Time to Buy Lyft or Uber Technologies Stock for More Upside?

As market jitters are still upon us, investors may be looking for viable buy-the-dip prospects and among them, ride-sharing companies Lyft LYFT and Uber Technologies UBER may be considered.

After all, Lyft and Uber’s stock have soared over the last year and are both up +20% in 2024.

Let’s see if there could be more short-term upside in Lyft or Uber shares and if their stocks should be considered after a market correction.

Image Source: Zacks Investment Research

Growth Trajectories

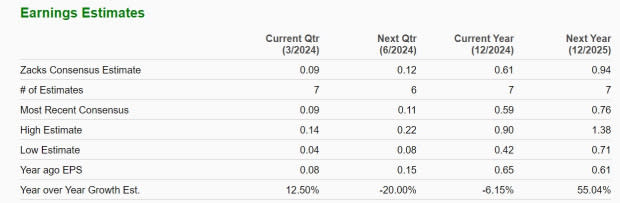

Concentrating on its core ride-hailing business primarily in the U.S. and Canada, Lyft’s total sales are expected to expand 16% in fiscal 2024 and jump another 13% in FY25 to $5.81 billion. Annual earnings are forecasted to dip to $0.61 per share in FY24 compared to $0.65 a share last year. However, FY25 EPS is anticipated to rebound and climb 55% to $0.94 per share.

Image Source: Zacks Investment Research

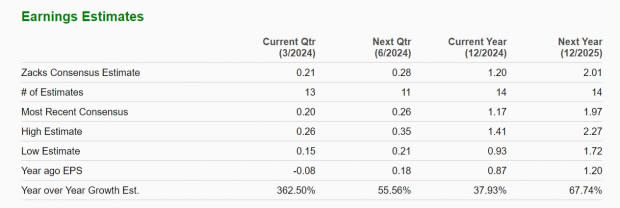

As for Uber, the company has continued to expand internationally including into Canada but throughout Europe, Latin America, and the Middle East as well. Uber has also stuck with incorporating food delivery into its services with sales projected to jump 16% in FY24 and forecasted to climb another 16% in FY25 to $50.49 billion.

Even better, Uber’s EPS is projected to leap 38% in FY24 to $1.20 per share versus $0.87 a share in 2023. More intriguing is that annual earnings are forecasted to soar another 68% next year to $2.01 per share.

Image Source: Zacks Investment Research

Earnings Estimate Revisions

The very strong price performances of Lyft and Uber’s stock have been centered on their appealing growth in recent years and crossing the profitability line. Still, positive earnings estimate revisions tend to be the biggest indicator of more upside in a stock and in this regard, Uber stands out.

Notably, EPS estimates for Uber’s FY24 and FY25 have continued to trend higher over the last quarter and are slightly up in the last 30 days.

Image Source: Zacks Investment Research

Meanwhile, Lyft’s FY24 and FY25 EPS estimates have dipped -3% and -11% over the last 60 days respectively.

Image Source: Zacks Investment Research

Bottom Line

Based on their compelling growth Lyft and Uber’s stock do appear to be formidable buy-the-dip candidates. However, Uber’s stock sports a Zacks Rank #1 (Strong Buy) and may likely have more upside given earnings estimates are up while Lyft shares land a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance