Top Medical Stocks to Buy for Growth & Performance

The higher the broader indexes go, the more conscious investors will be of investments that may offer defensive safety. Because of the essentiality of health-related services this makes medical stocks worth monitoring in this regard.

Speaking to such, it's noteworthy that a slew of medical stocks are standing out among the Zacks Rank #1 (Strong Buy) list. Notably, here are a few of these highly-ranked medical stocks to consider for their growth and impressive price performances.

New Strong Buy Stocks: HALO and NBIX

The medical sector currently has 30 stocks that comprise spots on the Zacks Strong Buy list (231 total stocks) and Halozyme Therapeutics HALO and Neurocrine Biosciences NBIX are two of the new additions this week. HALO and NBIX have risen 40% in the last year and are two of the market’s top performers over the last decade soaring 442% and 920%, respectively.

Far from the speculator growth phase, Halozyme is a biopharmaceutical company focused on treatments for oncology indications by targeting the tumor microenvironment while Neurocrine provides novel therapeutics for treating neuro-related diseases and disorders.

Image Source: Zacks Investment Research

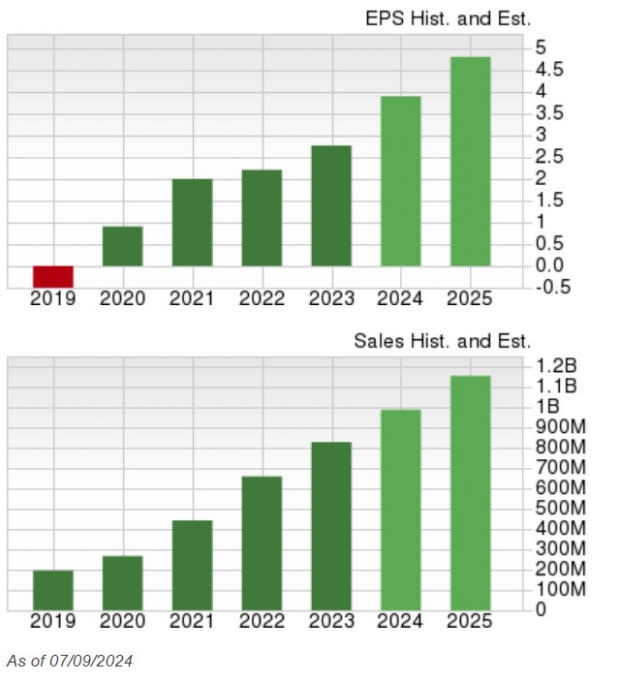

Halozyme’s valuation especially stands out, trading at 13.5X forward earnings with EPS projected to climb 41% this year to $3.90 compared to $2.77 a share last year. Better still, FY25 EPS is expected to increase by another 23%. Halozyme’s top line is forecasted to expand by double-digits as well with projections edging toward $1 billion.

Image Source: Zacks Investment Research

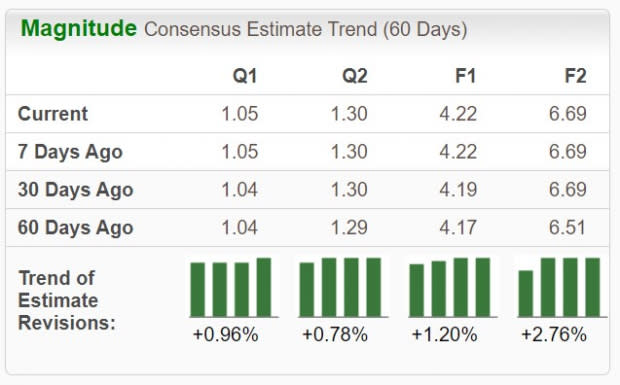

Similarly, Neurocrine’s growth trajectory has been very compelling as total sales are slated to rise over 15% in FY24 and FY25 with projections over $2 billion. Neurocrine’s increased profitability is even more mesmerizing as EPS is expected to skyrocket 71% this year to $4.22 versus $2.47 a share in 2023. More impressive, FY25 EPS is projected to soar another 58% to $6.69. Plus, earnings estimate revisions have trickled higher over the last 60 days.

Image Source: Zacks Investment Research

Haemonetics HAE

Blood management solutions provider Haemonetics has been a recent fixture on the Zacks Rank #1 (Strong Buy) list, holding a spot since mid-June.

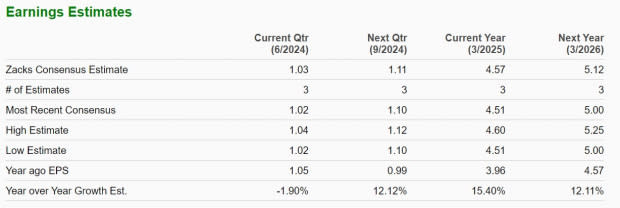

While Haemonetics stock has been virtually flat in the last year, HAE is up 30% over the last two years and has very respectable decade gains of 141%. Interestingly enough, this has been ample time to get in on Haemonetics stock at an attractive forward earnings multiple of 18.4X which is pleasantly beneath its decade-long high of 53.8X and a 28% discount to the median of 25.8X.

Image Source: Zacks Investment Research

Furthermore, Haemonetics is expecting double-digit EPS growth in its current FY25 and FY26. Serving as a viable long-term investment, Haemonetics’ integrated devices, information management, and consulting services cover each facet of the blood supply chain for clinics and hospitals.

Image Source: Zacks Investment Research

Bottom Line

The medical sector is crawling with opportunity as indicated in its representation on the Zacks Rank #1 (Strong Buy) list. Considering their impressive decade performances and continued expansion, Halozyme Therapeutics, Neurocrine Biosciences, and Haemonetics are three of these highly-ranked medical stocks that should be at the forefront of investors' attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Halozyme Therapeutics, Inc. (HALO) : Free Stock Analysis Report

Neurocrine Biosciences, Inc. (NBIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance