Three Top Picks On Euronext Paris With Estimated Intrinsic Value Discounts Ranging From 31.3% To 38.3%

Amid a backdrop of political shifts and economic recalibrations, the French market has shown resilience with notable gains in major indices like the CAC 40. In such an environment, identifying stocks that are potentially undervalued becomes particularly compelling, as they may offer investors opportunities for growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Arcure (ENXTPA:ALCUR) | €6.00 | €7.78 | 22.9% |

Wavestone (ENXTPA:WAVE) | €57.40 | €93.04 | 38.3% |

Tikehau Capital (ENXTPA:TKO) | €22.45 | €32.70 | 31.3% |

Thales (ENXTPA:HO) | €153.30 | €265.95 | 42.4% |

Lectra (ENXTPA:LSS) | €29.20 | €44.14 | 33.8% |

ENENSYS Technologies (ENXTPA:ALNN6) | €0.59 | €1.09 | 45.6% |

Vivendi (ENXTPA:VIV) | €10.32 | €16.19 | 36.3% |

Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.76 | €9.97 | 42.2% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.80 | €6.27 | 39.4% |

Esker (ENXTPA:ALESK) | €183.40 | €259.64 | 29.4% |

Let's review some notable picks from our screened stocks.

Tikehau Capital

Overview: Tikehau Capital is a private equity and venture capital firm that specializes in a diverse range of financing products such as senior secured loans, equity, and mezzanine, with a market capitalization of approximately €3.88 billion.

Operations: Tikehau Capital generates revenue primarily through two segments: Investment Activities, which brought in €179.19 million, and Asset Management Activities, contributing €322.32 million.

Estimated Discount To Fair Value: 31.3%

Tikehau Capital, priced at €22.45, is assessed to be significantly undervalued with a fair value of €32.7, reflecting a substantial discount. Despite lower profit margins this year compared to last, the company's revenue growth at 20.1% annually is projected to outpace the French market significantly. However, its Return on Equity is expected to remain modest at 12.6%. Recent strategic moves include a partnership with Nikko Asset Management aimed at enhancing global investment capabilities and expanding into Asian markets through joint ventures focused on decarbonization strategies.

Vivendi

Overview: Vivendi SE is a global entertainment, media, and communication company based in France with operations spanning Europe, the Americas, Asia/Oceania, and Africa, boasting a market capitalization of approximately €10.58 billion.

Operations: Vivendi's revenue is primarily generated through its diverse segments, with Canal + Group leading at €6.06 billion, followed by Havas Group at €2.87 billion, Lagardère at €0.67 billion, Gameloft at €0.31 billion, Prisma Media also contributing €0.31 billion, Vivendi Village at €0.18 billion, and New Initiatives adding another €0.15 billion.

Estimated Discount To Fair Value: 36.3%

Vivendi, priced at €10.32, is considered undervalued by over 20%, with a fair value estimated at €16.19. Despite its low forecasted Return on Equity of 5.9% in three years, the company's earnings are expected to grow significantly at 29.26% annually, outperforming the French market growth rate. Recent legal settlements have resolved longstanding disputes without admitting fault, potentially stabilizing its operational backdrop. However, Vivendi's dividend history remains inconsistent, reflecting potential risks in payout sustainability amidst growth pursuits.

Wavestone

Overview: Wavestone SA, primarily operating in France and internationally, offers technology consulting services with a market capitalization of approximately €1.41 billion.

Operations: The firm generates its revenue from management consulting and information system services, totaling approximately €701.06 million.

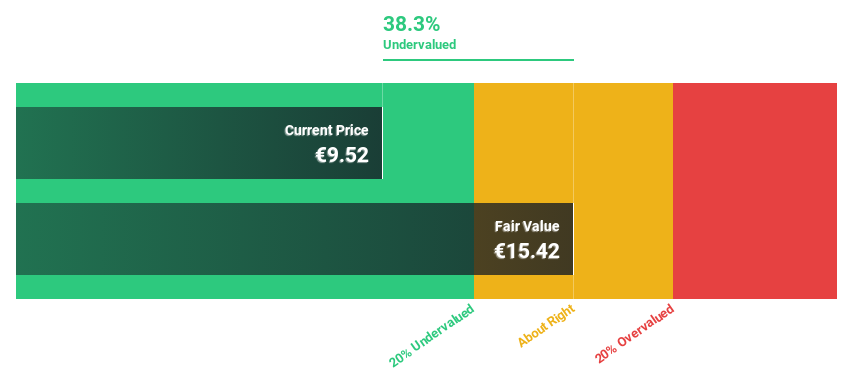

Estimated Discount To Fair Value: 38.3%

Wavestone, valued at €57.4, trades significantly below its estimated fair value of €93.04, indicating potential undervaluation based on discounted cash flow analysis. Although its Return on Equity is anticipated to be modest at 13.3% in three years, the company's earnings are expected to grow robustly by approximately 22% annually—surpassing the French market's average. Recent financial results show a solid year-over-year earnings increase from €50.07 million to €58.2 million, with revenue also rising from €532.26 million to €701.06 million, underscoring strong operational performance and growth prospects despite some shareholder dilution over the past year.

Summing It All Up

Embark on your investment journey to our 14 Undervalued Euronext Paris Stocks Based On Cash Flows selection here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:TKO ENXTPA:VIV and ENXTPA:WAVE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance