These are the countries where expats in Canada are sending money

As the dollar drops, it can make for less of a return and more of a headache when sending money internationally. And nearly three million Canadians (10 per cent) say money they send overseas would be impacted by a falling loonie, according to a new report from comparison website Finder.com.

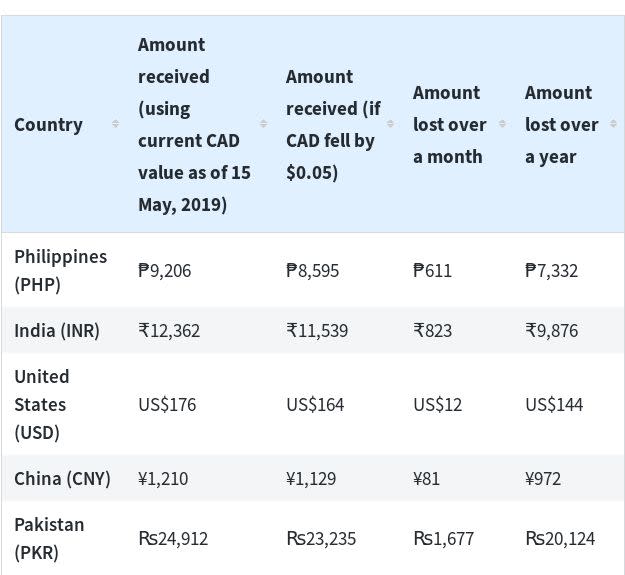

1,200 Canadian adults were surveyed for the study, which was commissioned by finder.com and fielded by OnePoll in April 2019. Previous reporting from Statistics Canada found that Canadian remitters sent $5.2 billion in 2017, and expats in Canada send the most of that money to the Philippines, India, China, the U.S. and Pakistan.

Getting the most for your buck, including the best rate, lowest fees and efficient transfer services, is the goal. But 47 per cent of Canadian adults say travelling was, or will be, more expensive with a weak dollar.

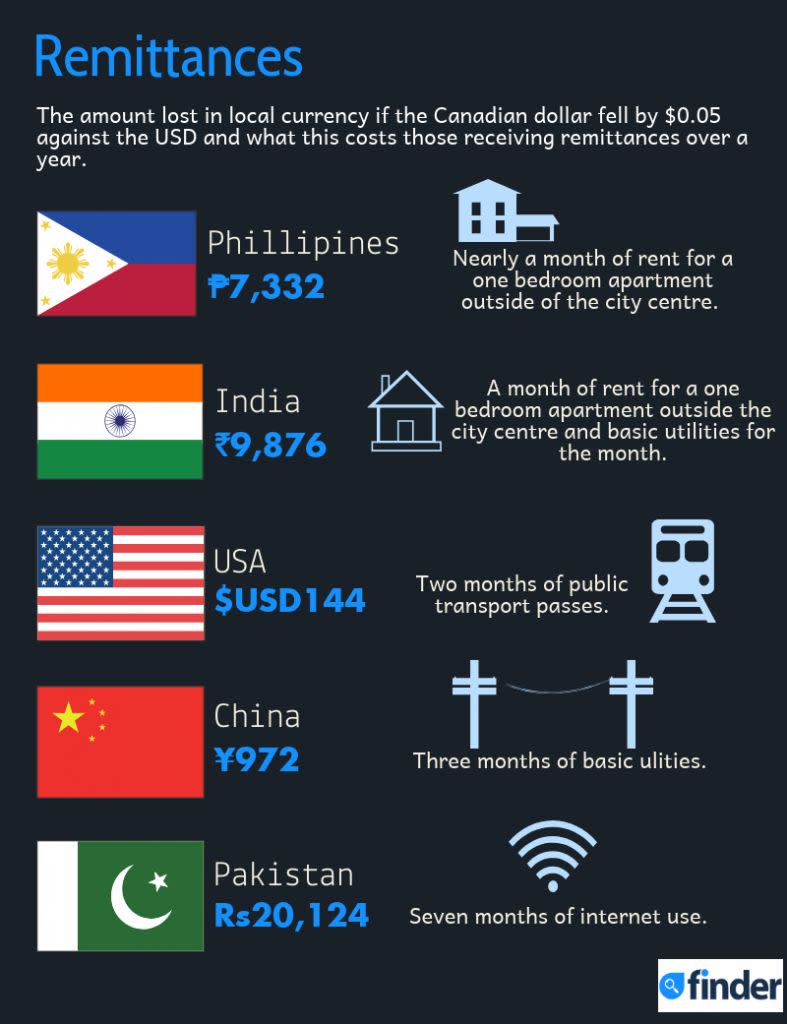

Consider the below infographic which looks at remittance loss. If the loonie falls by five cents, those receiving remittances would lose on average just over $202, annually, which is nearly a month’s worth of rent in the Philippines.

How to save

Start by calculating the exact fees you’ll be paying, as the main ways a provider makes money on your transfer is through a transaction fee and exchange rate mark-up, says Finder’s Angus Kidman to Yahoo Finance Canada.

“Some providers will charge a low fee but have a big mark-up on the exchange rate, while others charge a steep transaction fee but have a lower exchange rate,” he says. You need to look at both figures.

The transaction fee is more transparent. Providers will usually charge a set fee for the transaction, or a percentage of your total transfer amount, but don’t assume these work out to similar amounts, advises Kidman.

Aim to minimize the amount you pay on both of these (exchange rate and transaction fee), but pay even closer attention to the exchange rate fees.

“Some companies will advertise the mid-market exchange rate, but then mark up the rate when it’s time to make your transfer,” explains Kidman.

Selecting the more expensive transaction fee option could actually cost you hundreds of dollars.

Those sending money south of the border would see a loss of around US$144 over the year, factoring in the exchange rate. However, those paid in USD yet live in Canada could see a riper return.

Unfortunately, 2.3 million Canadians failed to even know whether they would be affected by a dwindling loonie. 16. 33 per cent said they have not or will not be impacted. Baby boomers had more confidence in any exchange rate change (23.13 per cent).

“If you’re worried about the exchange rate changing then consider scheduling payments ahead of time using a limit order or a forward contract to protect your transfer against market fluctuations,” says Kidman.

Also, negotiate.

“Some companies will offer a better deal if you can commit to a recurring exchange, so it’s worth looking into this if you regularly need to transfer money,” he says.

Yahoo Finance

Yahoo Finance