Top Dividend Stocks For July 2024

As the S&P 500 and Nasdaq Composite continue to reach record highs, driven by strong performances in sectors like technology, the broader U.S. market presents a dynamic landscape for investors. Amidst this buoyant environment, dividend stocks remain appealing for their potential to offer steady income in addition to growth opportunities, particularly as investors anticipate possible interest rate adjustments by the Federal Reserve.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.36% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.53% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.24% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.94% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.16% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.86% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.32% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.85% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.77% | ★★★★★★ |

Credicorp (NYSE:BAP) | 5.70% | ★★★★★☆ |

Click here to see the full list of 209 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

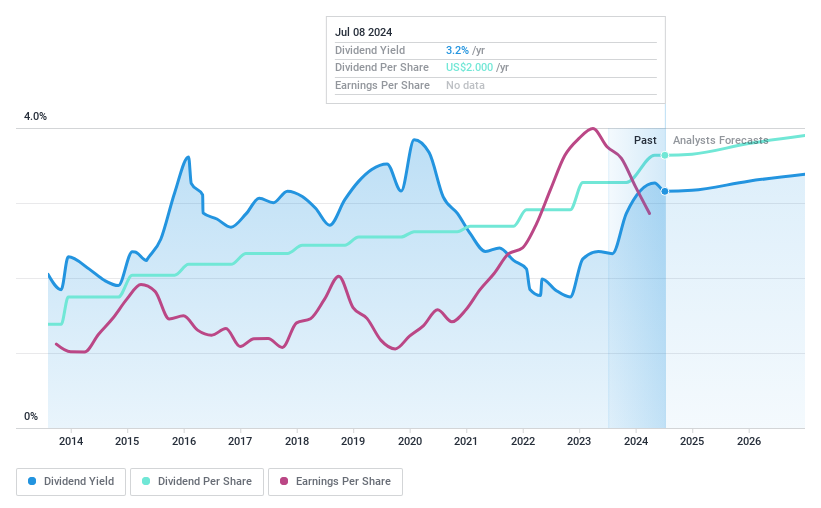

Archer-Daniels-Midland

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Archer-Daniels-Midland Company operates globally, focusing on the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products; it has a market capitalization of approximately $30.34 billion.

Operations: Archer-Daniels-Midland Company generates revenue primarily through three segments: AG Services and Oilseeds at $74.52 billion, Carbohydrate Solutions at $13.45 billion, and Nutrition at $7.28 billion.

Dividend Yield: 3.2%

Archer-Daniels-Midland offers a stable dividend yield of 3.16%, supported by a low payout ratio of 32.3% and an even lower cash payout ratio of 18.7%, indicating strong coverage by both earnings and cash flows. Despite this, the company's dividend yield remains below the top quartile in the U.S., where yields average around 4.76%. Additionally, recent index changes saw ADM added to several midcap indices while being dropped from major value indices, reflecting a mixed market perception that could influence investor sentiment towards its shares.

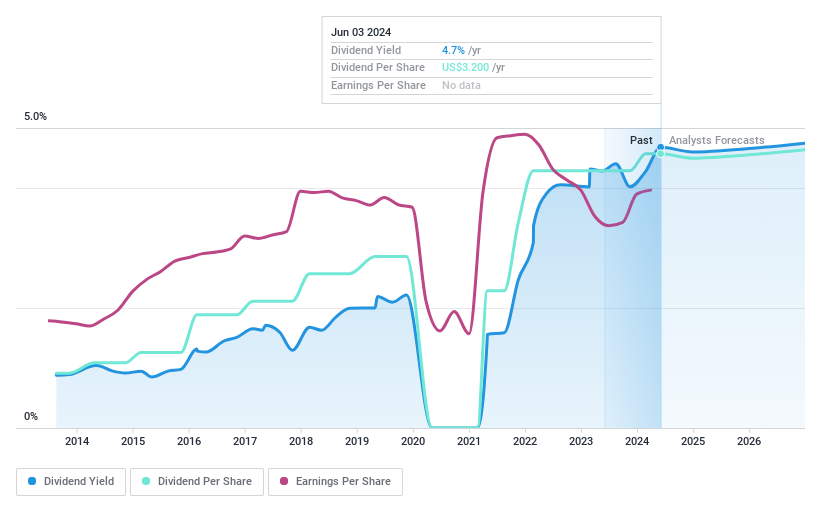

Carter's

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets children's apparel under various brands including Carter's and OshKosh, operating both in the United States and internationally, with a market capitalization of approximately $2.25 billion.

Operations: Carter's, Inc. generates revenue through three primary channels: U.S. Retail ($1.49 billion), U.S. Wholesale ($998.73 million), and International sales ($426.78 million).

Dividend Yield: 5.1%

Carter's maintains a dividend yield of 5.1%, positioning it in the top 25% of U.S. dividend payers. The dividends are supported by both earnings and cash flows, with payout ratios at 48.1% and 29% respectively, suggesting sustainability despite a history of volatility over the past decade. Recent affirmations include a steady quarterly dividend of US$0.80 per share, underscoring ongoing commitment to shareholder returns amidst modest annual earnings growth of 0.9%.

Take a closer look at Carter's potential here in our dividend report.

Our expertly prepared valuation report Carter's implies its share price may be lower than expected.

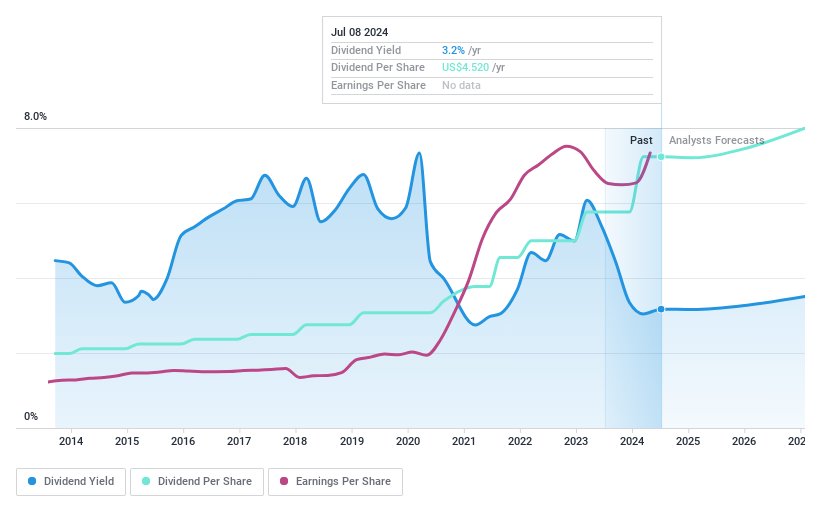

Williams-Sonoma

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Williams-Sonoma, Inc. is an omni-channel specialty retailer offering a range of home products, with a market capitalization of approximately $18.00 billion.

Operations: Williams-Sonoma, Inc. generates $7.66 billion in revenue from its retail home furnishing segment.

Dividend Yield: 3.2%

Williams-Sonoma recently announced a dividend adjustment following a 2:1 stock split, setting the new dividend at US$0.57 per share. Despite this change and its removal from several Russell 2500 indexes, the company maintains a robust dividend history with payments well-covered by earnings and cash flows, evidenced by payout ratios of 23.2% and 21% respectively. Strategic initiatives like collaborations with Westin Hotels & Resorts and product expansions under its Pottery Barn brand continue to diversify its revenue streams, although it faces challenges with projected annual revenue growth ranging from -3% to +3%.

Where To Now?

Get an in-depth perspective on all 209 Top Dividend Stocks by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:ADM NYSE:CRI and NYSE:WSM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance