These are the top 10 stocks held by 'Big Short' investor Michael Burry

Michael Burry invested a lot of money into the stock market last quarter, according to 13F filings.

The "Big Short" investor who has held a bearish tilt towards stocks initiated 17 new positions last quarter.

These are the top 10 stocks held by Burry's Scion Asset Management as of March 31.

"Big Short" investor Michael Burry has been bearish on stocks in recent months, but he still invested a lot of money into the market in the first three months of the year.

According to a recent 13F filing, Burry last quarter initiated 17 new positions in his Scion Asset Management portfolio, which managed $238 million in assets as of March 31.

Burry posted on Twitter on multiple occasions over the last few months that he had a bearish view on stocks. On January 31, Burry simply tweeted "Sell." But Burry has since seemingly changed his view, saying in late march that he "was wrong to say sell."

His new outlook shows through in his portfolio, given the slew of new positions he opened last quarter, including in struggling banks like First Republic, Pacific Western, and Western Alliance, among others.

These are the top 10 stocks held by Burry's Scion Asset Management as of March 31.

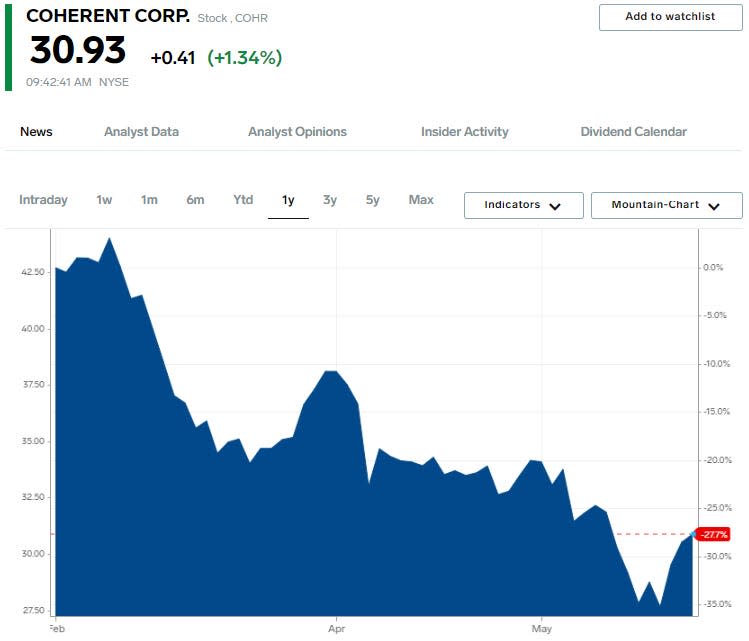

10. Coherent Corp.

Ticker: COHR

Position: $4.8 million

Percent of portfolio: 4.5%

9. Cigna

Ticker: CI

Position: $6.4 million

Percent of portfolio: 6.0%

8. Liberty Latin America

Ticker: LILAK

Position: $6.6 million

Percent of portfolio: 6.2%

7. Sibayne Stillwater

Ticker: SBSW

Position: $6.7 million

Percent of portfolio: 6.2%

6. Capital One Financial

Ticker: COF

Position: $7.2 million

Percent of portfolio: 6.7%

5. Zoom Video

Ticker: ZM

Position: $7.4 million

Percent of portfolio: 6.9%

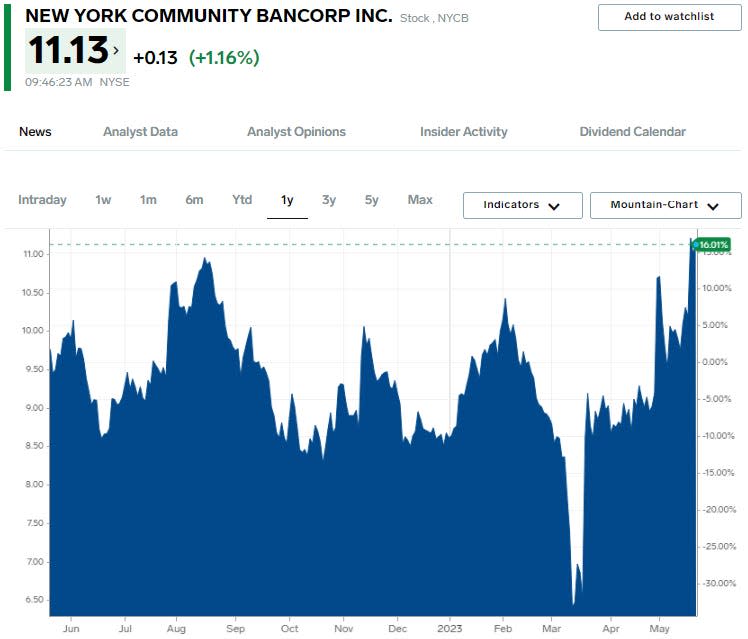

4. New York Community Bancorp

Ticker: NYCB

Position: $7.7 million

Percent of portfolio: 7.2%

3. Signet Jewelers

Ticker: SIG

Position: $9.7 million

Percent of portfolio: 9.1%

2. Alibaba

Ticker: BABA

Position: $10.2 million

Percent of portfolio: 9.6%

1. JD.com

Ticker: JD

Position: $10.9 million

Percent of portfolio: 10.3%

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance