Three Leading Dividend Stocks With Yields Up To 8.5%

The United States stock market has experienced a slight decline of 1.2% over the past week, though it remains up by 21% from last year with expectations of earnings growing by 15% annually. In this dynamic environment, dividend stocks that offer high yields can be particularly appealing for investors seeking both income and potential growth.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.61% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.02% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.94% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.05% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.88% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.87% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.83% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.85% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.85% | ★★★★★☆ |

Evans Bancorp (NYSEAM:EVBN) | 5.09% | ★★★★★☆ |

Click here to see the full list of 208 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

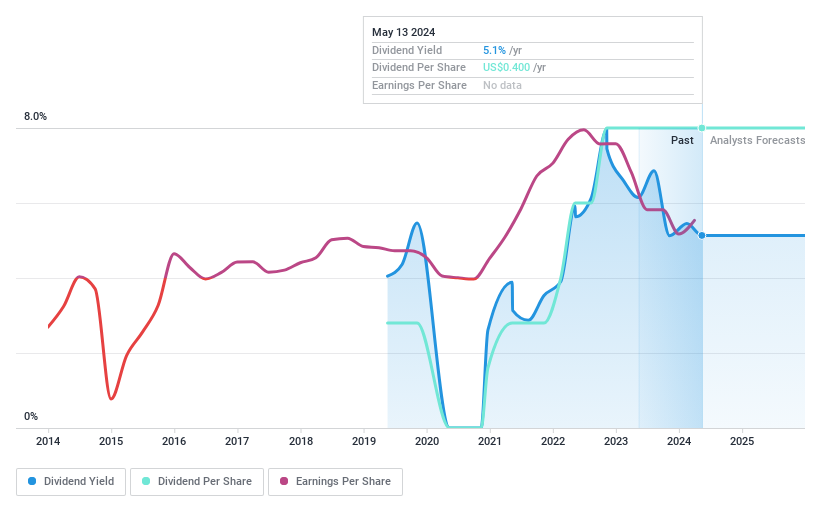

Pangaea Logistics Solutions

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions Ltd. operates globally, offering seaborne dry bulk logistics and transportation services to industrial clients, with a market capitalization of approximately $384.08 million.

Operations: Pangaea Logistics Solutions Ltd. generates its revenue primarily through its transportation-shipping segment, which amounted to $490.32 million.

Dividend Yield: 4.9%

Pangaea Logistics Solutions reported a substantial increase in net income to US$11.67 million for Q1 2024, up from US$3.47 million the previous year, despite a slight decline in revenue. The company declared a quarterly dividend of US$0.10 per share, maintaining its payout amidst earnings growth. However, the company's dividend history is marked by volatility and unreliability over the past five years, with a current payout ratio of 52% supported by earnings and a cash payout ratio of 78.6%, indicating moderate coverage by cash flows but raising concerns about sustainability given its unstable track record and lower profit margins compared to last year.

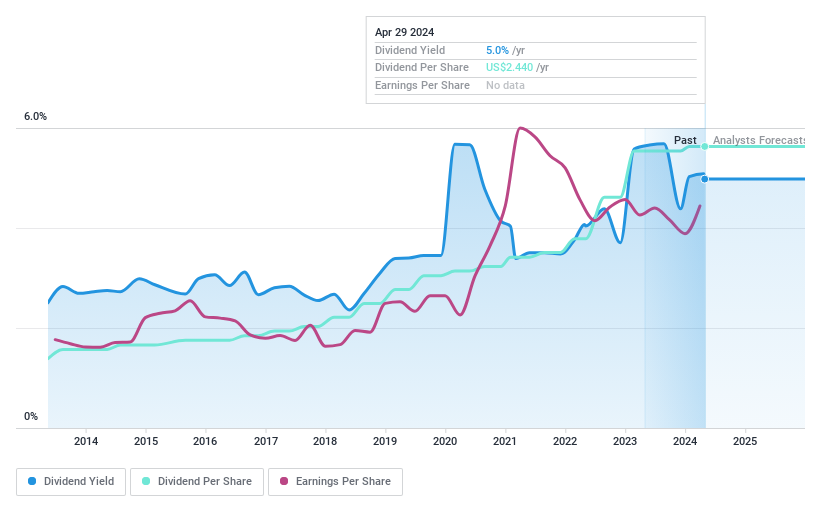

Northrim BanCorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northrim BanCorp, Inc., serving as the bank holding company for Northrim Bank, offers commercial banking products and services to businesses and professional individuals, with a market capitalization of approximately $310.23 million.

Operations: Northrim BanCorp, Inc. generates its revenues primarily through two segments: Community Banking, which brought in $106.27 million, and Home Mortgage Lending, contributing $24.08 million.

Dividend Yield: 4.3%

Northrim BanCorp has demonstrated a consistent dividend track record over the past decade, with its dividends per share remaining stable and a payout ratio of 46.7%, indicating that earnings adequately cover dividend payments. Recently, the company declared a quarterly cash dividend of $0.61 per share payable on June 14, 2024. Despite this reliability and an attractive yield of 4.33%, it falls short compared to the top quartile of US dividend payers at 4.73%. Additionally, Northrim's earnings have shown modest growth with an increase to US$8.2 million in Q1 2024 from US$4.83 million in the previous year, supporting ongoing payouts but highlighting limited growth potential relative to peers.

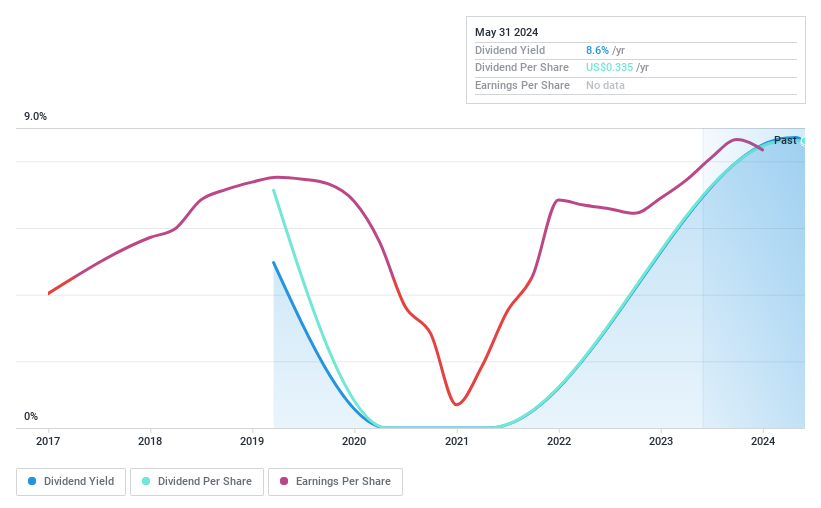

X Financial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: X Financial, operating in the People's Republic of China, offers personal finance services with a market capitalization of approximately $192.33 million.

Operations: X Financial generates revenue primarily through unclassified services, totaling CN¥4.81 billion.

Dividend Yield: 8.6%

X Financial's recent board reshuffle and a new $20 million share buyback program underscore its commitment to shareholder returns, despite a somewhat volatile dividend history. The firm reported strong earnings growth with a 46.2% increase year-over-year and maintains low payout ratios (4.8% from earnings), ensuring dividends are well-covered. However, the dividend track record remains unstable, with only five years of payments and some volatility in amounts distributed. This mixed performance highlights both strengths in financial management and areas of potential concern for consistency in shareholder returns.

Taking Advantage

Gain an insight into the universe of 208 Top Dividend Stocks by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:PANL NasdaqGS:NRIM and NYSE:XYF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance