Three High-Growth Stocks With Up To 33% Insider Ownership

As global markets continue to navigate through fluctuations, with the S&P 500 reaching new highs and sectors like manufacturing showing robust growth, investors are keenly watching for opportunities that align with these evolving economic conditions. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Medley (TSE:4480) | 34% | 28.7% |

Gaming Innovation Group (OB:GIG) | 20.2% | 36.2% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Vow (OB:VOW) | 31.8% | 97.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

We'll examine a selection from our screener results.

Vista Energy. de

Simply Wall St Growth Rating: ★★★★☆☆

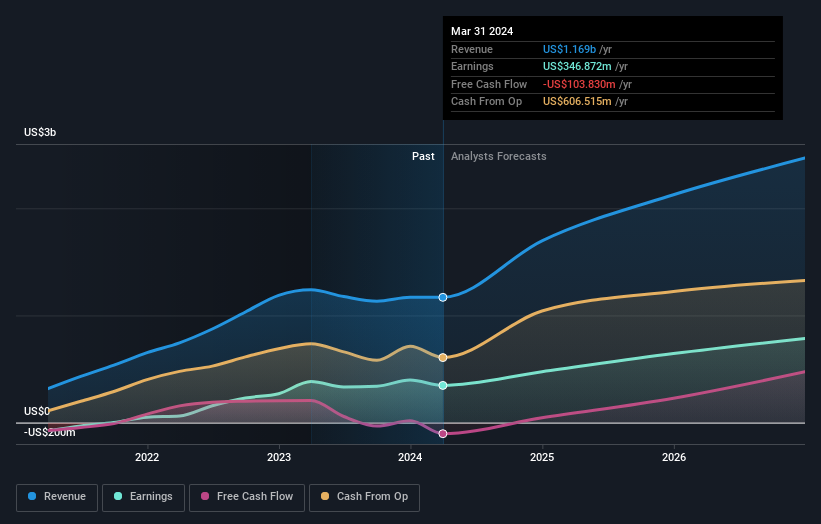

Overview: Vista Energy, S.A.B. de C.V. is a company involved in the exploration and production of oil and gas in Latin America, with a market capitalization of approximately MX$74.98 billion.

Operations: The company generates its revenue primarily from the exploration and production of crude oil, natural gas, and LPG, amounting to $1.17 billion.

Insider Ownership: 12.4%

Vista Energy, despite a substantial drop in net income from US$128.73 million to US$78.65 million in Q1 2024, is trading at 46.8% below its estimated fair value and has initiated a share repurchase program worth up to US$50 million, signaling potential confidence by management in the company's valuation. The company's revenue and earnings are expected to grow annually by 17.7% and 21.3%, respectively, outpacing the MX market forecasts significantly, although it faces challenges with high share price volatility and recent shareholder dilution.

Asia Aviation

Simply Wall St Growth Rating: ★★★★☆☆

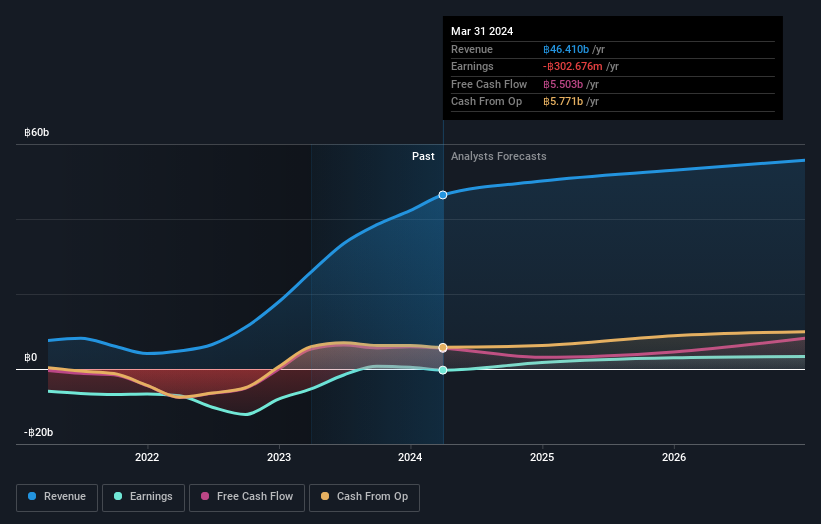

Overview: Asia Aviation Public Company Limited operates as an airline service provider in Thailand, with a market capitalization of approximately THB 26.98 billion.

Operations: The company generates revenue primarily from scheduled flight operations, which brought in THB 45.86 billion, and charter flight operations, contributing THB 85.89 million.

Insider Ownership: 17.9%

Asia Aviation is poised for profitability within three years, with earnings expected to grow by 62.88% annually, significantly above average market growth. Despite recent challenges, including a net loss of THB 409.09 million in Q1 2024 and shareholder dilution over the past year, the company's revenue increased to THB 14.02 billion from THB 9.81 billion year-over-year. Trading at 68.2% below its fair value suggests potential undervaluation relative to peers and industry standards.

Delve into the full analysis future growth report here for a deeper understanding of Asia Aviation.

Upon reviewing our latest valuation report, Asia Aviation's share price might be too pessimistic.

Siam Cement

Simply Wall St Growth Rating: ★★★★☆☆

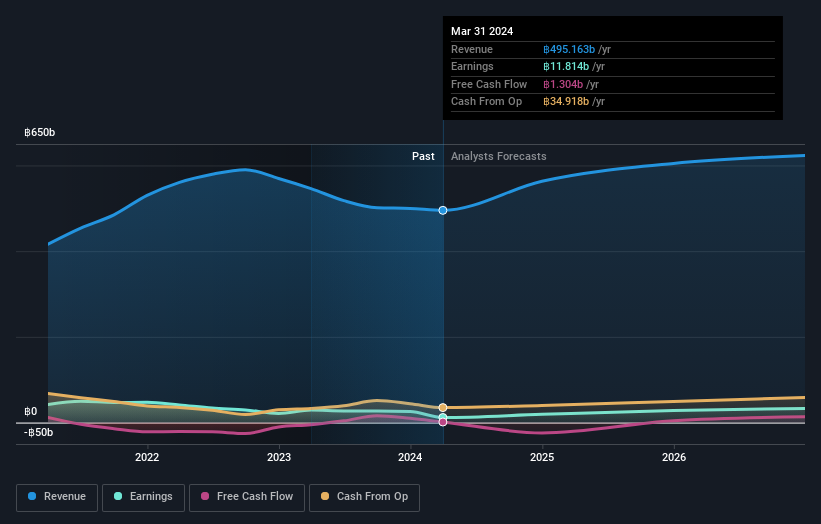

Overview: Siam Cement Public Company Limited operates in cement and building materials, chemicals, and packaging sectors both in Thailand and globally, with a market cap of approximately THB 273.60 billion.

Operations: The company generates revenue through three main business segments: chemicals (THB 190.05 billion), packaging (THB 129.62 billion), and cement and building materials.

Insider Ownership: 33.7%

Siam Cement, amid a challenging quarter with a notable drop in net income to THB 2.42 billion from THB 16.53 billion last year, still shows potential for growth with earnings expected to increase by 34.45% annually over the next three years. Recent board enhancements aimed at strengthening environmental sustainability could support long-term strategic goals, despite current profit margins shrinking to 2.4%. However, its dividends seem pressured by cash flows, reflecting some financial strain.

Dive into the specifics of Siam Cement here with our thorough growth forecast report.

Our valuation report here indicates Siam Cement may be overvalued.

Summing It All Up

Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1453 more companies for you to explore.Click here to unveil our expertly curated list of 1456 Fast Growing Companies With High Insider Ownership.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BMV:VISTA A SET:AAV and SET:SCC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance