Tim Hortons franchisees spar with parent company RBI as rising cost of goods squeezes profits

Tim Hortons franchisees have to make a choice: they can donate their Justin Bieber-themed merchandise to charity, or they can hand it out to staff, but selling it is no longer an option.

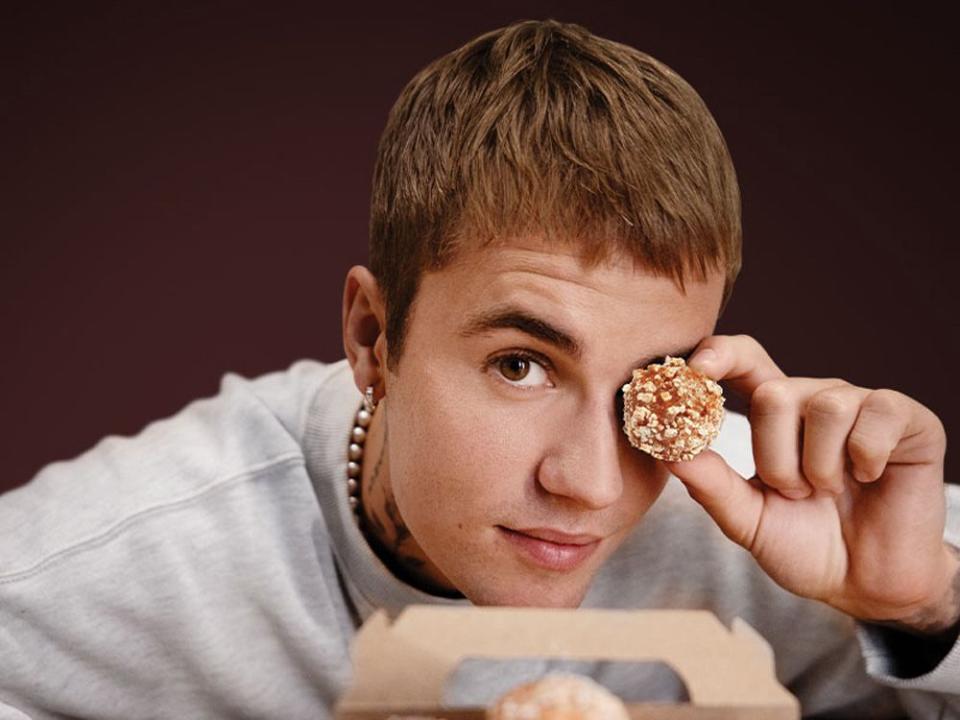

The coffee chain in 2021 partnered with the Canadian pop star in a bid to attract younger customers, launching a line of Timbits, called Timbiebs. Tim Hortons brought Timbiebs back last year along with a Bieber-themed coffee, Biebs Brew. As part of the promotion, the chain also sold commemorative totes and fanny packs and toques, or, more specifically, it sold the stuff to its franchisees, which then sold it to customers (who, in some cases, resold items for hundreds of dollars online).

Now that the promotion is over, Tim Hortons is contractually obligated to stop selling the merchandise and franchisees are out of pocket as a result, according to an organization that represents the chain’s restaurant owners.

“It’s a lot of money for a lot of owners,” said Dave Lush, executive director of the Alliance of Canadian Franchisees (ACF). “Some of that stuff just plain didn’t sell.”

In ordinary times, Lush said, he wouldn’t publicly complain about this sort of thing. (In his words: “Would I be talking to you over the Bieber promotion? Hell no.”) But the ACF has decided these are no longer ordinary times.

After years of silence, the group is speaking out, breaking what appeared, at least from the outside, to be a lasting peace with Tim Hortons management because it believes the chain’s cost increases are cutting into franchisee profits.

The (franchisees) are, in their minds, almost at a crisis point for profitability

Dave Lush

The group’s main concern has to do with the cost of products that franchisees are required to buy from head office, such as sugar, coffee beans, sandwich toppings and packaging. Lush said those costs have risen at a faster pace than menu prices, which have compressed franchisee profit margins.

`Crisis point for profitability’

ACF met with Tim Hortons executives three times in 2022, but decided to publicly complain after nothing changed, he said.

“It was deemed that this didn’t get anybody anywhere,” Lush said. “The (franchisees) are, in their minds, almost at a crisis point for profitability.”

But Tim Hortons said the concerns are unfounded and dismissed the ACF as an “antagonistic” group that is determined to drag the brand’s reputation down in public.

The company said it’s normal to have some merchandise left over at the end of a campaign such as Timbiebs. And this particular set of merchandise happened to be the “most successful retail campaign” in the company’s history, which drove sales and profits for its franchisees, according to a statement from spokesperson Michael Oliveira. It was mostly the tote bags that were left, he said.

“Airing grievances in the media is not what our guests expect of successful, profitable Tim Hortons restaurant owners,” Oliveira said in an email on Feb 10. “We do not recognize the association as a legitimate voice of franchisees.”

Before ACF went quiet more than three years ago, it had long been locked in a messy public battle with Tim Hortons’ parent company Restaurant Brands International Inc. But a legal settlement in 2019 and sales gains at the chain appeared to have brought about a lasting peace between the two sides.

The feud originally started a few years after the Brazilian investment firm 3G Capital bought the Canadian coffee chain in 2014 and merged it with Burger King to create Restaurant Brands International Inc., a giant global fast-food conglomerate that now also owns Popeyes Louisiana Kitchen and Firehouse Subs.

ACF — formerly known as the Great White North Franchisee Association — accused the company of mistreating franchisees and intimidating anyone who spoke out. RBI dismissed it as a disgruntled fringe group and moved to strip its leadership of their Tim Hortons’ franchises.

“We are certainly not just a ‘rogue group of franchisees’, or ‘a small group of disgruntled store owners’ that RBI would have you believe,” the association’s then president David Hughes wrote in a letter to franchisees in 2017.

We are certainly not just a ‘rogue group of franchisees’, or ‘a small group of disgruntled store owners’ that RBI would have you believe

David Hughes

RBI seized Hughes’ Tim Hortons locations in 2018, telling the Canadian Press at the time that its agreements with franchisees prohibited them from publicly disparaging the brand and leaking sensitive information to the media. RBI later said it had reached a settlement with Hughes that saw him exit the business.

In 2017, the group launched two class-action lawsuits against Tim Hortons, alleging, among other things, the company was jacking up the cost of products that restaurants were required to buy through RBI and mismanaging the advertising fund that franchisees contribute to.

Two years later, the company settled the suits, agreeing to contribute $10 million to the advertising fund and another $2 million to cover the legal and administrative costs of the franchisees’ lawsuits. The company also agreed to not discourage franchisees from joining a franchisee association.

Potential peace offering

After that, the association went silent. It rebranded as ACF and hired veteran Tim Hortons executive Nick Javor to lead it, but frequently turned down media requests for interviews.

Around the same time in 2020, Tim Hortons rolled out a “back to basics” plan to address franchisee complaints about the chain’s bloated, confusing menu and its lagging sales. More than three years later, Tim Hortons sales have recovered from pandemic lows and the company has pointed to sales breakthroughs from new menu items and promotions, such as the Bieber partnership, as a sign that its turnaround plan is resonating with customers.

In an earnings update on Feb. 14, RBI reported sales of US$1.83 million at Tim Hortons in the fourth quarter, up US$89 million or about five per cent over the previous year. Same-store sales at Tims — a key metric in the retail industry that excludes results from recently opened or closed stores to give a clearer picture on year-over-year growth — grew 11. 6 per cent in Canada in 2022.

RBI also announced that it was replacing chief executive José Cil with Joshua Kobza, currently the chief financial officer. Analysts at Citigroup Global Markets Inc. said in a note that they doubted Kobza represented a change in strategy, but is “potentially more of a peace offering to vocal franchisees.”

`Not making a profit’

Lush, who took over from Javor at the beginning of this year, said increases in restaurant costs have outpaced sales gains.

“This isn’t a case of ‘I’m not making enough money and that makes me unhappy. This is a case of ‘I’m not making a profit at all,’” he said. “The ratio between profitable locations and nonprofitable locations is growing on the nonprofitable side.”

Franchisees must go through the parent company for most of their ingredients, as well as equipment used in the restaurants. But in the past year, supply chain lags, drought, high fuel costs and the war in Ukraine have led to the highest level of food price inflation in Canada since the early 1980s.

Lush said his members believe RBI is increasing prices beyond what’s necessary. He said ACF consulted outside experts and conducted research to back up its claims, but declined to provide any documents. ACF won’t say how many members it has, only that they collectively operate 1,100 Tim Hortons restaurants in Canada out of a total of 5,600 worldwide.

“What’s your markup? Let’s just lay our cards out here,” he said. “What’s the deal?”

‘Sweet deal’ for Tims? Coffee-and-doughnut privacy breach settlement a marketing win, says expert

Tim Hortons unveils new 'Biebs Brew' partnership with Justin Bieber

RBI denied the allegation. In a lengthy statement, the company said franchisee profits are in better shape than their competitors after several years of pandemic and supply chain complications that hammered restaurant sales, particularly for coffee chains that catered to morning commuters.

Oliveira, the company’s spokesperson, said franchisees buy their products for less than operators at other restaurant brands do, and they receive steady, reliable deliveries despite global supply chain breakdowns.

“We do regular, extensive market research to make sure prices for our guests remain competitive in each region across the country,” he said.

RBI has said it already maintains an internal advisory board of franchisees who give feedback on the company’s strategy for Tim Hortons. Oliveira said the 19 franchisees on the board are “successful and sophisticated” operators who have been elected by their peers, unlike the “self-appointed” leaders of ACF.

“This association has proven over the years to only be antagonistic towards the company and seek media headlines to air their grievances,” he said. “Their views on how to approach the current challenges faced by the restaurant industry globally do not reflect the large majority of most Tim Hortons franchisees.”

• Email: jedmiston@postmedia.com | Twitter: jakeedmiston

Yahoo Finance

Yahoo Finance