Top 5 Internet Software Stocks to Strengthen Your Portfolio

The Internet Software and Services space is gathering momentum owing to robust IT spending on solutions that support hybrid operating environments. The level of technology adoption by businesses and the proliferation of connected consumer devices, which might help people connect and do business online, is also accelerating the industry’s growth. Outstanding penetration of mobile devices among users, makes sense for businesses to invest heavily in web-based infrastructure, applications, and security software.

Within the technology sector, the Zacks Defined Internet-Software Industry is currently placed in the top 29% of all industries with a year-to-date return of 12.8%. In the past year, the industry has returned a solid 29.3%. Since it is ranked in the top half of Zacks Ranked Industries, we expect the space to outperform the market over the next three to six months.

The Internet software industry is benefiting from continued demand for a global digital transformation. Growth prospects are alluring primarily due to the rapid adoption of Software as a Service (SaaS), which offers flexible and cost-effective delivery of applications.

SaaS attempts to deliver applications to any user, anywhere, anytime and on any device. It has been effective in addressing customer expectations of seamless communications across multiple channels, including voice, chat, email, web, social media and mobile.

The growing need to secure cloud platforms amid rampant incidences of cyber-attacks and hacking is driving demand for web-based cybersecurity software. As enterprises continue to move their on-premise workload to cloud environments, application and infrastructure monitoring is gaining importance. This is increasing the demand for web-based performance management monitoring tools.

Moreover, the pay-as-you-go model helps Internet software providers scale their offerings per the needs of different users. The subscription-based business model ensures recurring revenues for the industry participants.

At this stage, it will be prudent to invest in Internet software stocks with a favorable Zacks Rank to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five Internet software stocks with strong potential for the rest of 2024. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

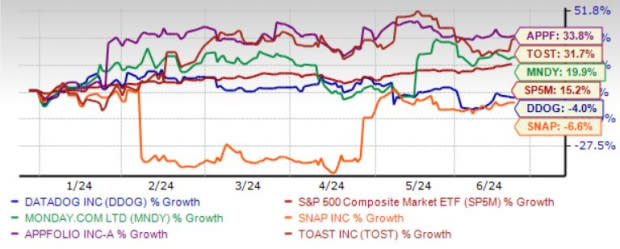

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Datadog Inc. DDOG has benefited from strength in customer demand for offerings in modern observability, cloud security, software delivery and cloud service management. DDOG had 3,340 customers with an annual run rate of $100K or more at the end of first quarter 2024.

DDOG’s dollar-based retention rate was in the mid-110s in the first quarter as customers increased their usage and adopted more products. Contributions from a solid cloud partner base, including Google Cloud, Microsoft Azure and Amazon Web Services, remain a key growth driver of DDOG besides an expanding portfolio.

Zacks Rank #1 Datadog has an expected revenue and earnings growth rate of 22.1% and 16.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.5% over the last 60 days.

monday.com Ltd. MNDY develops software applications in the United States, Europe, the Middle East, Africa, and internationally. MNDY provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

MNDY also offers product solutions for work management, sales CRM, software development verticals, business development, presale, and customer success services. MNDY serves organizations, educational or government institutions, and distinct business units of an organization.

Zacks Rank #1 monday.com has an expected revenue and earnings growth rate of 29.5% and 23.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 19.3% over the last 60 days.

AppFolio Inc. APPF provides cloud business management solutions for the real estate industry in the United States. APPF provides a cloud-based platform that enables users to automate and optimize common workflows, and tools that assist in leasing, maintenance, accounting, and other technology and services offered by third parties.

APPF also provides value-added services that are designed to enhance, automate, and streamline processes and workflows for property management businesses, such as electronic payment, tenant screening, and insurance services.

Zacks Rank #2 AppFolio has an expected revenue and earnings growth rate of 24.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the last 60 days.

Toast Inc. TOST operates a cloud-based digital technology platform for the restaurant industry in the United States and Ireland. TOST offers Toast POS, a software module that integrates payment processing with point-of-sale functionality, Toast Invoicing, which allows restaurants to send invoices and collect payment, Toast Mobile Order & Pay, Kitchen Display System software that connects the house with the kitchen staff, and Multi-Location Management.

TOST also provides Toast Flex, hardware for on-counter order and pay, Toast Go, an integrated handheld POS device, Toast Tap, a card reader for accepting EMV-contactless payments, Toast Online Ordering & Toast TakeOut, First-Party Delivery, POS integration for restaurants using third-party delivery services to order intake and eliminate the need for extra third-party tablets, and loyalty, email marketing, and Toast Gift Cards services.

Zacks Rank #2 Toast has an expected revenue and earnings growth rate of 25.9% and 70.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 17.6% over the last 30 days.

Snap Inc. SNAP is riding on user growth and rising user engagement due to the strong adoption of Augmented Reality (AR) Lenses, Discover content, Shows and Snap Map, which are used by 350 million users on a monthly basis. SNAP is gaining from rising user engagement between the age group of 13 and 34. SNAP reaches more than 75% of 13 to 34-year-olds in over 20 countries, representing above 50% of global advertising spend.

The subscription service reached more than nine million paying subscribers in the first quarter of 2024. SNAP made considerable progress in diversifying revenues with Snapchat+, ARES and AR advertising. An expanding partner base, with the likes of ITV in the U.K. and Spotify in the United States, is noteworthy.

Zacks Rank #2 Snap has an expected revenue and earnings growth rate of 16.3% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.3% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

monday.com Ltd. (MNDY) : Free Stock Analysis Report

Toast, Inc. (TOST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance