Time to Buy Meta Platforms (META) and Other Social Media Stocks as Earnings Approach?

This week the market is anticipating first quarter results from tech behemoth Meta Platforms META on Wednesday, April 24.

Joining Meta, Snap SNAP and Pinterest PINS will be two other social media stocks that investors might want to pay attention to over the next week with their Q1 reports set for Thursday, April 25, and Tuesday, April 30 respectively.

To that point, here’s a brief look at why now may be an ideal time to buy these top-rated social media stocks.

Domestic Digital Advertising Expansion

According to the Interactive Advertising Bureau (IAB), social media among other digital advertising revenue channels grew 7.3% in the United States last year to record levels of $225 billion. More intriguing, Q4 saw the highest growth rate at a 12.3% year-over-year increase compared to 4.4% growth in Q4 2022 with revenues rising to $64.5 billion.

The IAB expects innovations that merge social commerce, reality tech, and influencer marketing to drive higher engagement and conversions among social media platforms in 2024. This along with the plausibility that generative AI will optimize various advertising elements is reason to be higher on social media stocks going into their Q1 reports.

Meta & Pinterest’s EPS Growth

Notably, Meta and Piniterst posted high double-digit EPS growth last quarter and this is thought to have continued during Q1.

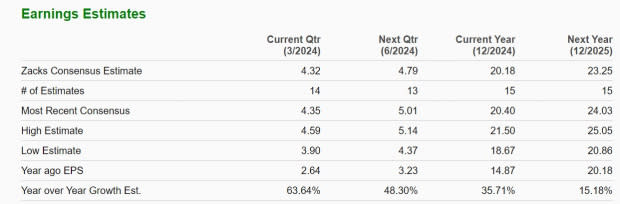

With most of its advertising revenue derived from Facebook, Meta’s portfolio also includes Instagram and WhatsApp Messenger. On Wednesday, Meta’s Q1 earnings are expected at $4.32 per share compared to $2.64 a share in the comparative quarter which would represent a 63% increase (Current Qtr). Furthermore, Meta’s annual earnings are projected to climb 36% this year and are forecasted to expand another 15% in fiscal 2025 to $23.25 per share.

Image Source: Zacks Investment Research

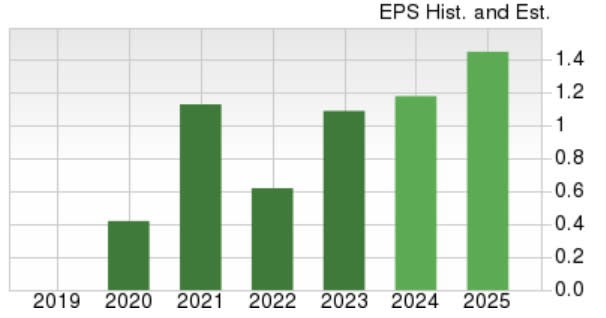

Pivoting to Pinterest, the company generates revenue by delivering ads on its website and mobile application which shows its users' visual recommendations based on their interests. Next Tuesday, Pinterest is expected to post Q1 earnings of $0.14 a share versus $0.08 a share in the prior-year quarter which would reflect a 75% increase. Better still, Pinterest is projected to post 23% EPS growth in FY24 with FY25 earnings forecasted to jump another 24% to $1.66 per share.

Image Source: Zacks Investment Research

Snap’s Revenue Growth

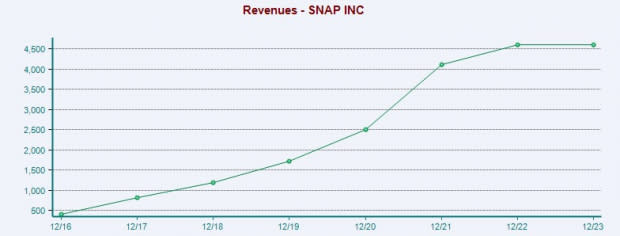

Advertisers' interest in Snap revolves around its popularity with younger generations as its Snapchat application allows users to communicate through short videos and images called snaps. Similar to Meta and Pinterest, Snap is experiencing expansive top line growth that alludes to its future earnings potential despite Q1 EPS expected at an adjusted loss of -$0.05 on Thursday versus $0.01 a share last year.

Image Source: Zacks Investment Research

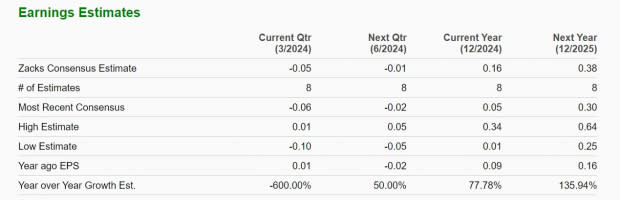

Still, Q1 sales are projected to rise 13% to $1.12 billion. Even better, total sales are forecasted to rise 13% in FY24 and are expected to expand another 15% in FY25 to $5.99 billion. More reassuring, is that high double-digit percentage growth is still forecasted on Snap’s bottom line in FY24 and FY25 despite the anticipated dip in Q1 earnings.

Image Source: Zacks Investment Research

Bottom Line

Although the broader advertising industry will not be immune to inflationary pressures among other economic headwinds, digital marketing has continued to strengthen making now an ideal time to buy Meta Platforms, Snap, and Pinterest stock as their Q1 results approach.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance