Is Titanium Transportation Group Inc.'s (CVE:TTR) Recent Performance Tethered To Its Attractive Financial Prospects?

Most readers would already know that Titanium Transportation Group's (CVE:TTR) stock increased by 4.1% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Titanium Transportation Group's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Titanium Transportation Group

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Titanium Transportation Group is:

13% = CA$6.3m ÷ CA$47m (Based on the trailing twelve months to December 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each CA$1 of shareholders' capital it has, the company made CA$0.13 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Titanium Transportation Group's Earnings Growth And 13% ROE

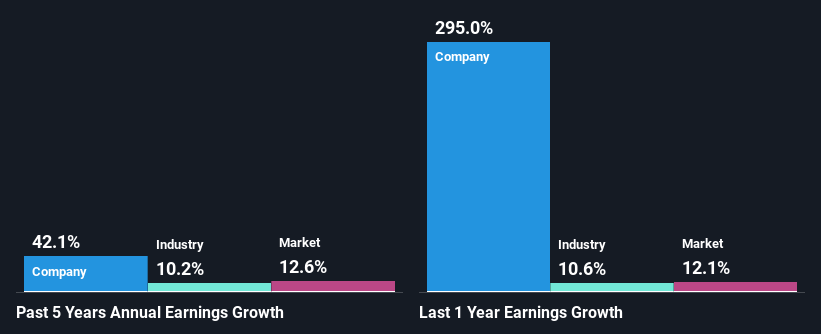

To start with, Titanium Transportation Group's ROE looks acceptable. Further, the company's ROE is similar to the industry average of 16%. This probably goes some way in explaining Titanium Transportation Group's significant 42% net income growth over the past five years amongst other factors. We believe that there might also be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Titanium Transportation Group's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 10%.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Titanium Transportation Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Titanium Transportation Group Efficiently Re-investing Its Profits?

Titanium Transportation Group's ' three-year median payout ratio is on the lower side at 12% implying that it is retaining a higher percentage (88%) of its profits. So it looks like Titanium Transportation Group is reinvesting profits heavily to grow its business, which shows in its earnings growth.

Conclusion

Overall, we are quite pleased with Titanium Transportation Group's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance