A TikToker's relaxing take on tax prep goes viral as the season officially begins — here are 6 tips to take the stress out of filing your return in 2023

Has tax preparation ever sent a tingle down your spine?

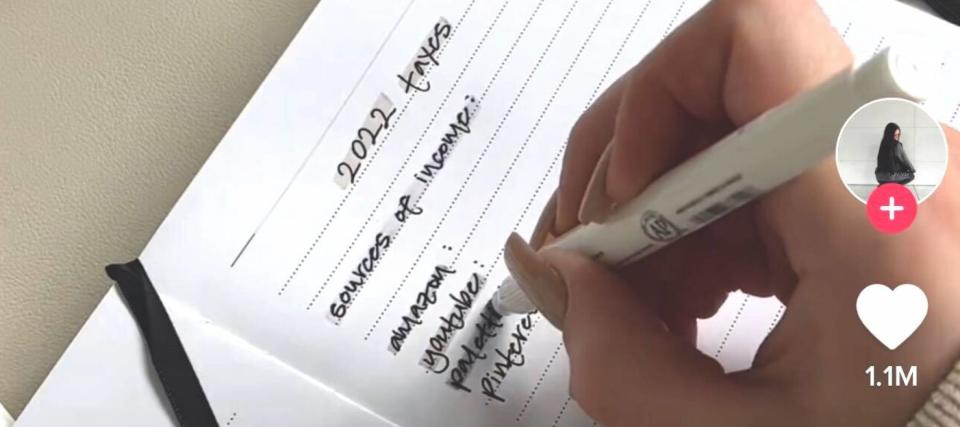

“Taxes terrify me,” Creator Kaeli Mae admits in the caption of her strangely serene TikTok video.

Don’t miss

'Hold onto your money': Jeff Bezos says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

Americans are paying nearly 40% more on home insurance compared to 12 years ago — here's how to spend less on peace of mind

Here's the golden secret to making your retirement fund as secure as Fort Knox

More than 6 million people have listened to the soft sounds of pouring coffee, clicking pens and stapling receipts against the backdrop of a picturesque home office make it an ideal ASMR video. ASMR is short for autonomous sensory meridian response which is the type of tingling or goosebumps you might feel while watching the short clip.

The video's 4,300 comments prove it's achieved one thing: it got the TikTok generation talking about taxes.

“The one essential we are never taught in school.”

“Wait … we’re supposed to keep our receipts?”

“You’ve inspired me. I’ll do my best to get it done today.”

Whether 1040 and W-2 forms spark joy or terror in you, tax season has officially begun. Here are 6 things you need to do to take some of the stress out of filing your return this year.

Know your dates

There’s something to be said for getting your taxes done and out of the way as early as you can.

The IRS officially starts accepting and processing individual tax returns on Jan. 23.

If you plan to put it off a little longer, there are several important tax deadlines you should keep in mind for the 2023 season.

If you’re just not sure where to start, the IRS is holding its annual Earned Income Tax Credit awareness Day on Jan. 27 to make sure people know about the various ways they can reduce they can reduce their taxable income.

For most taxpayers, the deadline to file your return is April 18. If you’re granted an extension, you’ll have until Oct. 16 to file.

The IRS has said they anticipate that you will receive your refund within 21 days of electronically filing your return if you choose direct deposit and there are no issues with your return.

Gather your information

Tax preparation and filing requires you to fill out a lot of forms. The more organized you keep them, the easier the whole process will be.

Having the right information at your fingertips can make the world of difference when it comes to your stress levels.

Start simple. You need to make sure all of your personal information is up-to-date and in front of you, including your full name (as it appears on your Social Security card), date of birth, Social Security number, home address. You’ll also need to submit your bank account information if you want to set up a direct deposit for any refunds you might receive.

You will also need your individual taxpayer identification numbers, adoption taxpayer identification numbers and this year's identity protection personal identification numbers (IP PIN). Taxpayers should get a unique 6-digit code with instructions on how to use it through an IRS-issued CP01A notice.

Report all of your income

The reality is most income is taxable. Until you sit down to do your taxes, you might not realize how many income streams you have. Getting this right is important if you want to avoid processing delays and speed up your potential payout.

Reporting your employment income should be fairly straightforward, using a 1040 form. Your employer should give you a W-2 form, which will give you all the information you need.

The W-2 includes the amount of federal, state and other taxes withheld from your paycheck. It also details other employer fringe benefits like health insurance, adoption and dependent care assistance, health savings account contributions and more.

You may also receive one of the various 1099 forms, where you should report things like self-employed income, unemployment compensation, state or local tax refunds, retirement plan distributions, Social Security benefits, income earned from rent or royalty payments, and investment income earned through interest, dividends or stock sales.

READ MORE: Insurance rates are rising faster than inflation in some states — are your finances keeping up?

Make the most of tax breaks

Now for the good part: tax credits and deductions.

There are many ways to reduce your taxable income. Taxpayers can claim deductions on things like student loan interest payments, home office expenses, self-employed health insurance payments, education expenses, mortgage interest, and charitable contributions.

Tax credits can also help you get some money back from the government. Common credits include the Earned Income Tax Credit, Child Tax Credit, Dependent Care Credit, education credits, residential energy credits, and health care credits, among others.

Time spent learning about which tax bracket you fall into and what deductions and credits you are eligible for will certainly pay off.

Use tax software

Tax preparation and filing can be daunting — but online tax software can help ease the burden.

The right tax software can make filing your federal and state tax returns surprisingly simple and ensure you take advantage of the money-saving opportunities available to you.

These products will typically connect you to an expert if you have questions or need more help as you go.

If your income is under a certain amount and you want to save on fees, you might qualify to use a free IRS filing program.

Help your future self

Do taxes also terrify you?

While the above tips might help you navigate the twists and turns of this year’s tax season, now is also the time to help your future self.

You can avoid the annual agony by starting a filing system for all of the relevant documents you gather throughout the year .

This can be as basic as throwing all relevant tax slips, receipts and income statements into an old shoe box or plastic bag — or even better, using a digital filing system or bookkeeping software.

This will give you a head start and should take some of the stress out of this process in the future.

What to read next

60% of working Americans don’t feel confident they’ll have enough money to retire — here’s how to protect your assets heading into a recession

Better than NFTs: You don't have to be ultra-rich to own a piece of a Pablo Picasso. Here's how to enter the fine art market

You could be the landlord of Walmart, Whole Foods and CVS (and collect fat grocery store-anchored income on a quarterly basis)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance