Three High Growth Chinese Stocks On The SSE With Insider Ownership Up To 23%

Amidst a backdrop of global economic shifts, China's stock market has shown resilience with nuanced performances across various sectors. As the Shanghai Composite Index navigates through these challenging times, investors may find potential in high-growth companies with significant insider ownership, suggesting a strong alignment between management and shareholder interests in navigating the complexities of today’s market environment.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 29.0% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

UTour Group (SZSE:002707) | 23% | 33.1% |

We'll examine a selection from our screener results.

Shanghai GenTech

Simply Wall St Growth Rating: ★★★★★☆

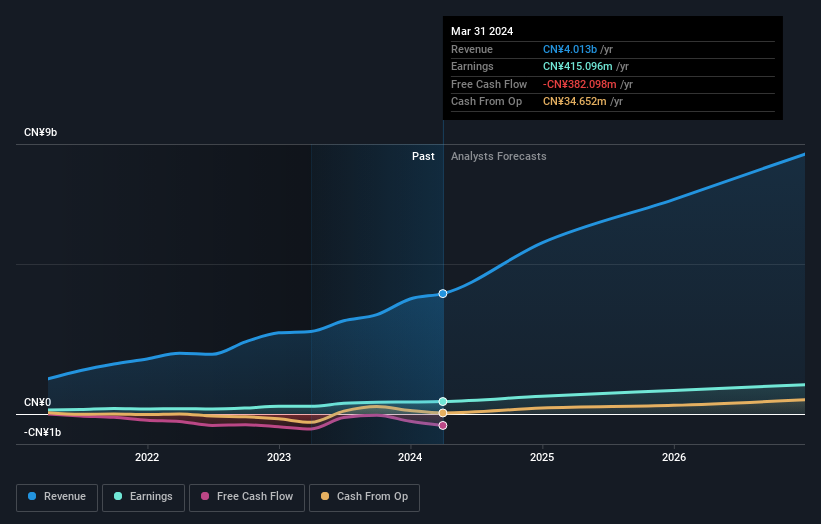

Overview: Shanghai GenTech Co., Ltd. specializes in delivering process critical system solutions to clients in high-tech and advanced manufacturing sectors across China, with a market capitalization of approximately CN¥9.43 billion.

Operations: The company generates revenue by providing system solutions to high-tech and advanced manufacturing sectors in China.

Insider Ownership: 13%

Shanghai GenTech, a growth company with significant insider ownership in China, recently announced a share repurchase program valued at CNY 50 million to boost employee incentives and align interests across the board. Despite substantial revenue growth from CNY 410.81 million to CNY 588.73 million year-over-year and doubling net income, its forecasted return on equity remains low at 18.5%. The firm's price-to-earnings ratio stands below the market average, suggesting relative undervaluation amidst aggressive expansion plans supported by high insider confidence and strategic buybacks aimed at sustainable development.

Puya Semiconductor (Shanghai)

Simply Wall St Growth Rating: ★★★★★☆

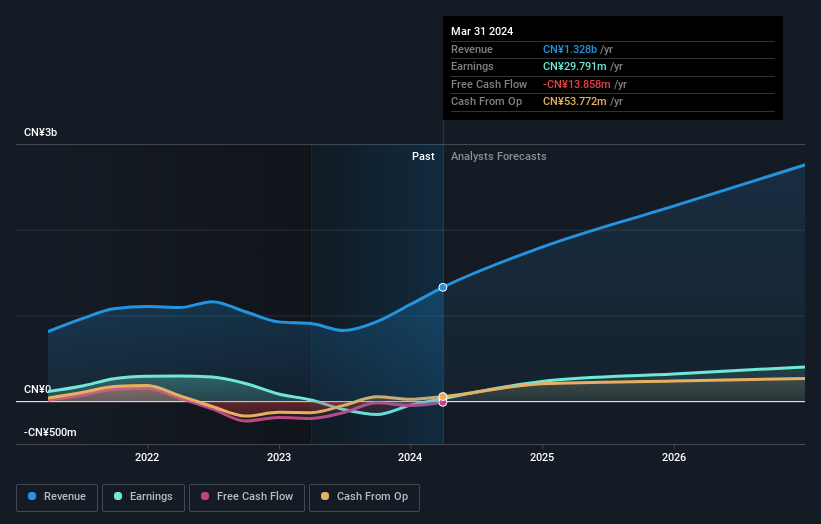

Overview: Puya Semiconductor (Shanghai) Co., Ltd. specializes in the design and sale of non-volatile memory chips and derivative chips, operating both in China and internationally, with a market capitalization of approximately CN¥9.81 billion.

Operations: The company generates revenue primarily from its integrated circuit segment, totaling approximately CN¥1.33 billion.

Insider Ownership: 23.8%

Puya Semiconductor (Shanghai) demonstrated a robust turnaround in its Q1 2024 earnings, with sales doubling to CNY 404.93 million and shifting from a net loss to a profit of CNY 49.92 million. This performance aligns with expectations of significant revenue growth at an annual rate of 25.1% and even faster earnings growth projected at approximately 52% per year, outpacing the Chinese market average significantly. Despite these positives, the company's forecasted return on equity is relatively low at 13.2%, indicating potential challenges in maintaining profitability levels as it scales.

Ninebot

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ninebot Limited operates globally, focusing on the design, research and development, production, sale, and servicing of transportation and robot products with a market capitalization of approximately CN¥27.22 billion.

Operations: The company generates revenue primarily through the design, development, production, and sale of transportation and robotic products globally.

Insider Ownership: 16.8%

Ninebot Limited showcased substantial growth in its Q1 2024 earnings, with revenue increasing to CNY 2.56 billion from CNY 1.66 billion year-over-year and net income rising to CNY 135.68 million from CNY 17.5 million. This performance indicates a strong upward trajectory, with revenue and earnings growth forecasted at 22.3% and 25.54% per year respectively, both exceeding market averages of 13.6% and 22%. However, its projected return on equity remains low at around 17%, suggesting potential efficiency challenges ahead.

Navigate through the intricacies of Ninebot with our comprehensive analyst estimates report here.

Our valuation report here indicates Ninebot may be overvalued.

Where To Now?

Gain an insight into the universe of 368 Fast Growing Chinese Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688596 SHSE:688766 and SHSE:689009.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance