Top Dividend Stocks To Consider In June 2024

As the United States market navigates through various economic pressures and corporate developments, investors continue to seek stable returns amid the volatility. Dividend stocks, known for their potential to provide regular income, could be particularly appealing in this environment where consistent performance is prized.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.73% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.29% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.08% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.06% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.98% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.93% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.45% | ★★★★★★ |

CVB Financial (NasdaqGS:CVBF) | 4.84% | ★★★★★☆ |

Evans Bancorp (NYSEAM:EVBN) | 4.84% | ★★★★★☆ |

Click here to see the full list of 210 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

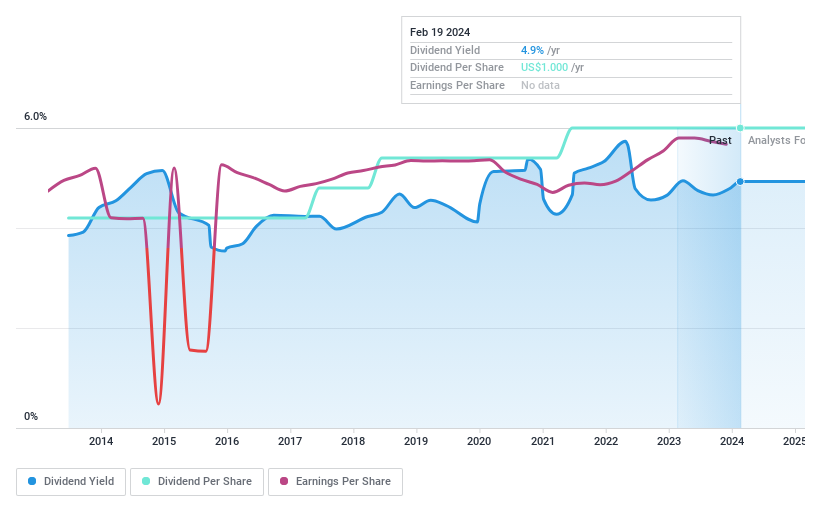

Ennis

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ennis, Inc., operating in the United States, is a manufacturer and seller of business forms and various business products, with a market capitalization of approximately $563.07 million.

Operations: Ennis, Inc. does not provide specific breakdowns of its revenue segments in the provided text.

Dividend Yield: 4.5%

Ennis, Inc. has maintained a stable dividend payout, recently affirming a quarterly cash dividend of US$0.25 per share, payable on August 5, 2024. Despite a slight decrease in quarterly sales and net income as reported on June 17, 2024—US$103.11 million in sales and US$10.69 million in net income compared to the previous year—the dividends appear sustainable with a cash payout ratio of 40.6% and an earnings payout ratio of 46.7%. Additionally, Ennis has consistently repurchased shares, enhancing shareholder value by completing significant buybacks since October 2008.

Click here to discover the nuances of Ennis with our detailed analytical dividend report.

Our valuation report unveils the possibility Ennis' shares may be trading at a discount.

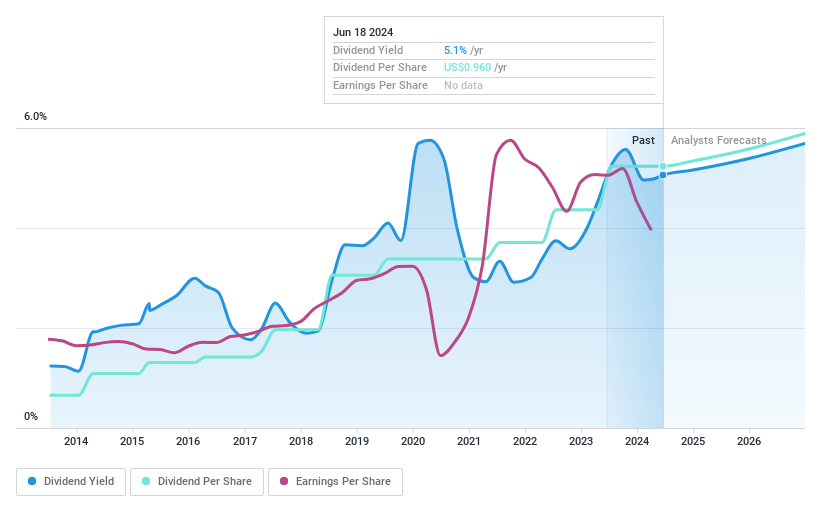

Regions Financial

Simply Wall St Dividend Rating: ★★★★★★

Overview: Regions Financial Corporation operates as a financial holding company, offering banking and related services to individual and corporate customers, with a market capitalization of approximately $17.31 billion.

Operations: Regions Financial Corporation generates revenue primarily through its Consumer Bank ($3.75 billion), Corporate Bank ($2.35 billion), and Wealth Management ($0.63 billion) segments.

Dividend Yield: 5.1%

Regions Financial has demonstrated a robust dividend profile with a 5.06% yield, ranking it among the top US dividend payers. Over the last decade, its dividends have shown consistent growth and stability, supported by a payout ratio of 49.6%, indicating strong coverage by earnings. The company's financial health is underscored by trading at 58.4% below its estimated fair value, suggesting potential undervaluation. Additionally, recent initiatives like the launch of Regions CashFlowIQSM aim to enhance commercial client services and may support sustained financial performance and shareholder returns.

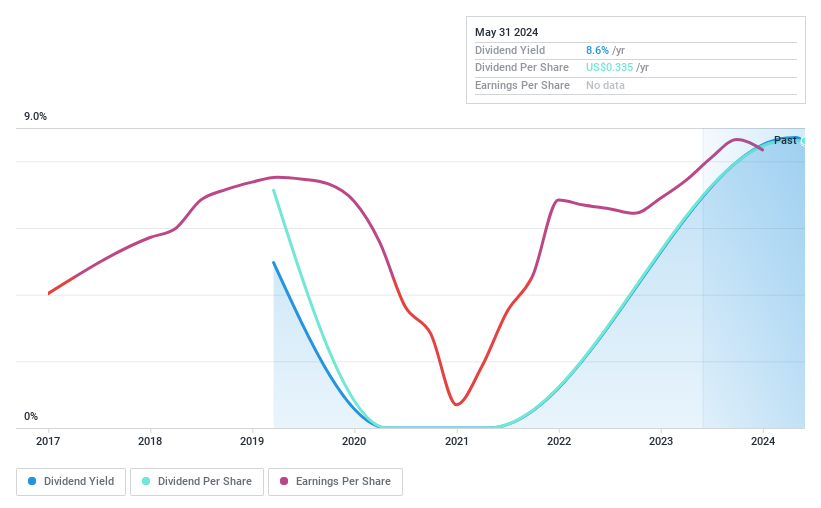

X Financial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: X Financial is a company based in the People's Republic of China that offers personal finance services, with a market capitalization of approximately $215.55 million.

Operations: X Financial generates its revenue primarily from unclassified services, totaling CN¥5.02 billion.

Dividend Yield: 7.5%

X Financial's recent tender offer and share repurchase program highlight active capital management, with a $20 million allocation for ADS buybacks enhancing shareholder value. The company reported a 20.2% increase in Q1 revenue year-over-year, reaching CNY 1.21 billion, and a 27.7% rise in net income to CNY 363.14 million. Despite this growth and a competitive dividend yield of 7.51%, the dividend history is short and volatile, reflecting potential risks in sustainability and reliability of future payouts.

Taking Advantage

Discover the full array of 210 Top Dividend Stocks right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:EBF NYSE:RF and NYSE:XYF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance