Top 3 Stocks Estimated To Be Undervalued On SIX Swiss Exchange In July 2024

The Switzerland market has shown robust performance recently, closing higher for the third consecutive session and reaching a record high, buoyed by positive sentiment surrounding U.S. interest rates and strong quarterly earnings. This upward trajectory in the SMI index reflects a vibrant economic environment that could present opportunities for investors to identify potentially undervalued stocks. In such a thriving market, discerning investors might look for stocks that are trading below their intrinsic values, which could benefit from the current economic optimism and favorable conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sulzer (SWX:SUN) | CHF134.00 | CHF220.93 | 39.3% |

COLTENE Holding (SWX:CLTN) | CHF48.20 | CHF77.65 | 37.9% |

Burckhardt Compression Holding (SWX:BCHN) | CHF614.00 | CHF856.05 | 28.3% |

Temenos (SWX:TEMN) | CHF65.40 | CHF84.78 | 22.9% |

Julius Bär Gruppe (SWX:BAER) | CHF52.18 | CHF94.77 | 44.9% |

Sonova Holding (SWX:SOON) | CHF277.30 | CHF469.35 | 40.9% |

SGS (SWX:SGSN) | CHF82.38 | CHF124.96 | 34.1% |

Comet Holding (SWX:COTN) | CHF386.00 | CHF588.70 | 34.4% |

Medartis Holding (SWX:MED) | CHF72.00 | CHF131.55 | 45.3% |

medmix (SWX:MEDX) | CHF14.92 | CHF24.14 | 38.2% |

Let's dive into some prime choices out of from the screener.

COLTENE Holding

Overview: COLTENE Holding AG is a company that develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories across various global regions, with a market capitalization of CHF 288.02 million.

Operations: The company generates CHF 242.73 million in revenue from its disposables, tools, and equipment segment for dental professionals.

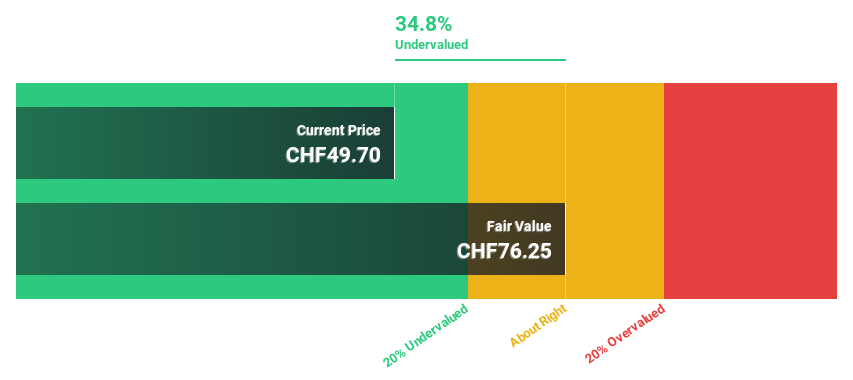

Estimated Discount To Fair Value: 37.9%

COLTENE Holding, priced at CHF48.2, is significantly undervalued based on DCF analysis, with an estimated fair value of CHF77.65. Despite a lower net profit margin this year (4.9%) compared to last (9.7%), its earnings are expected to grow by 20.86% annually, outpacing the Swiss market's 8.2%. However, its dividend coverage is weak, and revenue growth projections (2.8% per year) lag behind the broader market forecast of 4.4%. The company's Return on Equity is anticipated to be robust at 22.1% in three years.

medmix

Overview: medmix AG, a company based in Switzerland, specializes in designing, producing, and selling high-precision devices and services for healthcare, consumer, and industrial sectors globally with a market capitalization of CHF 608.47 million.

Operations: The company generates revenues from two primary segments: CHF 177 million from healthcare and CHF 309.60 million from consumer and industrial sectors.

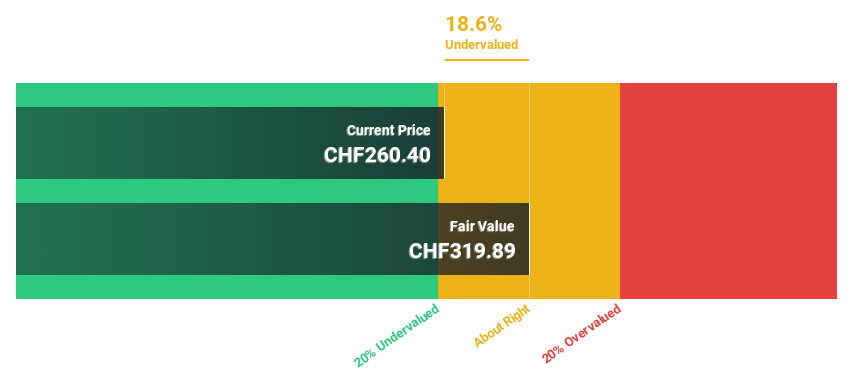

Estimated Discount To Fair Value: 38.2%

Medmix, with a current price of CHF14.92, is identified as undervalued by over 20% against a DCF-derived fair value of CHF24.14, suggesting significant investment potential. Despite this opportunity, challenges persist: its modest dividend yield of 3.35% lacks coverage from earnings and cash flows, and profit margins have dipped to 0.06% from last year's 2.4%. However, MEDX stands out with an expected earnings growth of 51.41% annually, substantially outperforming the Swiss market projection of 8.2%.

Click here and access our complete balance sheet health report to understand the dynamics of medmix.

Sika

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the construction and automotive industries globally, with a market capitalization of CHF 42.59 billion.

Operations: Sika generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 21.4%

Sika, priced at CHF265.5, trades 21.4% below its estimated fair value of CHF337.75, reflecting potential underpricing based on cash flows. Its earnings and revenue growth forecasts of 12.72% and 6.1% respectively outpace the Swiss market averages, suggesting robust financial health despite a high debt level. Recent expansions in China and Peru emphasize Sika's strategic growth initiatives, enhancing its production capabilities and market reach in significant industrial sectors.

Make It Happen

Gain an insight into the universe of 15 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:CLTN SWX:MEDX and SWX:SIKA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance