Top 6 Buys of Bernard Horn's Polaris Fund in the 1st Quarter

Bernard Horn (Trades, Portfolio), president of Polaris Capital Management, disclosed this week that his Polaris Global Value Fund's top six buys during the first quarter included an increased bet in Tyson Foods Inc. (NYSE:TSN) and new positions in the following five companies: HeidelbergCement AG (XTER:HEI), Laboratory Corp of America Holdings (NYSE:LH), Fresenius SE & Co. KGaA (XTER:FRE), H&R Block Inc. (NYSE:HRB) and Delta Air Lines Inc. (NYSE:DAL).

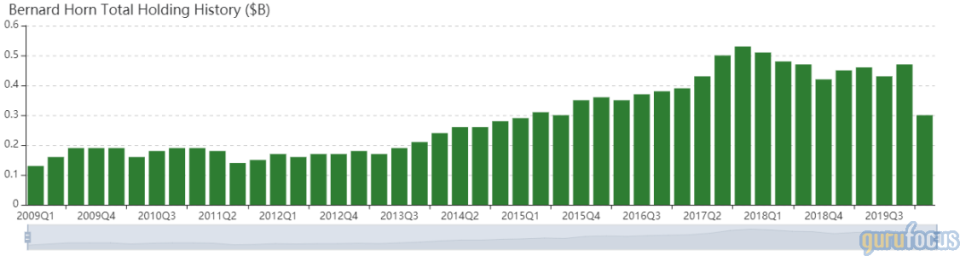

According to its website, the Boston-based firm seeks long-term growth appreciation in equity investments using a bottom-up, fundamental stock analysis that combines research on stock valuations with research on industry conditions, competitors and company management. Polaris diversifies its investments in over 15 industry groups and 15 countries around the globe.

Guru updates market environment and discusses fund actions based on its perspective

Horn discussed in his first-quarter shareholder letter that the Polaris Global Value Fund returned -31.75% for the three-month period, underperforming the MSCI World Index's return of -21.05% as the coronavirus outbreak in February and March bludgeoned markets around the globe. The fund manager attributed the underperformance to weaknesses in foreign currencies relative to the U.S. dollar, primarily in energy and resource-related countries on the heels of "collapsing" oil prices due to geopolitical conflicts between OPEC nations.

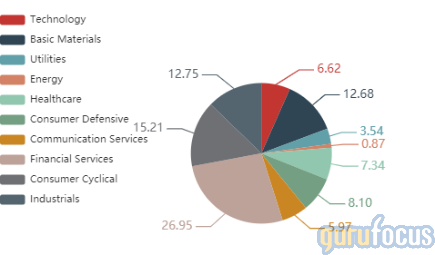

Horn also mentioned that while the fund trimmed its weight in cyclical sectors during the quarter, the fund remained overweight in financial services, consumer cyclical, industrials and materials, which detracted from absolute returns. As of the quarter-end, Polaris' $295 million equity portfolio contains weights of 26.95%, 15.21%, 12.75% and 12.68% in the above four sectors.

Despite the setback, Polaris deployed cash starting from the March 23 low and bought shares in companies "at attractive valuations," diversifying the portfolio further. The portfolio contained 99 stocks as of March 31, with 15 new positions and a turnover ratio of 15%.

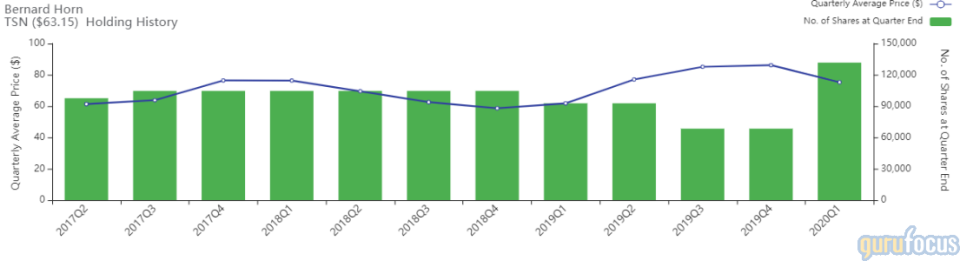

Tyson

Polaris purchased 63,300 shares of Tyson, boosting the position 92.54% and the equity portfolio 1.24%. Shares averaged $75.28 during the first quarter.

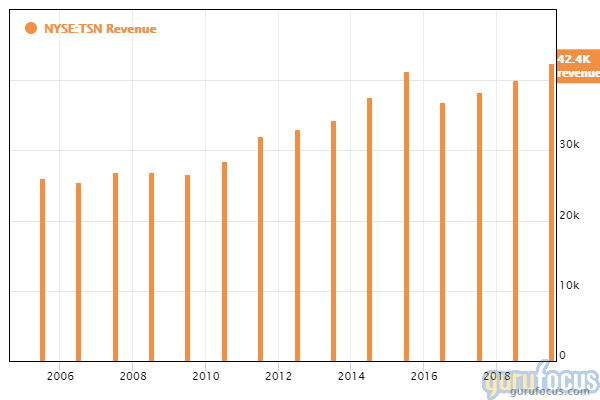

The Springdale, Arkansas-based company produces meat products, which include Tyson chicken, Jimmy Dean sausage and Sara Lee sliced ham. GuruFocus ranks the company's profitability 7 out of 10, driven primarily by expanding operating margins and a three-year revenue growth rate that outperforms 67% of global competitors.

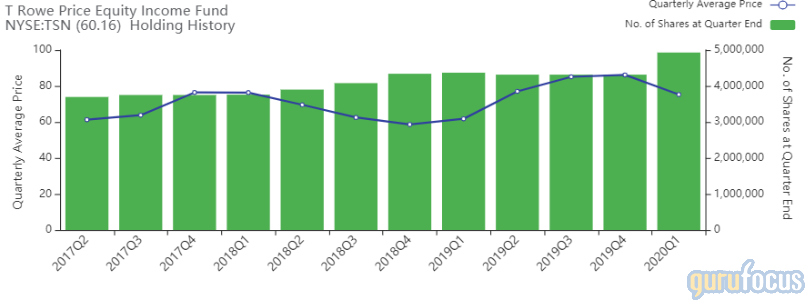

Gurus with large holdings in Tyson include the T Rowe Price Equity Income Fund (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

HeidelbergCement

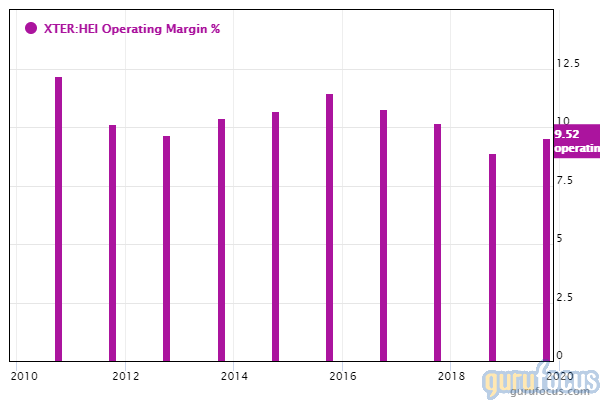

Polaris purchased 74,600 shares of HeidelbergCement, giving the holding 1.09% weight in the equity portfolio. Shares averaged 55.51 euros ($62.36) during the first quarter.

GuruFocus ranks the German cement producer's profitability 7 out of 10 on the back of a high Piotroski F-score of 7 and a three-year earnings growth rate that outperforms 68.61% of global competitors. Despite this, operating margins have contracted over the past five years and are outperforming just 52% of global peers.

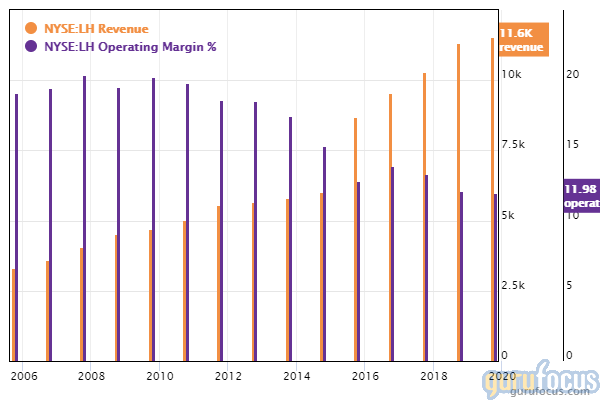

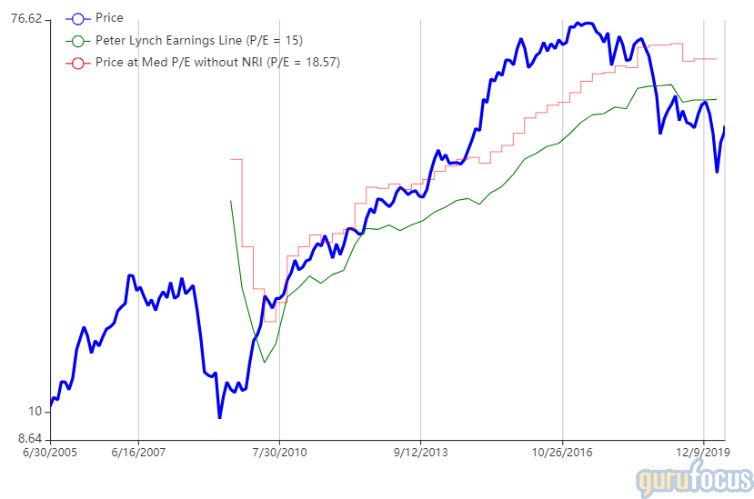

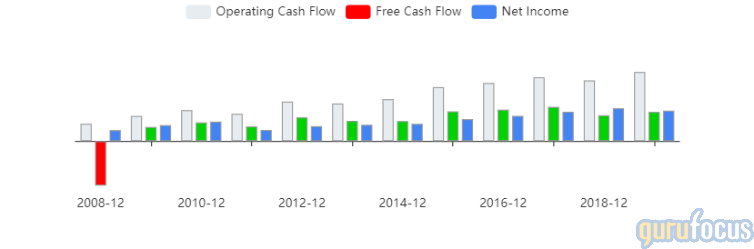

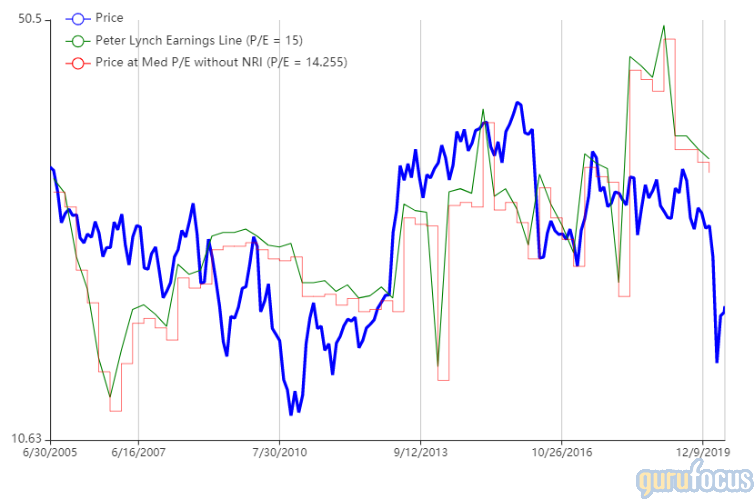

Laboratory Corp of America

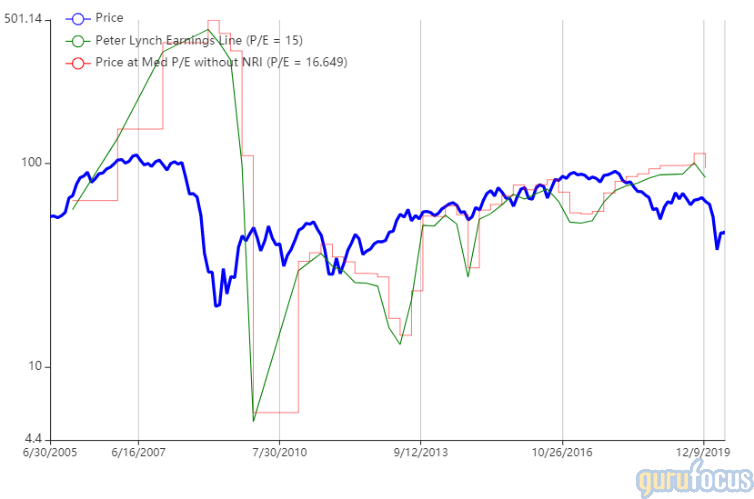

Polaris purchased 24,800 shares of Laboratory Corp of America, giving the position 1.06% weight in the equity portfolio. Shares averaged $168.30 during the first quarter.

The Burlington, North Carolina-based company operates over 2,000 patient service centers, offering a broad range of clinical lab tests. GuruFocus ranks the company's profitability 9 out of 10 on the back of a five-star business predictability rank and operating margins that are outperforming over 69% of global competitors.

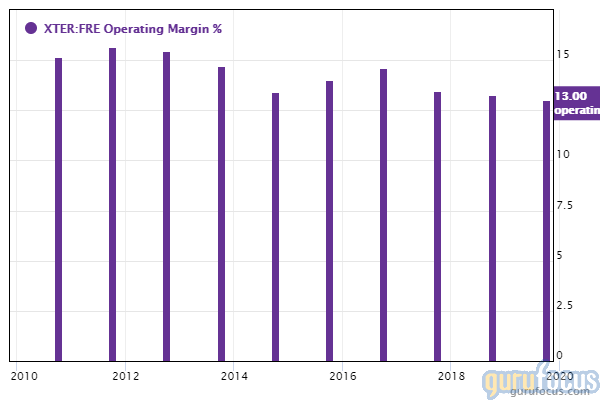

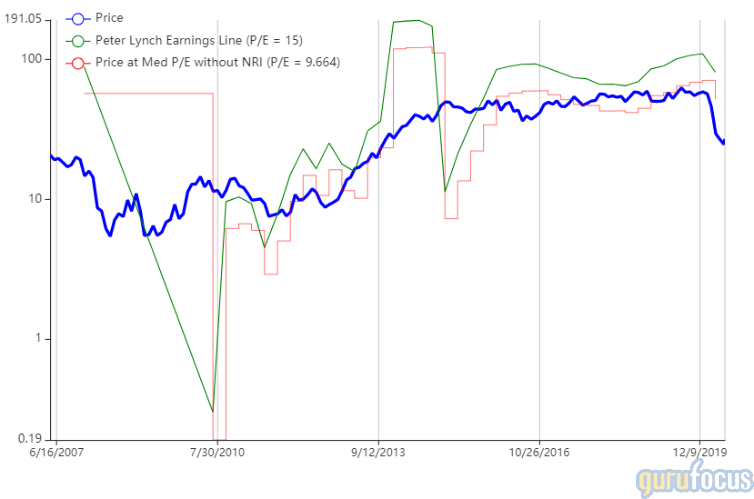

Fresenius

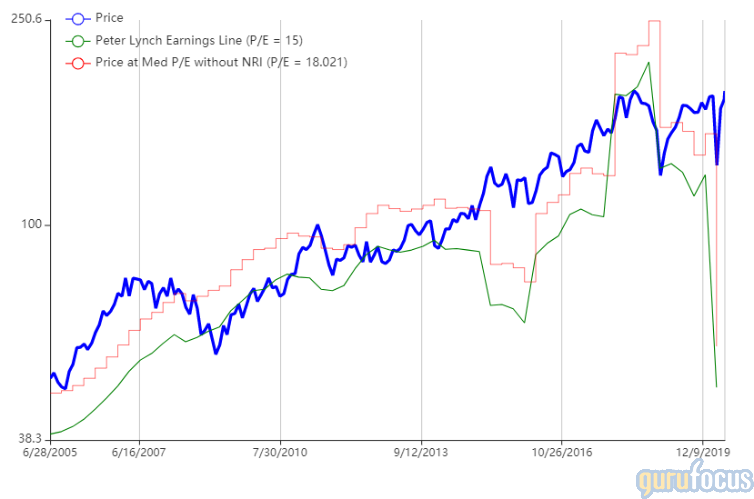

Polaris purchased 80,400 shares of Fresenius, giving the holding 1.02% weight in the equity portfolio. Shares averaged 43.56 euros during the first quarter.

Horn said in his shareholder letter that Polaris sought during the quarter companies that had "clean, liquid balance sheets and resilient business models" yet did not reach attractive price points until March. The fund manager further said that the investments "trended thematically" into two groups, with one group covering the stocks in defensive, "recession resistant" market sectors like health care and utilities. Fresenius, a German-based health care company, runs four businesses with operations in dialysis services, therapy manufacturing, hospital care and health care facility construction and operation management.

GuruFocus ranks Fresenius' profitability 7 out of 10 and valuation 8 out of 10 on several positive investing signs, which include operating margins outperforming over 76.32% of global competitors and price-earnings ratios outperforming over 80% of global health care providers.

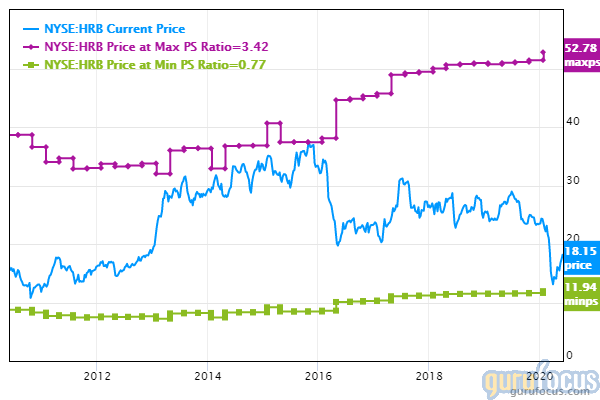

H&R Block

Polaris purchased 213,000 shares of H&R Block, giving the position 1.02% weight in the equity portfolio. Shares averaged $21.06 during the first quarter.

The Kansas City-based company provides income tax preparation services to the general public, primarily in the U.S., Canada and Australia. GuruFocus ranks the company's profitability 8 out of 10 on the heels of operating margins and returns on assets outperforming 80% and 91% of global competitors. Additionally, H&R Block's valuation ranks 9 out of 10, driven by price-earnings and price-sales ratios near 10-year lows.

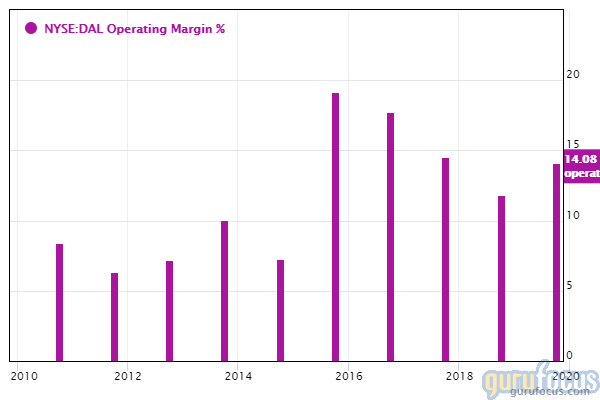

Delta

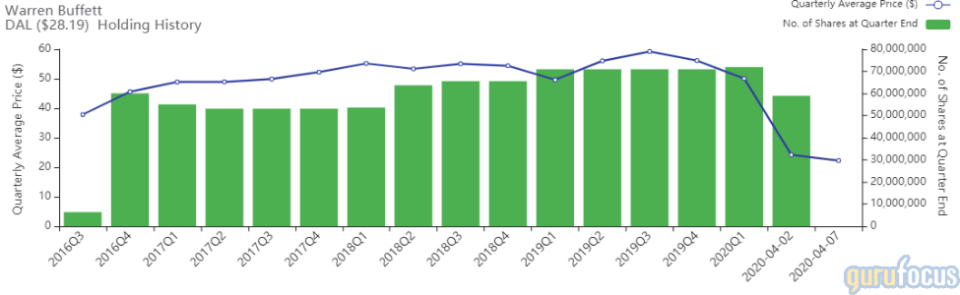

Polaris purchased 103,600 shares of Delta, giving the position 1% weight in the equity portfolio. While shares averaged $50.04 during the first quarter, shares of Delta closed on Wednesday at $28.44, down over 44% from the average price yet approximately 7.65% higher than the previous close of $26.42.

As mentioned prior, Polaris' stock investments trended thematically in two groups, with one group covering "recession resistant" market sectors. The other group of investments are in stocks that dramatically declined over the past few months but managers believe have potential to "rebound strongly" in the next one to two years, which include travel and tourism stocks.

GuruFocus ranks the Atlanta-based airline's profitability 7 out of 10 and valuation 9 out of 10 on several positive investing signs, which include expanding operating margins and price-earnings ratios that are near 10-year lows and outperform over 88% of global competitors.

See also

According to GuruFocus Real-Time Picks, a Premium feature, Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(BRK.B) sold in April its entire stake in airline stocks, including Delta, American Airlines Inc. (NASDAQ:AAL), Southwest Airlines Co. (NYSE:LUV) and United Airlines Holdings Inc. (NASDAQ:UAL). While his view on airlines might have changed in the past few weeks, Buffett said during his conglomerate's May 2 shareholder meeting that "the world has changed" for the airline industry as shelter-in-place orders around the globe sent demand for air travel tumbling during March and April.

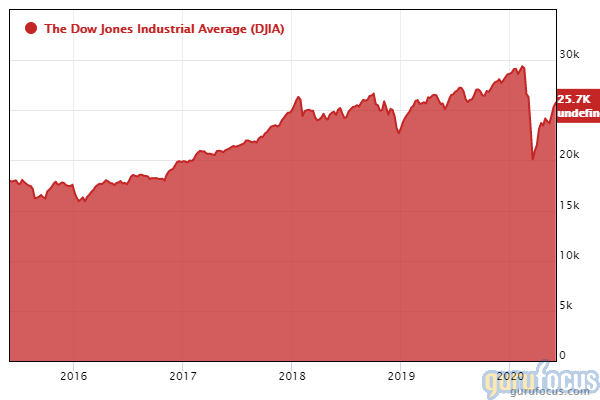

On Wednesday, the Dow Jones Industrial Average closed at 26,269.89, up 527.24 points or 2.05% from Tuesday's close of 25,742.65. The 30-stock index closed above 26,000 for the first time since March 5: CNBC attributed the Dow's surge on "bolstered investor optimism over the recovery of coronavirus-led shutdowns."

Disclosure: The author is long Southwest as of this writing. The mention of stock trades in this article reflect information as of the March-quarter filing and does not factor in trades made during April and May, apart from Berkshire's sells in airlines.

Read more here:

Charles de Vaulx Exits 4 Stocks, Boosts 2 Holdings in 1st Quarter

Warren Buffett's Market Indicator Reaches 144% Heading Into June

Michael Burry's Firm Axes Alphabet, Buys 5 Stocks in the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance