Three Growth Companies On SIX Swiss Exchange With High Insider Ownership And 20% Earnings Growth

The Switzerland market recently showed a modest uptick, with the SMI index closing higher by 0.38% at 12,051.66 after a range of fluctuations throughout the trading session. This positive momentum reflects an environment where investors are actively engaging with the market, demonstrating sustained buying interest across various sectors. In such a market scenario, growth companies with high insider ownership can be particularly compelling as they often signal strong confidence from those closest to the company in its future prospects and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Earnings Growth |

Stadler Rail (SWX:SRAIL) | 14.5% | 23.1% |

Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

VAT Group (SWX:VACN) | 10.2% | 21% |

Temenos (SWX:TEMN) | 17.4% | 14.7% |

Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

Partners Group Holding (SWX:PGHN) | 17.1% | 13.7% |

SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Here's a peek at a few of the choices from the screener.

Partners Group Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm that manages a diverse range of investment strategies including direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt, with a market capitalization of approximately CHF 31.35 billion.

Operations: The company generates revenue through its segments in private equity (CHF 1.17 billion), real estate (CHF 186.90 million), infrastructure (CHF 379.20 million), and private credit (CHF 211.30 million).

Insider Ownership: 17.1%

Earnings Growth Forecast: 13.7% p.a.

Partners Group Holding AG, despite a high level of debt, is positioned for notable growth with its revenue expected to increase by 14.1% annually, outpacing the Swiss market's 4.5%. However, its dividend sustainability is questionable as it isn't well-covered by earnings or cash flows. Recent activities include a CHF 300 million fixed-income offering and potential strategic moves such as the discussed sale of Formosa Solar, indicating active management and possible future capital re-allocation.

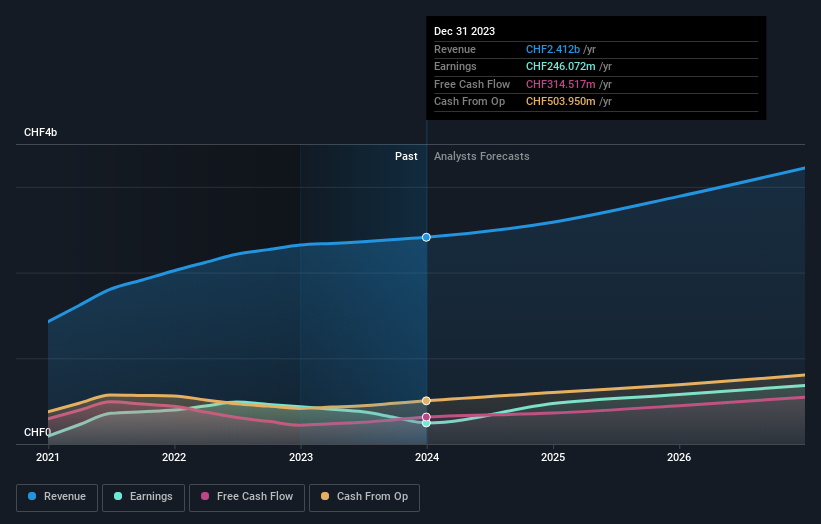

Straumann Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG, a global provider of tooth replacement and orthodontic solutions, has a market capitalization of CHF 18.81 billion.

Operations: The company generates revenue from various geographical segments, with CHF 1.17 billion from Europe, the Middle East, and Africa (EMEA), CHF 793.05 million from North America (NAM), CHF 451.27 million from Asia Pacific (APAC), and CHF 265.82 million from Latin America (LATAM).

Insider Ownership: 32.7%

Earnings Growth Forecast: 20.8% p.a.

Straumann Holding AG, despite a highly volatile share price recently, trades at 5.3% below its estimated fair value and is poised for substantial growth. Its revenue and earnings are expected to outpace the Swiss market with forecasts of 9.8% and 20.8% annual increases respectively. However, its profit margins have declined from last year's figures. Recent engagements include presentations at multiple European healthcare conferences, showcasing its active role in the industry dialogue.

Dive into the specifics of Straumann Holding here with our thorough growth forecast report.

Our expertly prepared valuation report Straumann Holding implies its share price may be too high.

VAT Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG operates globally, specializing in the development, manufacturing, and supply of vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows with a market capitalization of approximately CHF 15.58 billion.

Operations: The company's revenue is primarily generated from two segments: Valves, which contributed CHF 782.74 million, and Global Service, adding CHF 172.87 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 21% p.a.

VAT Group AG, a Swiss company, is positioned for robust growth with its earnings expected to outpace the market at 21% annually. Notably, its revenue growth forecast at 15.5% yearly also surpasses the Swiss market average. The firm's projected Return on Equity stands impressively high at 39.1%. Despite these strong indicators, there has been no significant insider buying or selling in the past three months. Recently, VAT Group presented at the Berenberg European Conference in New York.

Take a closer look at VAT Group's potential here in our earnings growth report.

Our valuation report here indicates VAT Group may be overvalued.

Key Takeaways

Access the full spectrum of 15 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SWX:PGHN SWX:STMN and SWX:VACN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance