Three Undervalued Stocks With Intrinsic Discounts Ranging From 10% To 49.7%

As global markets exhibit mixed signals with record highs in some indices and contractions in key sectors, investors are navigating through a landscape marked by fluctuating interest rates and economic indicators. In this context, identifying undervalued stocks becomes crucial as they may offer potential for growth amidst the prevailing economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR740.00 | IDR1478.57 | 50% |

Truecaller (OM:TRUE B) | SEK35.60 | SEK70.98 | 49.8% |

Sparebanken Vest (OB:SVEG) | NOK131.60 | NOK262.87 | 49.9% |

Acerinox (BME:ACX) | €9.885 | €19.70 | 49.8% |

Caregen (KOSDAQ:A214370) | ₩22350.00 | ₩44549.16 | 49.8% |

Arcadis (ENXTAM:ARCAD) | €60.00 | €119.89 | 50% |

High Quality Food (BIT:HQF) | €0.654 | €1.30 | 49.7% |

Nusco (BIT:NUS) | €0.974 | €1.94 | 49.7% |

Strike Energy (ASX:STX) | A$0.225 | A$0.45 | 49.8% |

Nexxen International (AIM:NEXN) | £2.385 | £4.76 | 49.9% |

Let's dive into some prime choices out of from the screener

Ally Financial

Overview: Ally Financial Inc. is a digital financial-services company offering a range of products and services in the United States, Canada, and Bermuda, with a market capitalization of $12.11 billion.

Operations: The company's revenue is primarily generated from its automotive finance operations at $3.98 billion, followed by insurance operations at $1.55 billion, corporate finance operations at $0.47 billion, and mortgage finance operations at $0.23 billion.

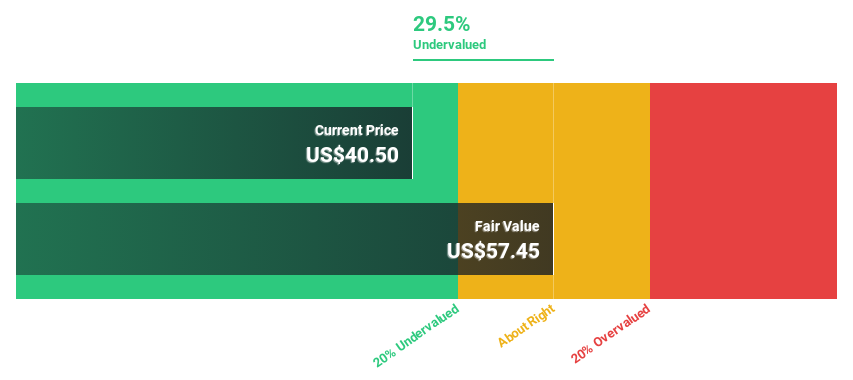

Estimated Discount To Fair Value: 29.5%

Ally Financial, currently trading at US$40.5—29.5% below its estimated fair value of US$57.45—appears undervalued based on cash flow analysis. Despite a low forecasted return on equity of 12.5% over three years and unstable dividend records, Ally exhibits robust growth prospects with earnings expected to rise by 26.7% annually, outpacing the US market projection of 14.8%. Recent strategic moves include multiple fixed-income offerings and inclusion in various Russell indexes, enhancing its financial flexibility and market presence.

Burlington Stores

Overview: Burlington Stores, Inc., a retailer in the United States, offers branded merchandise and has a market capitalization of approximately $14.88 billion.

Operations: The company generates its revenue primarily from the retail apparel segment, amounting to approximately $9.94 billion.

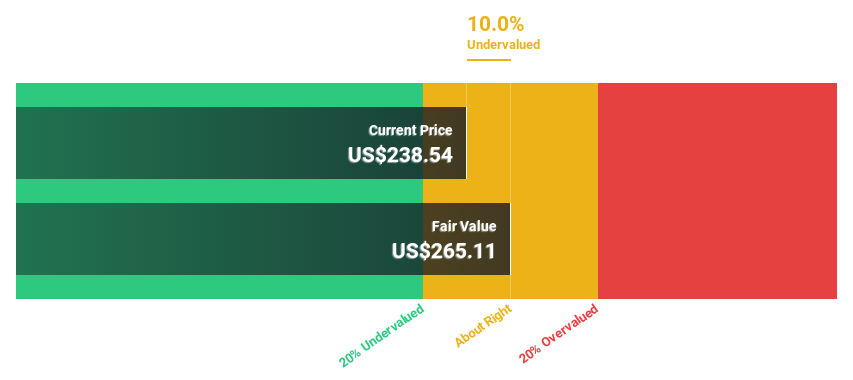

Estimated Discount To Fair Value: 10%

Burlington Stores, priced at US$238.54, is considered undervalued with a fair value of US$265.11, reflecting a modest discrepancy from its intrinsic worth based on cash flows. The company's earnings have shown significant growth of 55.6% over the past year and are projected to increase by 18.87% annually, surpassing the US market's average growth rate. Despite this promising outlook, Burlington carries a high level of debt and has seen considerable insider selling recently, which could signal caution among investors about its financial health and future prospects.

Zhaojin Mining Industry

Overview: Zhaojin Mining Industry Company Limited operates in the exploration, mining, processing, smelting, and sale of gold and silver products within the People’s Republic of China, with a market capitalization of approximately HK$50.15 billion.

Operations: The company primarily generates revenue through the exploration, mining, processing, and smelting of gold and silver.

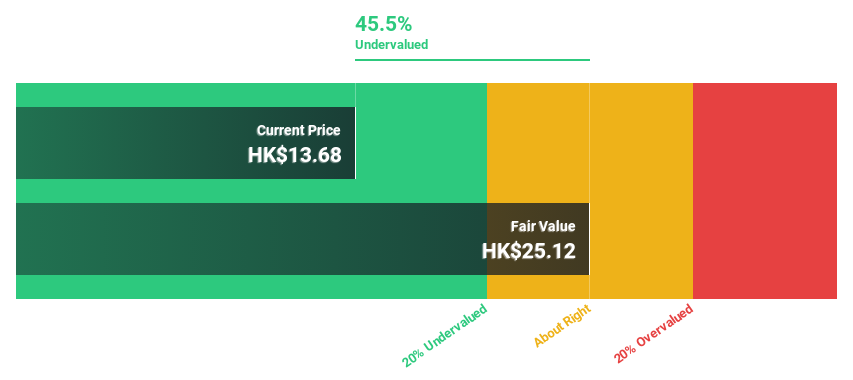

Estimated Discount To Fair Value: 49.7%

Zhaojin Mining Industry, trading at HK$14.98, is significantly below its estimated fair value of HK$29.77, indicating a high undervaluation based on cash flows. Despite earnings growth of 94.3% last year and expected annual growth of 41.66%, concerns arise from debt not being well covered by operating cash flow and large one-off items affecting results. Recent activities include a follow-on equity offering raising HK$1.725 billion and amendments to company bylaws to potentially enhance corporate governance.

Next Steps

Get an in-depth perspective on all 939 Undervalued Stocks Based On Cash Flows by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:ALLY NYSE:BURL and SEHK:1818.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance