. For example, consistency helps develop a habit, letting go of the fear, which helps in managing moments when the market goes down, and optimism to pursue big dreams like retiring early."

Check It Out: 8 Best Penny Stocks To Buy Under $1.00

Danetha Doe, Creator of Money & Mimosas

"I believe everyone should be investing in themselves to build their wealth. You are your No. 1 investment. Whether it's signing up for a personal finance workshop or a gym membership, investing in you will always pay the best dividends."

Mandi Woodruff-Santos, Host of 'MandiMoney'

"Don't get complacent with where you're at and always be looking for new opportunities to grow. Always stay open to new career opportunities and practice your negotiation skills. There's just no better opportunity to negotiate higher compensation than when you were leaving one job for a new one, and you may hold yourself back financially if you stay too loyal to one employer. As far as increasing your earning potential, you need to be a couple of steps ahead of yourself, always thinking of where your industry is heading and how you can start to acquire specific skill sets that match. There's a time about 5 to 10 years into your career when it's also a great moment to start specializing or niching down so that you become the go-to person at a specific aspect of your work. The more unique and in-demand your skill set is, the more resilient you'll be as a professional."

Tori Dunlap, Founder of Her First $100K

"[Invest]. Investing is like climbing a staircase -- super easy, just that first step is 20 feet high. I know from research for my book "Financial Feminist" that the biggest reason women don't invest is fear -- fear of getting started, fear of making a mistake, fear of losing money. But truly, the worst choice you can make when it comes to investing is making no choice at all. You just need to get started."

Learn More: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Michelle Singletary, Author of 'The Color of Money' Column

"Budget is not a bad word. Your budget is not your enemy, yet that is the biggest mistake people make. They fear the figures, and that, in turn, keeps them uninformed about their true financial situation."

John Liang, @johnsfinancetips on TikTok

"Credit cards. They are one of the easiest and best financial tools to help you save money. But so often people are misinformed on how to use them. Or worse, they're too scared to use them. As long as you pay your credit card bill on time and in full, you'll stand to reap all benefits -- [like] building a strong credit score and earning travel points and miles."

Taylor Price, @pricelesstay on TikTok

"It's crucial to prioritize financial responsibility and plan for the long term, rather than sacrificing financial stability for short-term gratification. Lastly, personal finance is personal - consider your own financial situation and goals to better evaluate the advice being given."

Read Here: Why Stealth Wealth Is the Best Way To Handle Your Money

Erin Lowry, Author of 'Broke Millennial'

"You just have to figure out what works for you and your emotional triggers around money. How we handle our personal finances has just as much to do with our psychology as it does with the math of how money works. A method of managing money that works for your parents, friends, co-workers, siblings or spouse is not necessarily what will connect for you and that's totally okay."

Andrew Aziz, Author of 'How to Day Trade for a Living'

"Regardless of how much money you currently have, one of the most important steps toward building wealth is to establish a solid financial plan. This includes setting clear financial goals, creating a budget, and managing your debts and expenses effectively."

Tonya Rapley, Creator of 'My Fab Finance'

"I found ways to diversify my income rather than depending on one income stream. This allowed me to become more aggressive in targeting my financial goals."

Read: Here's How Much Money Experts Say You Should Have in Your Savings Account If You're in Your 50s

John Eringman, @johnefinance on TikTok

"I wish people were more informed about creating a strong financial foundation before beginning to invest. A lot of people want to dive head-first into investing in stocks, real estate or crypto. Yet they have large student loans, car loans or credit card debt. They're investing with a weak financial foundation and if the investment goes wrong, they will be further behind. Start with the basics first, get your budget together, build an emergency fund and then you can invest from a position of strength."

More From GOBankingRates

Jaime Catmull and Cameron Diiorio contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: The Top Money Advice From Mark Cuban, Dave Ramsey and More of the Most Influential Experts

Yahoo Finance

Yahoo Finance