Can Top-Line Growth Benefit Pinterest (PINS) Q3 Earnings?

Pinterest, Inc. PINS is scheduled to report third-quarter 2022 results on Oct 27 after the closing bell. In the last reported quarter, the company delivered a negative earnings surprise of 35.3%. It pulled off a trailing four-quarter earnings surprise of 35.1%, on average.

The San Francisco-based Internet content provider is expected to have recorded year-over-year higher revenues due to a rise in sales in U.S.-based markets.

Factors at Play

In the third quarter, Pinterest expanded into the Latin American markets of Chile, Argentina and Colombia to monetize content in emerging markets. It continues to establish a unique value proposition to advertisers by leveraging organic engagement activity. Through various innovations, it continues to improve the advertising platform, which presently appears to be one of the best for consumer discretionary brands looking for new ways to reach customers and stretch smaller advertisement budgets. The consensus estimate for revenues from the United States stands at $559 million, which implies an increase from $498 million reported a year ago.

The company expects operating expenses to increase substantially in the near term as it seeks to expand operations, domestically and internationally, enhance product offerings, broaden Pinner and advertiser base, expand marketing channels, hire additional employees and develop technology. These efforts will likely weigh in on the company’s bottom-line growth in the near term. The consensus estimate for International Revenue stands at $25 million, which indicates a decline from $135 million reported a year ago.

For the September quarter, the Zacks Consensus Estimate for total revenues is pegged at $665 million, which indicates growth from the year-ago quarter’s reported figure of $633 million. Management expects third-quarter 2022 revenues to increase in the mid-single digit year over year. The consensus estimate for adjusted earnings per share stands at 5 cents, suggesting a decline from 28 cents reported in the prior year.

Earnings Whispers

Our proven model does not predict an earnings beat for Pinterest this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is 0.00%, with both pegged at 5 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

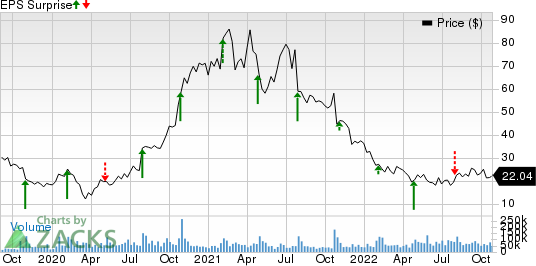

Pinterest, Inc. Price and EPS Surprise

Pinterest, Inc. price-eps-surprise | Pinterest, Inc. Quote

Zacks Rank: Pinterest currently has a Zacks Rank #3.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

Arista Networks, Inc. ANET is set to release quarterly numbers on Oct 31. It has an Earnings ESP of +1.27% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Cogent Communications Holdings, Inc. CCOI is +34.78% and it carries a Zacks Rank of 3. The company is set to report quarterly numbers on Nov 3.

The Earnings ESP for CDW Corporation CDW is +0.31% and it carries a Zacks Rank of 3. The company is scheduled to report quarterly numbers on Nov 2.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CDW Corporation (CDW) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance