Time to Buy into the Strong Price Performance of These Building Products Stocks After Earnings

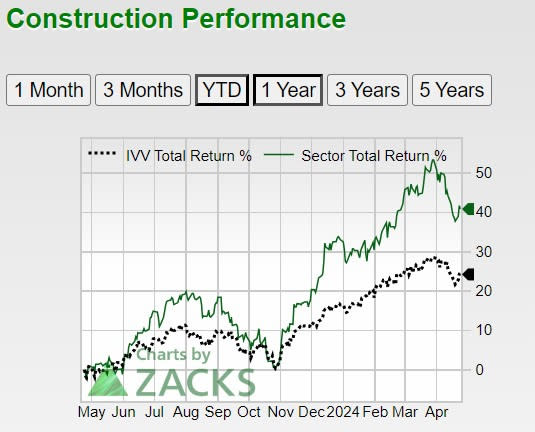

The Zacks Construction sector’s price performance has been blazing over the last year and Rollins ROL and United Rentals URI are two building products stocks that could keep the rally going.

Following their favorable Q1 reports on Wednesday, Rollins and United Rentals stock spiked +3% and +5% respectively in today’s trading session while broader indexes fell due to slower-than-expected GDP growth and rising consumer prices.

Let’s see what led to their Q1 post-earnings bounce and why now may be a good time to buy Rollins and United Rentals stock.

Image Source: Zacks Investment Research

Q1 Review

Notably, Rollins' Zacks Building Products-Maintenance Service Industry is currently in the top 4% of over 250 Zacks industries. Benefiting as a provider of pest and termite control to residential and commercial customers, Rollins was able to reach its Q1 earnings expectations of $0.20 a share which was also a slight increase from EPS of $0.18 in the comparative quarter. On the top line, Rollins’ Q1 sales of $748.35 million beat estimates by 3% and expanded 13% from $658.02 million a year ago.

Image Source: Zacks Investment Research

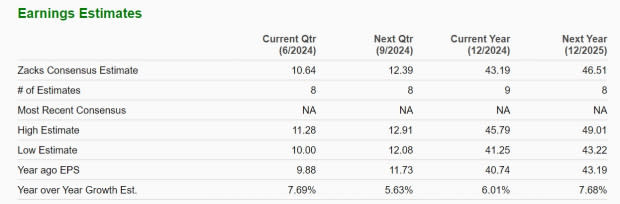

As for United Rentals, its Building-Products Miscellaneous Industry is in the top 13% of all Zacks industries. The renowned construction equipment provider beat Q1 EPS estimates by 9% with earnings at $9.15 per share which was a 15% leap from $7.95 a share in the prior year quarter. Quarterly sales of $3.48 billion beat estimates by 2% and rose 6% from $3.28 billion in Q1 2023. Furthermore, United Rentals has exceeded earnings expectations for four straight quarters.

Image Source: Zacks Investment Research

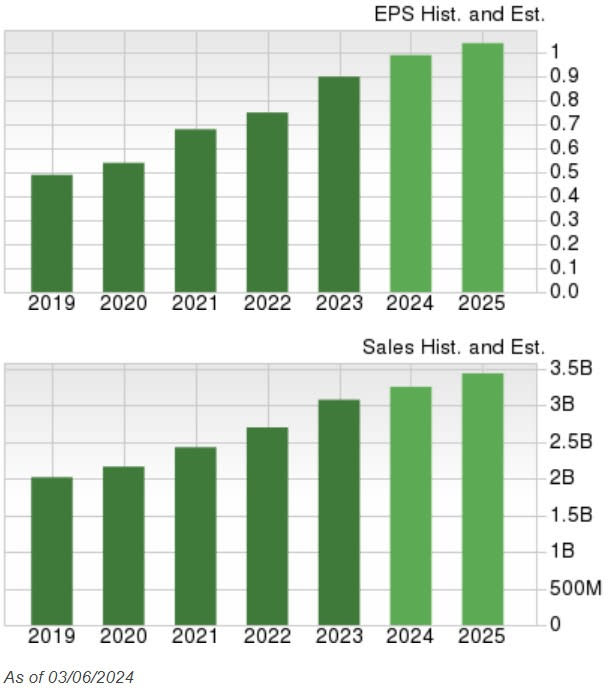

Steady Growth

Based on Zacks estimates, Rollins’ annual earnings are now expected to rise 10% in fiscal 2024 and are projected to jump another 10% in FY25 to $1.09 per share. Plus, total sales are projected to increase 8% in FY24 and are expected to rise another 7% next year to $3.55 billion.

Image Source: Zacks Investment Research

Pivoting to United Rentals, 6% EPS growth is expected in FY24 with earnings projected to increase another 7% next year to a whopping $46.51 per share. Total sales are forecasted to rise 4% in FY24 and FY25 with projections now heading north of $15 billion.

Image Source: Zacks Investment Research

Bottom Line

At the moment Rollins and United Rentals stock both sport a Zacks Rank #2 (Buy). To that point, their Q1 results helped reconfirm their attractive growth trajectories as they are beneficiaries of booming industries.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance