Top 3 Estimated Undervalued Stocks On The KRX For July 2024

The South Korean market has shown robust growth, climbing 3.3% in the last week and achieving a 9.8% increase over the past year, with earnings expected to grow by 30% annually. In this thriving environment, identifying stocks that are potentially undervalued could offer investors opportunities for significant value in July 2024.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Caregen (KOSDAQ:A214370) | ₩23100.00 | ₩44549.16 | 48.1% |

Revu (KOSDAQ:A443250) | ₩10990.00 | ₩20652.42 | 46.8% |

Anapass (KOSDAQ:A123860) | ₩27850.00 | ₩48730.05 | 42.8% |

NEXTIN (KOSDAQ:A348210) | ₩64000.00 | ₩109491.92 | 41.5% |

KidariStudio (KOSE:A020120) | ₩4215.00 | ₩7309.75 | 42.3% |

Genomictree (KOSDAQ:A228760) | ₩22850.00 | ₩39248.14 | 41.8% |

Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

Shinsung E&GLtd (KOSE:A011930) | ₩2065.00 | ₩4027.15 | 48.7% |

SK Biopharmaceuticals (KOSE:A326030) | ₩80000.00 | ₩149728.31 | 46.6% |

Ray (KOSDAQ:A228670) | ₩12840.00 | ₩21064.64 | 39% |

Let's uncover some gems from our specialized screener.

Genomictree

Overview: Genomictree Inc. is a South Korean biomarker-based molecular diagnostics company that focuses on developing and commercializing products for detecting cancer and various infectious diseases, with a market capitalization of approximately ₩547.99 billion.

Operations: The company generates revenue primarily through its Cancer Molecular Diagnosis segment, which brought in ₩1.86 billion, and its Genomic Analysis segment, contributing ₩0.68 billion.

Estimated Discount To Fair Value: 41.8%

Genomictree, priced at ₩22850, appears undervalued with a DCF-based fair value of ₩39248.14, indicating a significant 41.8% discount. Despite its highly volatile share price and low meaningful revenue of ₩3B, the company is expected to become profitable within three years alongside an impressive revenue growth forecast of 81% per year—substantially outpacing the South Korean market's average. However, its projected Return on Equity remains modest at 3.7%.

Hotel ShillaLtd

Overview: Hotel Shilla Co., Ltd operates as a hospitality company in South Korea and internationally, with a market capitalization of approximately ₩1.997 billion.

Operations: The company generates revenue through its hospitality operations both domestically and internationally.

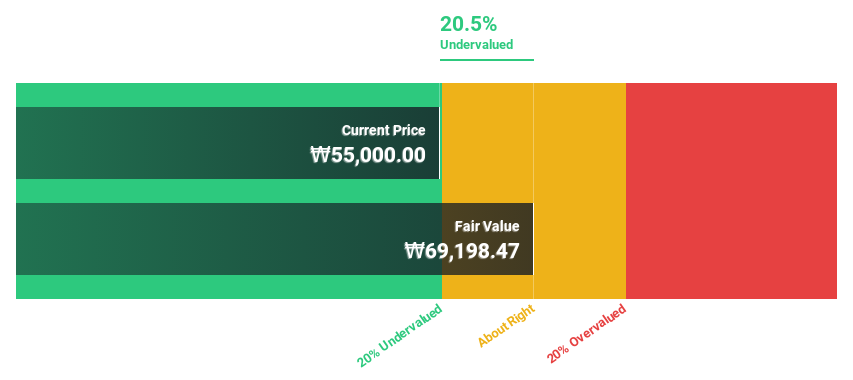

Estimated Discount To Fair Value: 33.6%

Hotel Shilla Co., Ltd, trading at ₩53000, is valued below its estimated fair value of ₩79761.65, reflecting a 33.6% undervaluation. Its earnings have surged by 174.8% over the past year with forecasts predicting robust annual growth of 46.29%. Despite this rapid growth, concerns linger as interest payments are not well covered by earnings and large one-off items have skewed financial results. Moreover, revenue growth projections (12.6% per year) slightly exceed the Korean market average (10.8%).

SK Biopharmaceuticals

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on developing drugs for central nervous system disorders, with a market capitalization of approximately ₩6.27 billion.

Operations: The company primarily generates revenue through the development and commercialization of pharmaceuticals targeting central nervous system disorders.

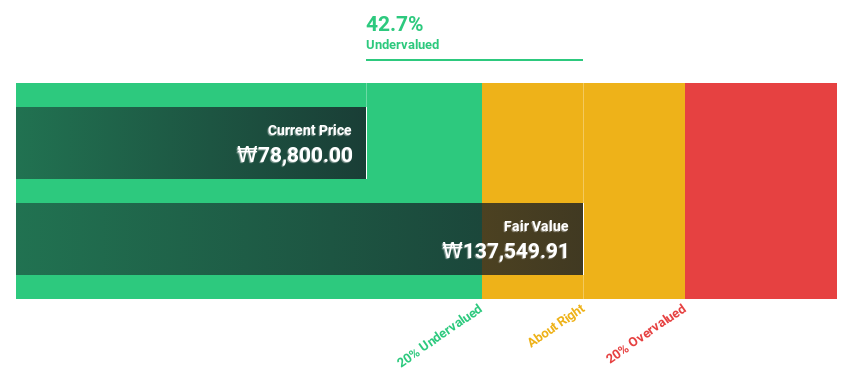

Estimated Discount To Fair Value: 46.6%

SK Biopharmaceuticals Co., Ltd, priced at ₩80000, is significantly undervalued against a fair value of ₩149728.31, indicating a 46.6% discount. The company has demonstrated robust earnings growth of 29.9% annually over the past five years and is expected to see earnings soar by approximately 85% yearly. Revenue projections are also strong, with an anticipated increase of 22.2% per year—twice the pace of the Korean market average. Despite these positives, profitability is only expected in the next three years, suggesting some initial caution for investors looking for immediate returns.

Delve into the full analysis health report here for a deeper understanding of SK Biopharmaceuticals.

Next Steps

Delve into our full catalog of 35 Undervalued KRX Stocks Based On Cash Flows here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A228760 KOSE:A008770 and KOSE:A326030.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance